What is the application for an establishment and operation license to insurance limited liability company in Vietnam?

- What is the application form for an establishment and operation license to insurance limited liability company in Vietnam?

- What is the application for an establishment and operation license to insurance limited liability company in Vietnam?

- What are the procedures for applying for establishment and operation license to insurance limited liability company in Vietnam?

What is the application form for an establishment and operation license to insurance limited liability company in Vietnam?

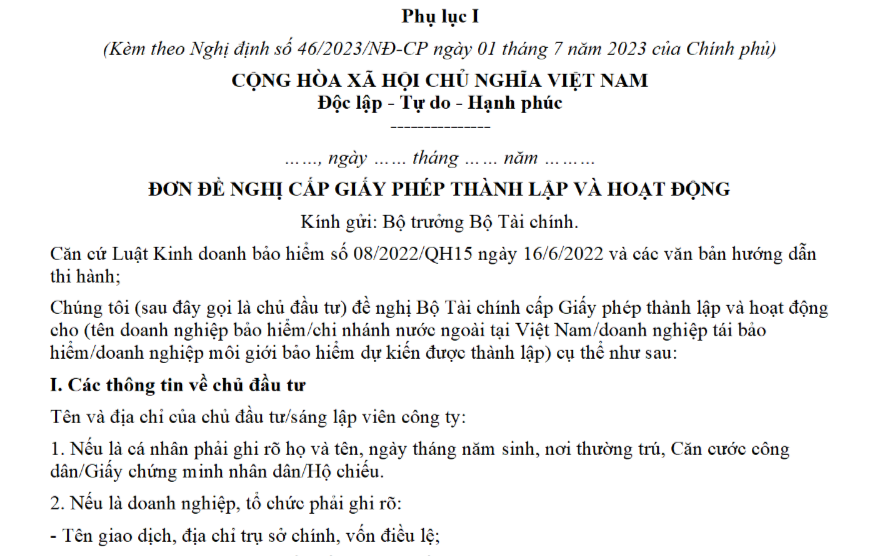

Application for a License according to the form specified in Appendix I issued with Decree 46/2023/ND-CP as follows:

DOWNLOAD the application form for an establishment and operation license to insurance limited liability company here.

What is the application for an establishment and operation license to insurance limited liability company in Vietnam?

What is the application for an establishment and operation license to insurance limited liability company in Vietnam?

Dossier to request an establishment and operation license is specified in Article 12 of Decree 46/2023/ND-CP as follows:

- An application form for a License, provided in Appendix I to Decree 46/2023/ND-CP.

- Draft of the company's charter as prescribed in the Law on Enterprises.

- Operation plan for the first 5 years suitable to the business line for which the License is requested. The plan must clearly state the types of insurance to be provided, target market, distribution channel, and method of setting aside the technical reserves, reinsurance program, capital investment, business efficiency, solvency, internal control, internal audit, risk management, information technology of the insurer or reinsurer.

- Copies of 9-digit or 12-digit ID cards or passports; police (clearance) certificates or equivalent of foreigners as prescribed by foreign law; curricula vitae, copies of degrees, certificates and other documents proving the eligibility of the person expected to be appointed as President of the Members' Council, Director or General Director, Legal Representative, Appointed Actuary of the insurer or reinsurer.

- List of capital contributors and the following attached documents:

+ A copy of the establishment decision or business registration certificate or other equivalent document;

+ A copy of the company's charter;

+ A decision issued by the competent authority of the capital contributor on capital contribution to establish the insurer or reinsurer;

+ A written authorization, a copy of 9-digit or 12-digit ID card or passport of the capital contributor’s authorized representative;

+ The audited financial statements for the three consecutive years preceding the year of application. In case a foreign insurer, foreign reinsurer, or foreign financial and insurance corporation authorizes a subsidiary to contribute capital to establish an insurer or reinsurer in Vietnam, it must also submit copies of the subsidiary’s audited financial statements for the three consecutive years preceding the year of application.

