Declaration of Personal Income Tax Finalization for Self-Finalizing Individuals: Regulations and Submission Location

How is the tax finalization declaration for individuals' personal income tax (PIT) regulated?

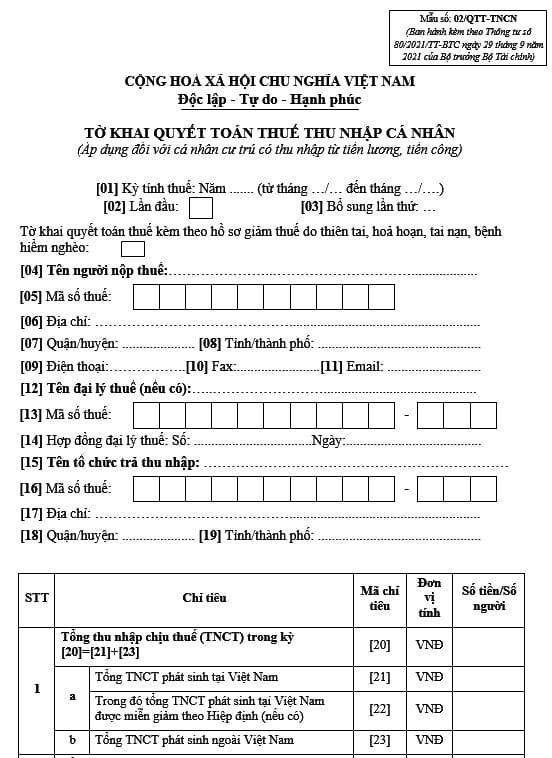

The personal income tax finalization declaration form for individuals with income from salaries and wages is Form 02/QTT-TNCN issued with Circular 80/2021/TT-BTC as follows:

Download the personal income tax finalization declaration form for individuals with income from salaries and wages here.

Tax finalization declaration for PIT for individuals. Where to submit PIT finalization dossiers?

When to self-finalize personal income tax for salaries and wages?

Based on point d.3, clause 6, Article 8 of Decree 126/2020/ND-CP, the regulations are as follows:

Types of taxes declared monthly, quarterly, annually, per each tax obligation arising, and for annual tax finalization

…

6. Types of taxes and fees required to be declared and finalized annually and at the time of dissolution, bankruptcy, cessation of activities, termination of contracts, or reorganization of enterprises. In case of transformation of the enterprise type (excluding equitized state enterprises) where the new enterprise inherits all tax obligations of the transformed enterprise, there is no need to finalize taxes up to the decision date of conversion, the enterprise will finalize taxes at the end of the year. Specifically, as follows:

…

d) Personal income tax from organizations and individuals paying salaries and wages; individuals with income from salaries and wages who authorize tax finalization to organizations and individuals paying such income; individuals with income from salaries and wages directly finalizing taxes with tax authorities. Specifically, as follows:

d.3) Resident individuals with income from salaries and wages directly declare personal income tax finalization to tax authorities in the following cases:

Have additional tax payable or excess tax paid to be refunded or deducted in the next tax declaration period, except for the following cases: individuals have additional payable tax after the annual tax finalization amounting to 50,000 VND or less; individuals have payable tax less than the prepaid tax and do not request a refund or deduction in the next tax declaration period; individuals with income from salaries and wages signing labor contracts of 03 months or more at one entity, simultaneously having irregular income at other places with an average monthly amount in the year not exceeding 10 million VND and have the personal income tax deducted at 10% rate without requesting to finalize tax for this income; individuals whose employers purchase life insurance (excluding voluntary pension insurance), other non-compulsory insurance with insurance premiums accumulation, and the employers or insurers have deducted personal income tax at 10% on the corresponding premium money ratio for the portion of insurance purchased or contributed by the employers, individuals do not need to finalize personal income tax for this income.

Individuals present in Vietnam in the first calendar year for less than 183 days, but within 12 consecutive months from the first day of presence in Vietnam are 183 days or more.

Foreign individuals ending working contracts in Vietnam shall declare tax finalization with tax authorities before exiting. If the individual has not completed the tax finalization procedures with tax authorities, they must authorize the income-paying organization or other organization, individual, to finalize taxes according to regulations on tax finalization for individuals. In case of income-paying organizations or other organizations, individuals authorized to finalize, they shall be responsible for the additional personal income tax payable or the excess tax refund of the individual.

