Who is eligible for loans to support job creation, maintenance and expansion from the National Employment Fund of Vietnam?

- How much is the maximum loan amount granted to each eligible employee from the National Employment Fund of Vietnam?

- What are the loan interests offered to employees taking loans from the National Employment Fund of Vietnam?

- What is the loan application letter to support job creation, maintenance and expansion from the National Employment Fund of Vietnam in 2023?

Who is eligible for loans to support job creation, maintenance and expansion from the National Employment Fund of Vietnam?

Pursuant to Article 12 of the Law on Employment 2013, regulations on borrowers of loans from the National Employment Fund of Vietnam, specifically as follows:

Borrowers of loans from the National Employment Fund

1. Eligible borrowers of loans from the National Employment Fund include:

a/ Small- and medium-sized enterprises, cooperatives, cooperative groups and business households;

b/ Workers.

2. The entities defined in Clause 1 of this Article that fall in the cases below may take loans from the National Employment Fund at lower interest rates:

a/ Small- and medium-sized enterprises, cooperatives, cooperative groups and business households that employ many people with disabilities or ethnic minority people;

b/ Ethnic minority people who are living in areas with extremely difficult socio-economic conditions, and people with disabilities.

Pursuant to Article 23 of Decree 61/2015/ND-CP regulating borrowers as follows:

Borrowers

1. The entities eligible for loans (hereinafter referred to as borrowers) shall be prescribed in Clause 1 Article 12 of the Law on employment.

2. Small and medium-sized enterprises, cooperatives, artels or business households (hereinafter referred to as business entities) that employ many disabled people or ethnics as prescribed in Point a Clause 2 Article 12 of the Law on employment, in particular:

a) The business entity employing many disabled employees means that the number of disabled employees accounts for at least 30% of the total number of employees;

b) The business entity employing many ethnic employees means that the number of ethnic employees accounts for at least 30% of the total number of employees;

c) The business entity employing many disabled and ethnic employees means that the number of disabled and ethnic employees accounts for at least 30% of the total number of employees.

Accordingly, subjects eligible for loans from the National Employment Fund include:

- Small and medium-sized enterprises, cooperatives, artels or business households.

- Employees.

Who is eligible for loans to support job creation, maintenance and expansion from the National Employment Fund of Vietnam?

How much is the maximum loan amount granted to each eligible employee from the National Employment Fund of Vietnam?

Pursuant to Article 24 of Decree 61/2015/ND-CP (amended by Clause 2, Article 1 of Decree 74/2019/ND-CP), regulations on loan amounts from the National Employment Fund are as follows:

Loan amounts

1. The maximum loan amount granted to a business entity is VND 02 billion/project but shall not exceed VND 100 million/employee benefiting employment creation, maintenance and development policies.

2. The maximum loan amount granted to each eligible employee is VND 100 million.

3. The specific loan amount shall be subject to the consideration and agreement between Vietnam Bank for Social Policies (VBSP) and the borrower according to fund sources, business cycle and solvency of that borrower.

Accordingly, the maximum loan amount granted to each eligible employee is VND 100 million.

What are the loan interests offered to employees taking loans from the National Employment Fund of Vietnam?

Pursuant to Article 26 of Decree 61/2015/ND-CP (amended by Clause 4, Article 1 of Decree 74/2019/ND-CP) stipulates as follows:

Loan interests

1. The interest rate on a loan offered to any of the entities defined in Clause 1 Article 12 of the Law on employment shall be same as that on the loan granted to a near-poor household as regulated in the law on credits granted to near-poor households.

2. With regard to those prescribed in Clause 2 Article 12 of the Law on employment, the loan interest shall equal (=) 50% of the interest prescribed in Clause 1 of this Article.

3. The overdue interest shall equal (=) 130% of the loan interest prescribed in Clause 1 and Clause 2 of this Article..

Accordingly, The interest rate on a loan offered to any of the entities shall be same as that on the loan granted to a near-poor household as regulated in the law on credits granted to near-poor households.

For ethnic minorities living in areas with extremely difficult socio-economic conditions, people with disabilities, the loan interest rate is 50% of the loan interest rate for near-poor households according to the provisions of Law on credit near-poor households.

The overdue interest shall equal 130% of loan interest.

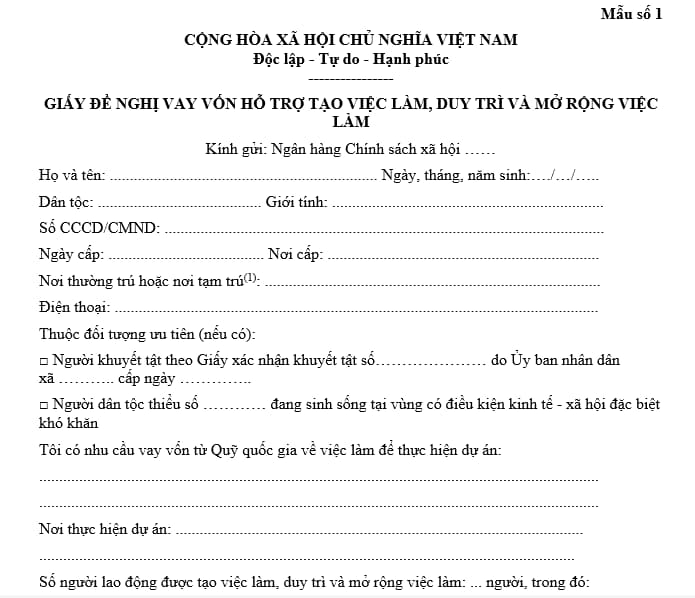

What is the loan application letter to support job creation, maintenance and expansion from the National Employment Fund of Vietnam in 2023?

The current form of loan application letter to support job creation, maintenance and expansion is Form No. 01 issued with Decree 104/2022/ND-CP as follows:

Download the loan application letter to support job creation, maintenance and expansion here

* Instructions on filling out the loan application form to support job creation, maintain and expand employment:

The applicant requests to fill out the loan application form to support job creation, maintenance and expansion of jobs mentioned above according to the following instructions:

(1) Location of the Social Policy Bank sending the loan request for support

(2) In case you request a loan at your permanent residence, write down the permanent residence information; In case of requesting a loan at a temporary residence, write down information about the temporary residence.

(3) Check the box corresponding to the priority object (if any), including:

- People with disabilities according to the Certificate of Disability issued by the Commune People's Committee

- Ethnic minorities living in areas with particularly difficult socio-economic conditions.

(4) Clearly state the project name and briefly state the purpose of that project

(5) Clearly state the address, location, and place of project implementation

(6) Number of workers with jobs created, maintained and expanded, specifically:

- Female workers (if any)

- Disabled workers (if any)

- Ethnic minority workers (if any)

(7) Total amount of money available to implement projects to support employment for workers

(8) The amount of money will be requested to borrow from the social policy budget

(9) List and clearly state the purpose of the loan amount for each specific job

(10) Clearly determine the loan term (number of months), which month to pay principal and which month to pay interest.

LawNet