Do Vietnamese citizens exiting Vietnam to reside overseas have the right to make a written request for confirmation of fulfillment of tax obligations?

- Do Vietnamese citizens exiting Vietnam to reside overseas have the right to make a written request for confirmation of fulfillment of tax obligations?

- What form is used to request for confirmation of fulfillment of tax obligations for Vietnamese citizens exiting Vietnam to reside overseas?

- What are the procedures for confirmation of fulfillment of tax obligations in Vietnam?

Do Vietnamese citizens exiting Vietnam to reside overseas have the right to make a written request for confirmation of fulfillment of tax obligations?

Pursuant to Clause 1, Article 66 of the Law on Tax Administration 2019 on fulfillment of tax liability upon taxpayer’s exit:

Fulfillment of tax liability upon taxpayer’s exit

1. Taxpayers against whom tax decisions are enforced, Vietnamese citizens exiting Vietnam to reside overseas, Vietnamese people residing overseas, foreigners exiting Vietnam shall fulfill their tax liability before the exit. Otherwise, they shall be suspended from exit in accordance with immigration laws.

2. Tax authorities shall inform immigration authorities of the cases specified in Clause 1 of this Article.

3. The Government shall elaborate this Article.

Taxpayers against whom tax decisions are enforced, Vietnamese citizens exiting Vietnam to reside overseas, Vietnamese people residing overseas, foreigners exiting Vietnam shall fulfill their tax liability before the exit. Otherwise, they shall be suspended from exit in accordance with immigration laws.

Vietnamese citizens exiting Vietnam to reside overseas shall fulfill their tax liability before the exit. Therefore, they have the right to make a written request for confirmation of fulfillment of tax obligations.

What form is used to request for confirmation of fulfillment of tax obligations for Vietnamese citizens exiting Vietnam to reside overseas?

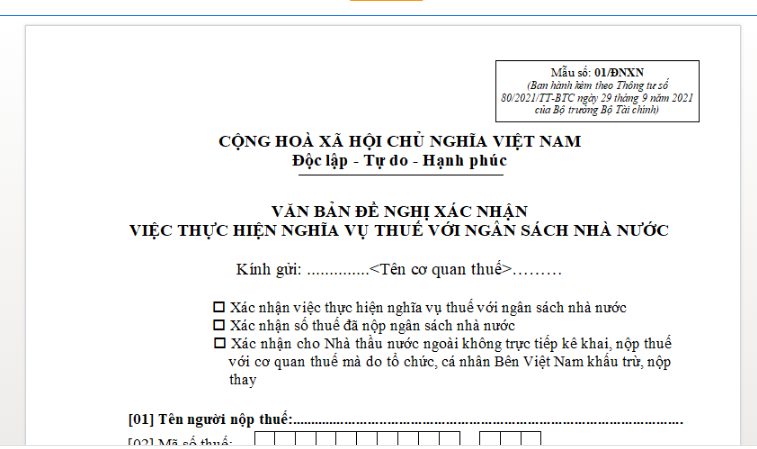

Pursuant to Form No. 01/DNXN, Appendix I issued with Circular 80/2021/TT-BTC:

>>> Download request form for confirmation of fulfillment of tax obligations for Vietnamese citizens exiting Vietnam to reside overseas >>> Here.

Do Vietnamese citizens exiting Vietnam to reside overseas have the right to make a written request for confirmation of fulfillment of tax obligations? What form is used to request for confirmation of fulfillment of tax obligations for Vietnamese citizens exiting Vietnam to reside overseas? (Image from the Internet)

What are the procedures for confirmation of fulfillment of tax obligations in Vietnam?

Pursuant to Clause 1, Article 70 of Circular 80/2021/TT-BTC, the procedures for confirmation of fulfillment of tax obligations are as follows:

- Receipt, processing of requests for confirmation of fulfillment of tax obligations or confirmation of tax payment (hereinafter referred to as "confirmation of fulfillment of tax obligations").

+ The taxpayer shall send the written request for confirmation of fulfillment of tax obligations according to Form No. 01/DNXN in Appendix I hereof to the tax authority in accordance with Point c of this Clause.

In case tax incurred by the foreign contractor is declared and paid by the Vietnamese party and the Vietnamese party has fulfilled the foreign contractor's tax obligations: The foreign contractor or the Vietnamese party shall send the written request for confirmation of fulfillment of tax obligations to the supervisory tax authority of the Vietnamese party.

+ Processing of requests for confirmation of fulfillment of tax obligations at state budget revenue-managing tax authorities

++ Review of data and information about the taxpayer's fulfillment of their tax obligations.

On the basis of the tax administration database on the tax administration system, the state budget revenue-managing tax authority shall review the information about the taxpayer's fulfillment of tax obligations, including:

+++ Paid, unpaid and overpaid tax, late payment interest and fines;

+++ The taxpayer's administrative tax offences (if any).

++ In case the taxpayer's information matches information on the tax administration system, the tax authority shall send a notice of confirmation of fulfillment of tax obligations according to Form No. 01/TB-XNNV in Appendix I hereof to the taxpayer in accordance with Point b.4 of this Clause.

++ In case the taxpayer's information and information on the tax administration system are inadequate or inconsistent, the tax authority shall send the taxpayer a request for explanation and supplementary information according to Form No. 01/TB-BSTT-NNT enclosed with Decree No. 126/2020/ND-CP in accordance with Point b.4 of this Clause.

The time needed for providing supplementary information shall be excluded from the time for processing the request for confirmation of fulfillment of tax obligations.

If the taxpayer's supplementary information is adequate, the tax authority shall send the taxpayer a notice of confirmation of fulfillment of tax obligations according to Form No. 01/TB-XNNV in Appendix I hereof to the taxpayer in accordance with Point b.4 of this Clause. In case the confirmation cannot be given, the tax authority shall send a notice according to Form No. 01/TB-XNNV in Appendix I hereof and provide explanation in accordance with Point b.4 of this Clause.

++ Within 10 working days from the receipt of the taxpayer's request, the tax authority shall issue a notice according to Form No. 01/TB-XNNV to grant or reject the confirmation, or issue Form No. 01/TB-BSTT-NNT enclosed with Decree No. 126/2020/ND-CP requesting the taxpayer to provide explanation or supplementary information

LawNet