Resident individuals with income from salaries and wages simultaneously subjected to tax reduction due to natural disasters, fires, accidents, severe illness affecting their tax payment ability, shall not authorize income-paying organizations, individuals to finalize tax on their behalf but must directly declare tax finalization with tax authorities according to regulations.

Thus, resident individuals with income from salaries and wages directly declare personal income tax finalization in the following cases:

- Have additional tax payable or excess tax paid to be refunded or deducted in the next tax declaration period, except as otherwise provided by law.- Presence in Vietnam in the first calendar year for less than 183 days, but within 12 consecutive months from the first day of presence in Vietnam are 183 days or more.- Foreign individuals ending working contracts in Vietnam shall declare tax finalization with tax authorities before exiting.- Resident individuals with income from salaries and wages simultaneously subjected to tax reduction due to natural disasters, fires, accidents, severe illness affecting their tax payment ability, shall not authorize income-paying organizations, individuals to finalize tax on their behalf but must directly declare tax finalization with tax authorities according to regulations.

Where must individuals submit tax finalization documents?

Based on clause 8, Article 11 of Decree 126/2020/ND-CP, the regulations are as follows:

Place of tax declaration submission

...

8. The place of tax declaration submission for taxpayers being individuals with tax obligations arising from salaries and wages, subject to personal income tax finalization, in accordance with point d, clause 4, Article 45 of the Law on Tax Administration, is as follows:

a) Individuals directly declaring taxes monthly or quarterly according to clause 1, Article 8, Article 9 of this Decree, includes:

a.1) Resident individuals with income from salaries and wages paid by organizations, individuals in Vietnam subject to personal income tax but not deducted tax, shall submit tax declaration to the tax authority directly managing the income-paying organization or individual.

a.2) Resident individuals with income from salaries and wages paid from abroad, shall submit tax declaration to the tax authority where the individual arises work in Vietnam. If the place of work of the individual is not in Vietnam, the individual submits a tax declaration to the tax authority where the individual resides.

b) Individuals directly declaring annual tax finalization according to clause 6, Article 8 of this Decree includes:

b.1) Resident individuals with income from salaries and wages at one place and fit the criteria to self-declare tax during the year shall submit tax finalization documents to the tax authority where the individual directly declared tax during the year in accordance with point a of this clause. If individuals have income from salaries and wages at two or more places, including the case of both self-declared income and income paid by organizations that have deducted tax, then the individual submits tax finalization documents to the tax authority where the largest income source during the year is. If unable to identify the largest income source, then the individual chooses the place of tax finalization submission at the tax authority managing the income-paying organization or where the individual resides.

b.2) Resident individuals with income from salaries and wages subject to tax deduction at source at two or more places shall submit tax finalization documents as follows:

Individuals having calculated family deductions for themselves in the income-paying organizations, individuals shall submit tax finalization documents to the tax authority directly managing the income-paying organization or individual. If individuals change their place of work, the final income-paying organization calculates family deductions for them, then submit tax finalization documents to the tax authority managing the final income-paying organization. If individuals change their place of work, and the final income-paying organization does not calculate family deductions, submit tax finalization documents to the tax authority where the individual resides. If individuals do not calculate family deductions in any income-paying organization, submit tax finalization documents to the tax authority where the individual resides.

For resident individuals who do not sign labor contracts, or sign labor contracts under 03 months, or service contracts with income at one or many places deducted at 10%, submit tax finalization documents to the tax authority where the individual resides.

Resident individuals during the year having income from salaries and wages at one or many places but at the finalization time are not working at any income-paying organization, then the place of tax finalization submission is the tax authority where the individual resides.

Thus, depending on the subject who pays the salary, wages and related to tax deduction, individuals directly declare tax finalization at different tax authorities (department, unit) according to each specific case listed above.

In case individuals declare and submit PIT finalization documents at the website https://canhan.gdt.gov.vn, the system has a function to support identifying the finalizing tax authority based on the information related to tax obligations arising in the year declared by the individual.

LawNet