Is personal income tax withheld from the probationary employment contract in Vietnam? How to withhold PIT from a probationary employment contract in Vietnam?

Is personal income tax withheld from the probationary employment contract in Vietnam?

Pursuant to Point i, Clause 1, Article 25 of Circular No. 111/2013/TT-BTC providing for withholding tax in other cases as follows:

Tax withholding is the income payer’s calculating and withholding the tax payable from the taxpayer’s income before paying the income to the taxpayer. To be specific:

- Incomes from wages:

+ The income payer shall withhold tax from incomes of residents that sign employment contracts for 03 months or longer according to the progressive tax table, including the persons that sign such contracts at various places.

+ The income payer shall still withhold tax from the incomes earned residents that sign employment contracts for 03 months but resign before such employment contracts expire according to the progressive tax table.

- Withholding tax in other cases:

The organization or person that pays a total income from 2 million VND to a resident that does not sign a employment contract (as guided in Point c and Point d Clause 2 Article 2 of Circular No. 111/2013/TT-BTC) or that signs a employment contract for less than 03 months shall withhold 10% tax on the income before it is paid to the person.

- For the person that earns only a taxable income as stated above but the total taxable income estimated after personal withholdings are made does not reach the taxable level:

+ The person shall make and send a commitment (the form is provided in the guiding documents on tax administration) to the income payer as the basis for temporarily exempting the income from personal income tax.

+ Based on the commitment made the income earner, the income payer shall not withhold tax.

+ At the end of the tax year, the income payer shall make a list of persons that earn incomes below that taxable level (the form is provided in the guiding documents on tax administration) and send it to the tax authority.

The persons are responsible for the commitments they made. Any deceit discovered shall be penalized in accordance with the Law on Tax administration.

The persons that make commitments as guided in this Point shall obtain tax registration and have tax codes when the commitments are made.

Thus, according to the above regulations, when an employee signs a probationary employment contract or a probationary employment contract with a employment contract of less than 3 months, only his income is subject to tax withholding at the rate of 10%, but the total taxable income after personal withholdings are made does not reach the taxable level and make a commitment according to the form, it is not required to pay personal income tax.

Is personal income tax withheld from the probationary employment contract in Vietnam? How to withhold PIT from a probationary employment contract in Vietnam?

How to withhold PIT from a probationary employment contract in Vietnam?

Pursuant to Official Dispatch No. 47484/CT-TTHT in 2018 guiding the withholding of personal income tax during the probationary period as follows:

- If a employment contract effected for at least three (03) months is signed after termination of a probationary employment contract with an employee:

You will be responsible for withholding PIT, calculated according to the progressive taxation table, from income paid to that employee before making wage or salary payment, including PIT on income that he/she earns during his/her probation period.

- If you refuse to sign an employment contract after termination of a probationary employment contract with an employee:

You will have to withhold PIT at 10% rate from his/her total probationary income of at least 2 million dong/payment.

- If your employee earns only one source of income to be withheld as PIT at the 10% rate, but his/her estimated total income subject to family relief-inclusive PIT does not reach the taxable amount in the tax year:

He/she will have to sign a commitment prepared by completing the Form No. 02/CK-TNCN annexed to the Circular No. 80/2021/TT-BTC dated June 15, 2015 of the Ministry of Finance, and submit it to you.

Note: Based on such commitment, you can temporarily suspend withholding of 10% PIT on wages or salaries paid to that employee.

In this case, the employee will be legally liable for his/her commitment and will ensure that they have had his/her TIN at the signature date. He/she will be subject to penalties prescribed in the Law on Tax Administration in case of any fraudulent act.

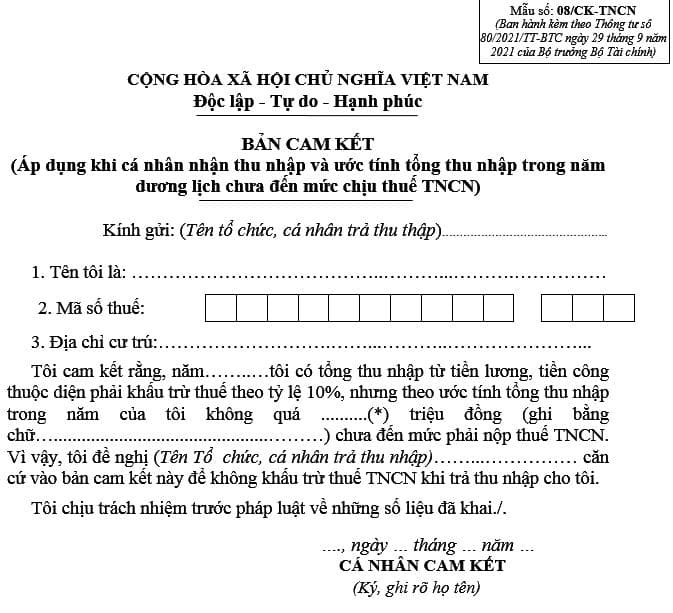

How is the latest PIT commitment form in 2023 regulated?

Individuals whose taxable incomes of employees, after withholding their family circumstances, are not up to the point where they have to pay tax, shall fulfill their commitment to temporarily not withhold personal income tax, according to Form 08/CK-TNCN enclosed with Circular No. 80/2021/TT-BTC.

Download the PIT Commitment Form: Click here.

LawNet