Guidance on Organizing Registration for Changes in Taxpayer Information Without Changing the Managing Tax Authority

What documents are required for organizations to change taxpayer registration information without changing the managing tax authority?

Based on Subsection 8, Section 2, Part 2 of administrative procedures issued together with Decision 2589/QD-BTC year 2023 as follows:

- Taxpayers as specified in Points a, b, c, d, h, n Clause 2 Article 4 of Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance, including:

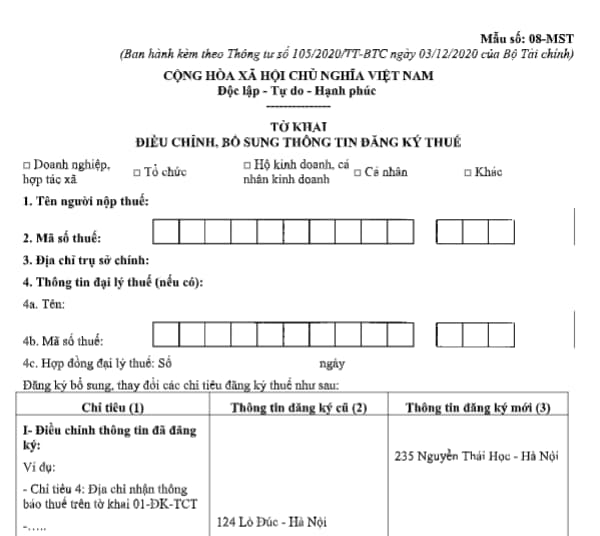

+ Declaration for adjustment and supplementation of taxpayer registration information according to Form 08-MST issued together with Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance;

+ Copies of the Establishment and Operation License, or Certificate of Operational Registration of dependent units, or Establishment Decision, or equivalent License issued by a competent authority if the information on these documents changes.

- Taxpayers as specified in Point d Clause 2 Article 4 of Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance, including:

Declaration for adjustment and supplementation of taxpayer registration information according to Form 08-MST issued together with Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance.

Guide for organizations to register changes in taxpayer registration information without changing the managing tax authority

How to perform the procedure for changing taxpayer registration information without changing the managing tax authority?

Based on Subsection 8, Section 2, Part 2 of administrative procedures issued together with Decision 2589/QD-BTC year 2023 regulations on the procedure for changing taxpayer registration information for taxpayers who are economic organizations, other organizations (including dependent units) changing taxpayer registration information without changing the managing tax authority as follows:

Step 1:

Economic organizations, other organizations (including dependent units) who have registered taxpayer information with the tax authority must carry out the procedure to change taxpayer registration information with the directly managing tax authority within 10 (ten) working days from the date of occurrence of the changed information if there is a change in any information on the taxpayer registration declaration, the attached list of declarations for taxpayer registration;

- For electronic taxpayer registration documents:

Taxpayers (NNT) access the electronic portals that the taxpayer chooses (The General Department of Taxation's electronic portal/ electronic portal of the competent state authority, including the National public service portal, Ministry-level public service portal, provincial public service portal according to the regulations on the implementation of the one-stop-shop mechanism and have been connected to the General Department of Taxation's electronic portal/ electronic portal of the T-VAN service provider) to declare information and send necessary documents in electronic form (if any), sign electronically and send to the tax authority through the chosen electronic portal;

NNT submits the documents (taxpayer registration documents concurrently with business registration documents according to the one-stop-shop linkage mechanism) to the competent state management authority as prescribed. The competent state management authority sends the information of the received documents of the NNT to the tax authority through the General Department of Taxation's electronic portal.

Step 2: Tax authority receipt:

- For paper taxpayer registration documents:

+ In case documents are submitted directly at the tax authority: Tax officers receive and stamp the receipt on the taxpayer registration documents, clearly stating the date of receipt, number of documents according to the inventory list of documents submitted directly at the tax authority. Tax officers issue an appointment slip for the result date, specifying the time limit for processing the received documents;

+ In case the taxpayer registration documents are sent by post: Tax officers stamp the receipt, note the date of receipt on the documents, and record the correspondence number of the tax authority;

Tax officers check the taxpayer registration documents. If the documents are incomplete and need explanation or supplementary information, the tax authority notifies the taxpayers according to Form No. 01/TB-BSTT-NNT in Appendix II issued together with Decree 126/2020/ND-CP dated October 19, 2020 of the Government of Vietnam within 02 (two) working days from the date of receipt of the documents.

- For electronic taxpayer registration documents:

The tax authority receives the documents through the General Department of Taxation's electronic portal, verifies, and processes the documents through the electronic data processing system of the tax authority:

+ Documents receipt: The General Department of Taxation's electronic portal sends a receipt notification that the NNT has submitted the documents to the NNT through the selected electronic portal (General Department of Taxation's electronic portal/ competent state authority's electronic portal or T-VAN service provider) within 15 minutes from the time of receiving the taxpayer registration documents electronically submitted by the taxpayer;

+ Verifying and processing documents: The tax authority verifies and processes the taxpayer's documents according to the regulations of the law on taxpayer registration and returns the processing results through the chosen electronic portal:

++ If the documents are complete and in compliance with the procedures and the results need to be returned: The tax authority sends the processing results to the chosen electronic portal by the time specified in Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance guiding on taxpayer registration;

++ If the documents are incomplete or incorrect in terms of procedures, the tax authority sends a notification of non-acceptance of the documents to the chosen electronic portal within 02 (two) working days from the date stated on the receipt notification.

Latest form of declaration for adjustment and supplementation of taxpayer registration information?

The declaration for adjustment and supplementation of taxpayer registration information is specified according to Form 08-MST issued together with Circular 105/2020/TT-BTC dated December 03, 2020 of the Ministry of Finance, as follows:

Download the form for adjustment and supplementation of taxpayer registration information here

LawNet