Is there any penalty for business suspension of household business without sending a notification? What are the current regulations on notification of business suspension in Vietnam?

- In which case must a household business notify of business suspension in Vietnam?

- Is there any penalty for business suspension of household business without sending a notification?

- What is the latest form of notification of business suspension of household business in Vietnam according to Circular 02?

In which case must a household business notify of business suspension in Vietnam?

Pursuant to the provisions on business suspension of household business in Article 91 of Decree No. 01/2021/ND-CP as follows:

Business suspension and resumption of business ahead of notified schedule

1. If the suspension period is 30 days or longer, the household business must send a notification to the business registration authority of district where it was registered and its supervisory tax authority.

2. If the household business suspends business or resumes its business ahead of the notified schedule, the household business shall send a written notification to the business registration authority of district where it was registered at least 03 working days before the planned date of business suspension or resumption of business ahead of the notified schedule. Such notification must be enclosed with the copy of the minutes of the meeting of family household members on business suspension or resumption of business ahead of schedule if the household business is established by family household members. When receiving the notification, the district-level business registration authority shall give a confirmation slip to the household business. Within 03 working days from the receipt of the valid application, the district-level business registration authority shall issue a certificate of registration of business suspension or certificate of registration of resumption of business ahead of the notified schedule to the household business.

Thus, according to the above regulations, if the suspension period is 30 days or longer, the household business must send a notification of business suspension.

Is there any penalty for business suspension of household business without sending a notification? What are the current regulations on notification of business suspension in Vietnam?

Is there any penalty for business suspension of household business without sending a notification?

According to the provisions of Article 91 of Decree No. 01/2021/ND-CP mentioned above, the household business must notify of business suspension if the suspension period is 30 days or longer.

In case household businesses fail to notify in accordance with regulations, they will be handled according to Article 63 of Decree No. 122/2021/ND-CP as follows:

Violations against regulations on information provision and reporting by household businesses

1. A fine ranging from VND 5,000,000 to VND 10,000,000 shall be imposed for any of the following violations:

a) Failure to submit a business report at the request of the district-level business registration authority;

b) Changing the household business’s owner without submitting an application for changes to household business to the district-level business registration authority where the household business is registered;

c) Suspending or resuming business ahead of schedule without sending a written notification to the district-level business registration authority where the household business is registered;

d) Changing business location without notifying the district-level business registration authority;

dd) Shutting down a household business without sending a notification or without returning the original certificate of household business registration to the district-level business registration authority;

e) Changing a business line without sending a notification the business registration authority of the district where the household business’s head office is located;

g) Carrying out business operations at multiple locations without notifying the business registration authority of the district where the household business is headquartered, tax authority or market surveillance authority.

In the case of a tax offence, fines therefor shall be imposed according to regulations on penalties for administrative tax offences.

2. Remedial measures:

The violator is compelled to:

a) submit a business report at the request of the district-level business registration authority as requested if the violation specified in Point a Clause 1 of this Article is committed;

b) notify the district-level business registration authority to the enterprise registration if any of the violations specified in Points b, c, d, dd, e and g Clause 1 of this Article is committed.

Thus, household business that suspend their business but do not notify will be handled as follows:

- A fine ranging from VND 5,000,000 to VND 10,000,000 (imposed upon individuals, if the organization commits the same violations, the fine will be doubled);

- The violator is compelled to notify the business registration authority of the suspension of household business.

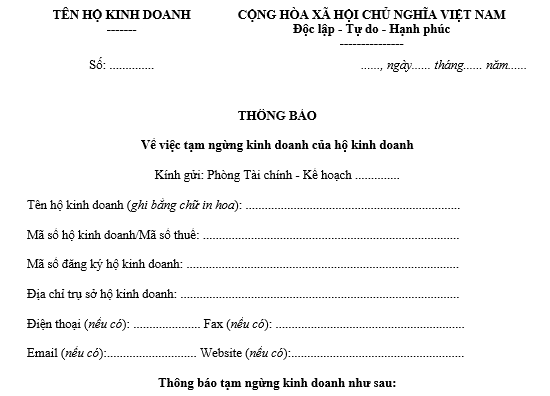

What is the latest form of notification of business suspension of household business in Vietnam according to Circular 02?

The latest form of notification of business suspension of household business in Vietnam is applied from July 1, 2023, is the form in Appendix III-4 issued together with Circular No. 02/2023/TT-BKHDT.

Download the latest form of notification of business suspension of household business in Vietnam: Click here.

Circular No. 02/2023/TT-BKHDT takes effect from July 1, 2023.

LawNet