How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam?

- How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam?

- How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam at actual prices?

- How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam at comparative prices?

How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam?

Pursuant to Item 2, Subsection 1, Section I, Appendix II issued together with Circular 33/2022/TT-BCT stipulates as follows:

Concepts and methods of calculation

The production value of the mining industry is the total value of physical products and services produced by the mining industry in a given period.

The production value of the mining industry includes:

- Value of raw materials, energy, spare parts.

- Cost of production services and depreciation of fixed assets.

- Cost of wages and salaries for laborers.

- Production tax, surplus value created in the product value.

The production value of the mining industry is calculated according to two types of prices: actual prices and comparative prices.

...

Accordingly, the production value of the mining industry is calculated according to two types of prices: actual pricesand comparative prices.

How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam?

How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam at actual prices?

Pursuant to Item 2, Subsection 1, Section I, Appendix II issued together with Circular 33/2022/TT-BCT stipulating the method of calculating production value of the mining industry according to actual prices as follows:

The production value of the mining industry at actual prices is the total value of products generated by production activities of the mining industry calculated at the prices at the time of calculating the production value.

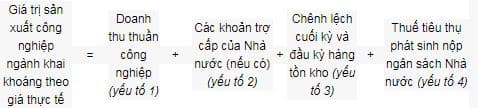

Calculation method:

In there:

- Factor 1: Industrial net revenue

Is the revenue from consumption of products and services of the mining industry after deducting a number of items such as:

Trade discounts, rebates, value of returned goods and export taxes and value added taxes of industrial enterprises (calculated by the direct method) are payable in proportion to the revenue determined in the period. (including domestic consumption and export) are produced at the enterprise and other types of revenue are prescribed for industrial production.

- Factor 2: State subsidies (if any)

Amounts subsidized by the State from the state budget for enterprises for the purpose of price subsidies are regulated by the State at low selling prices (for goods and services serving the public at home or to cover losses for other items). State-promoted production for export).

This amount is calculated by the actual amount generated in the period in which the State has to subsidize the enterprise even though the enterprise has not yet received the full amount.

- Factor 3: Difference between the end of the period and the beginning of the period in inventory

Factors participating in the calculation of inventory variance in the mining industry include: Costs of work in progress, finished products, and consignments of industrial activities. Specifically:

+ Work in progress is equal to ( =) the difference plus (+) or minus (-) at the end of the period and at the beginning of the period in progress, including: Difference between work in progress on the production line and semi-finished products of Industrial production. The difference in work in progress of other non-industrial activities (such as construction in progress) is not included.

+ Finished products are equal to (=) the difference plus (+) or minus (-) at the end of the period and at the beginning of the period finished goods in stock. The difference between finished goods inventory does not include inventories of goods purchased and sold without processing at the enterprise and inventories of raw materials, fuels, materials, tools and spare parts.

+ Goods consigned for sale is equal to (=) the difference plus (+) or minus (-) at the end of the period and at the beginning of the period of consignment.

This clause includes the value of goods produced by the enterprise with the enterprise's raw materials or products that the enterprise processes in another unit, which has been shipped from warehouse but on the way to be consumed, not yet collected. received money or has not been accepted for payment, or is at the agent warehouse at the beginning and the end of the period. It is calculated according to the selling price excluding consumption tax in the sales invoice.

- Factor 4: Consumption tax incurred must be paid to the State budget

+ Consumption tax payable includes taxes levied on products and services for consumption, arising only when there is consumption of industrial products and services, including: Value-added tax on domestically sold goods according to the method of consumption. direct, value added tax on domestic sales by credit method and export tax.

+ For value added tax on domestic sales by the direct method (without deduction), export tax is the actual tax amount incurred to be paid in the period corresponding to the revenue calculated in the element "Revenue purely industrial".

+ For value-added tax on domestic sales calculated by the credit method, the arising value-added tax payable is the output value-added tax amount minus (-) input value-added tax already paid. deduction for the period.

How to calculate the production value of the mining industry in the statistics of industry and trade in Vietnam at comparative prices?

Pursuant to Item 2, Subsection 1, Section I, Appendix II issued together with Circular 33/2022/TT-BCT stipulating the method of calculating production value of the mining industry at comparative prices as follows:

The production value of the mining industry at comparative prices has the same content as the production value at actual prices, but is calculated on the basis of the producer's fixed price as a basis for comparison.

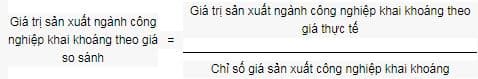

Calculation method:

Circular 33/2022/TT-BCT will take effect from February 4, 2023.

LawNet