How much are the motorcycle insurance premiums in Vietnam? What is the latest table of motorcycle insurance premiums according to Decree 67/2023/ND-CP?

How much are the motorcycle insurance premiums in Vietnam?

Pursuant to Decree 67/2023/ND-CP on compulsory civil liability insurance of motor vehicle owners, compulsory fire and explosion insurance and compulsory insurance for construction investment activities.

Compulsory motorcycle insurance premiums are implemented according to Section A, Appendix I issued with Decree 67/2023/ND-CP.

As follows:

No. | Vehicle type | Premium (VND) |

I | Motorbikes | |

1 | Lower than 50 cc | 55.000 |

2 | Of 50 cc or above | 60.000 |

II | Motorized tricycles | 290.000 |

III | Mopeds (including electric mopeds) and similar motor vehicles | |

1 | Electric mopeds | 55.000 |

2 | Other vehicles | 290.000 |

Note: The 2024 motorbike insurance premiums mentioned above are the premiums for 1 year and does not include value added tax.

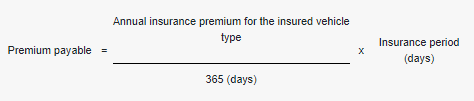

In case of insurance periods other than 1-year period, the insurance premium shall be calculated on the basis of the insurance premiums prescribed by the Ministry of Finance of Vietnam and the corresponding insurance period. To be specific:

In case of an insurance period of not exceeding 30 days, the insurance premium payable shall be calculated by dividing the annual insurance premium for the insured vehicle type by 12 months.

On the basis of insurance coverage records of each motor vehicle or accident records of each motor vehicle owner, insurers shall consider increasing or decreasing insurance premiums. The maximum increase/decrease shall be 15% of the insurance premiums.

How much are the motorcycle insurance premiums in Vietnam? What is the latest table of motorcycle insurance premiums according to Decree 67/2023/ND-CP? (Image from the Internet)

What are the exclusions of motorcycle insurance in Vietnam?

Pursuant to the provisions of Article 7 of Decree 67/2023/ND-CP, Insurers shall not provide indemnities in the following cases:

- Damage done intentionally by motor vehicle owners, motor vehicle operators or victims of the accidents.

- Vehicle operators intentionally fleeing the scene after committing accidents without exercising civil liabilities of motor vehicle owners. Vehicle operators intentionally fleeing the scene after committing accidents and exercising civil liabilities of motor vehicle owners shall not be insurance exclusions.

- Operators who fail to satisfy requirements of age range to operate motor vehicles as per regulations in the Law on Road Traffic; operators who do not carry legitimate, proper driving licenses according to regulations of laws on training, testing and granting driving licences, or carry damaged driving licences or use expired driver's licences at the points of time when accidents occur or carry inappropriate driving licenses when operating motor vehicles which require specific driving license. In case driving licenses of operators are revoked or suspended, the operators are considered not carrying driving licenses.

- Damage that causes indirect consequences including: reduced commercial value, damage related to use and utilization of damaged property.

- Damage to property caused by operators whose blood/breath alcohol concentrations (BACs) exceed the maximum permitted BAC under guidance of the Ministry of Health; or use narcotics or other prohibited stimulants as per the law.

- Damage to property due to thievery or robbery as a result of an accident.

- Damage to special property including: gold, silver, precious stones, financial instruments namely money, antiques, precious fine arts, and cadavers.

- War, acts of terrorism, earthquake.

How long is the maximum period of motorcycle insurance in Vietnam?

Pursuant to the provisions in Article 9 of Decree 67/2023/ND-CP as follows:

Insurance period

1. Period of compulsory civil liability insurance of motor vehicle owners shall be from 1 to 3 years, except for the following cases where insurance period shall be less than 1 year:

a) Foreign motor vehicles which were temporarily imported for re-export participate in traffic within Socialist Republic of Vietnam territory for less than 1 year.

b) Service life of motor vehicles is less than 1 year as per the law.

c) Temporarily registered motor vehicles according to regulations of Ministry of Public Security.

2. In case a motor vehicle owner has multiple vehicles covered by insurance at different times in a specific year and wishes to unify insurance coverage time in the following year in order to manage, insurance period of these vehicles may be less than 1 year and equal to remaining effective period of the first insurance policy concluded in that year. For policies and certificates of insurance which have been unified in terms of coverage time, insurance period of the following year shall conform to Clause 1 of this Article.

3. In case a vehicle title transfer takes place within the effective period specified on a certificate of insurance, the former motor vehicle owner has the power to terminate the policy as prescribed in Article 11 hereof.

Thus, according to the above regulations, the maximum period of motorcycle insurance is 3 years.

In some special cases below, the insurance period is less than 1 year:

- Foreign motor vehicles which were temporarily imported for re-export participate in traffic within Socialist Republic of Vietnam territory for less than 1 year.

- Temporarily registered motor vehicles according to regulations of Ministry of Public Security.

LawNet