What is the Schedule of prices of locally manufactured motorcycles and imported motorcycles for registration fee determination? Where to pay registration fee for motorcycles in Vietnam?

- What are the registration fee rates for motorcycles in Vietnam according to the percentage of Decree 10/2022/ND-CP?

- Vietnam: What is the Schedule of prices of locally manufactured motorcycles and imported motorcycles for registration fee determination?

- Where to pay registration fee for motorcycles in Vietnam?

What are the registration fee rates for motorcycles in Vietnam according to the percentage of Decree 10/2022/ND-CP?

Pursuant to the provisions in Article 8 of Decree 10/2022/ND-CP as follows:

Registration fee rates (%)

1. Houses, land: 0,5%.

2. Hunting guns; guns used for training or sports: 2%

3. Ships, including barges, canoes, tugs, pushers, submarines, submersibles; boats, including yachts; aircraft: 1%

4. Motorcycles: 2%

Except:

a) Motorcycles registered for the first time under organizations or individuals in centrally affiliated cities, in provincial cities or in towns where the People's Committee of the province is based, to which the rate of 5% applies.

b) Motorcycles chargeable by re-registration fee, to which a rate of 1% applies. The re-registration fee rate of 5% applies to motorcycles on which the owner has declared and paid the registration fee at the rate of 2% before conducting the transfer to another organization or individual in an administrative division prescribed in Point a of this Clause.

5. Motor vehicles, trailers or semi-trailers towed by motor vehicles, or equivalences: 2%.

Except:

a) Passenger motor vehicles with 9 seats or fewer (including pickups for passenger transport), to which the rate of 10% applies upon first-time registration. If it is necessary to apply a higher rate to match local circumstances, the People's Council of the province or centrally affiliated city shall decide an increase not exceeding 50% of the general rate specified in this Point.

b) Pickups for cargo transport with the maximum payload capacity allowed to be in traffic of under 950 kg and 5 or fewer seats and vans with the maximum payload capacity allowed to be in traffic of under 950 kg, to which the rate equal to 60% of the first-time registration fee for passenger motor vehicles with 9 seats or fewer applies upon first-time registration.

c) Electric cars running on batteries:

- Within 3 years from the date this Decree comes into force: the first-time registration fee is 0%.

- Within the next 2 years: the first-time registration fee is 50% of the fee rate for petrol and oil cars with the same quantity of seats.

d) Types of motor vehicles prescribed in Points a, b, and c of this Clause, to which the re-registration fee rate of 2% applies uniformly on a nation-wide scale.

Tax agencies shall consider the type of vehicle specified in the certificate of technical safety and quality and environment protection as issued by Vietnamese registry agencies to determine the registration fees payable on motor vehicles, trailers or semi-trailers towed by motor vehicles, and equivalences according to this Clause.

...

Thus, the registration fee rate for motorcycles is 2%

Note:

- Motorcycles registered for the first time under organizations or individuals in centrally affiliated cities, in provincial cities or in towns where the People's Committee of the province is based, to which the rate of 5% applies.

- Motorcycles chargeable by re-registration fee, to which a rate of 1% applies. The re-registration fee rate of 5% applies to motorcycles on which the owner has declared and paid the registration fee at the rate of 2% before conducting the transfer to another organization or individual in an administrative division prescribed in Point a of this Clause.

In addition, the content in Clause 5, Article 8 of Decree 10/2022/ND-CP mentioned above is also amended by Article 1 of Decree 41/2023/ND-CP. Accordingly, for Motor vehicles, trailers or semi-trailers towed by motor vehicles, or equivalences, the registration fee rate will be 1% until December 31, 2023.

What is the Schedule of prices of locally manufactured motorcycles and imported motorcycles for registration fee determination? Where to pay registration fee for motorcycles in Vietnam? (Image from the Internet)

Vietnam: What is the Schedule of prices of locally manufactured motorcycles and imported motorcycles for registration fee determination?

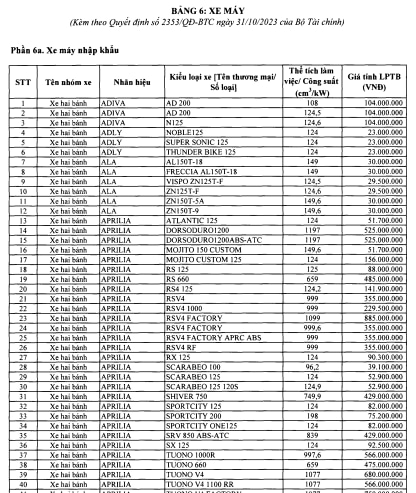

On October 31, 2023, the Ministry of Finance issued Decision 2353/QD-BTC 2023 on issuance of Schedule of car and motorcycle prices for registration fee determination.

See the entire Schedule of prices of locally manufactured motorcycles and imported motorcycles for registration fee determination in Decision 2353/QD-BTC 2023.

Where to pay registration fee for motorcycles in Vietnam?

Pursuant to Article 11 of Decree 10/2022/ND-CP regulating registration fee payment as follows:

- Organizations and individuals shall conduct declarations and payments of registration fees in accordance with regulations of the law on tax administration when applying to competent state agencies for the right to own and use properties.

- Digital database of payment of registration fees via the Vietnam State Treasury, commercial banks, or providers of intermediary payment services digitally signed by the General Department of Tax and uploaded to the National Public Service Portal, has the same value as paper receipts for traffic enforcer agencies, agencies of natural resources and environment, and other competent state agencies connected to the National Public Service Portal to access and utilize for purposes of resolving financial procedures related to registration of ownership and use rights.

Thus, registration fees may be paid at the Vietnam State Treasury, commercial banks, or providers of intermediary payment services.

LawNet