Audited financial statements of foreign insurers, foreign reinsurers, foreign financial and insurance corporations, and their subsidiaries must comply with Point d, Clause 1, Article 11 of this Decree;

+ An authorization letter, if the foreign insurer, foreign reinsurer, or foreign financial and insurance corporation authorizes their subsidiary to perform offshore investment and commit to jointly take responsibility, together with the subsidiary, for capital contribution and obligations of the subsidiary in the establishment of insurers and reinsurers in Vietnam;

+ The written commitment of the foreign insurer, foreign reinsurer, or foreign financial and insurance corporation to provide financial support, technology, corporate governance, risk and operation management for insurers, reinsurers to be established in Vietnam. They shall ensure that newly-established insurers and reinsurers comply with regulations on financial safety and risk management in accordance with the Law on Insurance Business;

+ Documents proving that the foreign insurer, foreign reinsurer, or foreign financial and insurance corporation has contributed capital in accordance with Point c, Clause 1, Article 65 of the Law on Insurance Business.

- A list of beneficial owners, including their full name, date of birth, 9-digit or 12-digit ID card number or passport number, nationality (specify all nationalities they have and their corresponding permanent addresses in those countries), residential address in Vietnam (if any), direct and indirect ownership rates in the insurer or reinsurer to be established.

- Certification of an authorized bank in Vietnam that the charter capital deposited in a blocked account opened at the bank is not lower than the minimum charter capital specified in Article 35 of this Decree. The certification must clearly state the capital contribution amount of each member, blocked amount, blockade purpose, blockade duration and conditions for lifting blockade.

- A minutes of the meeting of capital contributors (for the application for establishment of multiple-member limited liability company) in the matter of:

+ Agreement to contribute capital to establish an insurance limited liability company or a reinsurance limited liability company, together with a list of capital contributors;

+ Approval for the draft of the company's charter.

- A certificate of the competent authority of the home country of the foreign insurer, foreign reinsurer, or foreign financial and insurance corporation that:

+ The foreign insurer, foreign reinsurer, or foreign financial and insurance corporation is permitted to establish insurers and reinsurers in Vietnam. If the home country's regulations do not require a written approval, a written certification from a competent authority, organization, or individual is required in accordance with the law of the country;

+ The foreign insurer, foreign reinsurer, or foreign financial and insurance corporation has operated in the line of business they intend to conduct operations in Vietnam;

+ The foreign insurer, foreign reinsurer, or foreign financial and insurance corporation has financial soundness and has fully met the management requirements in their home country;

+ The foreign insurer, foreign reinsurer, or foreign financial and insurance corporation has not seriously violated their home country’s regulations on insurance business for 3 consecutive years preceding the year of application.

- A certification issued by a competent authority that Vietnamese capital contributors meet financial safety conditions and are allowed to contribute capital to establish an insurer or reinsurer in accordance with law. If relevant law does not require a written approval, the capital contributor must have a written certification of this.

- The written commitment of the capital contributors that they meet the eligibility requirements for issuance of the License as prescribed in Article 11 of Decree 46/2023/ND-CP and Article 65 of the Law on Insurance Business.

- A document proving that the capital contributors ensure that the difference between owner's equity and the required capital is greater than or equal to their planned contribution as prescribed in Point a, Clause 1, Article 11 of Decree 46/2023/ND-CP.

- A document authorizing an individual or organization to act on behalf of capital contributors to carry out the procedures for applying for a License.

What are the procedures for applying for establishment and operation license to insurance limited liability company in Vietnam?

The form of application submission is specified in Clause 1, Article 16 of Decree 46/2023/ND-CP as follows:

Procedures for applying for Establishment and Operation License

1. An application for Establishment and Operation Licenses shall be prepared as per this Decree; and submitted in person at the Ministry of Finance, or sent by post, or through the online public service system if eligible.

2. Within 30 days of receiving an incomplete or invalid application, the Ministry of Finance shall notify the applicant in writing to supplement or revise the application. The time limit for supplementation or revision of the investor’s application is 6 months from the date of notification. In case the investor fails to supplement or revise the application within the prescribed time limit, the Ministry of Finance will deny the application.

The time limit for the applicant to supplement or revise their application is 12 months from the date of the first notication by the Ministry of Finance. If the applicant fails to complete the application within the specified time limit, the Ministry of Finance has the discretion to deny the application.

...

Thus, according to regulations, an establishment and operation license to insurance limited liability company may be submitted in person at the Ministry of Finance, or sent by post, or through the online public service system if eligible.

LawNet