How many times can a public company in Vietnam issue shares for debt swap in a year?

What are the regulations on the certificate of registration of issuance of shares for swapping debts in Vietnam?

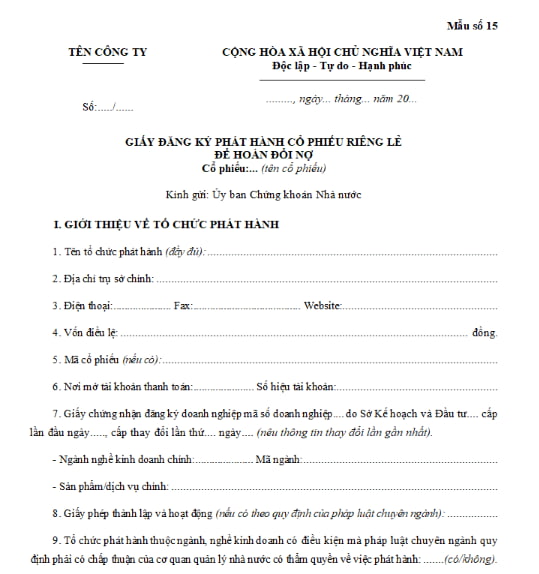

The certificate of registration of issuance of shares for swapping debts in Vietnam is made according to Form No. 15 of the Appendix issued together with Decree 155/2020/ND-CP, as follows:

Download the certificate of registration of issuance of shares for swapping debts in Vietnam: Click here.

How many times can a public company in Vietnam issue shares for debt swap in a year?

How many times can a public company in Vietnam issue shares for debt swap in a year?

Pursuant to Article 57 of Decree 155/2020/ND-CP stipulating the conditions for a public company to issue shares for debt swap are as follows:

Conditions for a public company to issue shares for debt swap

1. There is an issuance plan which is approved by the General Meeting of Shareholders.

2. The debts being swapped are included in the latest annual financial statement which is audited by an accredited audit organization and approved by the General Meeting of Shareholders.

3. There is a written agreement in principle of the creditors on debt swap.

4. The interval between the private placements shall be at least 06 months form the ending date of the offering according to Clause 7 Article 48 of this Decree.

5. The conditions specified in Clauses 2, 5, 6, 7 Article 49 of this Decree are satisfied.

According to the above regulations, public companies are allowed to issue shares for debt swap up to 02 times per year.

What are the procedures for issuance of shares for debt swap of public companies in Vietnam?

Pursuant to Clause 1, Article 59 of Decree 155/2020/ND-CP stipulating the procedures for issuance of shares for swap as follows:

Procedures for issuance of shares for swap

1. The issuance procedures in the cases specified in Article 49, Article 51 and Article 57 of this Decree shall be the same as the procedures for private placement (without escrow accounts); reports on the issuance shall be prepared in accordance with Clause 3 of this Article.

Thus, based on Article 48 of Decree 155/2020/ND-CP, the procedures for private placement of shares are as follows:

- The issuer shall send the application for private placement to the State Security Commission (SSC).

- Within 07 working days from the receipt of the satisfactory report, SSC shall issue a written approval and announce the receipt of the application on its website. In case the application is rejected, SSC shall make a written response and provide explanation.

- The issuer shall complete the private placement within 90 days from the day on which SSC issues the written approval.

- Within 10 days from the end of the offering, the issuer shall send the report on the revenue generated by the offering enclosed with confirmation of the bank or FBB where the escrow account is opened to SSC in accordance with SSC and disclose this information on the websites of the issuer and SSC.

- Within 03 days from the receipt of the satisfactory report, SSC shall send a written notification of the receipt of the report to the issuer, the Stock Exchange and VSDCC, and announce the receipt of it on the website of SSC.

- After receiving the notification from SSC, the issuer may request unfreezing of the amount obtained from the offering.

- The interval between the private placements shall be at least 06 months from the ending date the private placement, including private placement of shares, convertible bonds, warrant-linked bonds, warrant-linked preference shares; issuance of shares for swap to shareholders of non-public joint stock companies, swapping stakes of contributing members of limited liability companies; issuance shares for swap to pre-selected shareholders in public companies; issuance of shares for swapping debts.

LawNet