Proposal for adjustment of monthly salary as the basis for payment of social insurance, adjustment of monthly income as a basis for payment of social insurance in Vietnam?

- Is there a Draft Circular regulating adjustment of monthly salary and income as a basis for payment of social insurance in Vietnam?

- How is the proposal to adjust the monthly salary as a basis for payment of social insurance?

- How is the proposal to adjust the monthly income as a basis for payment of social insurance in Vietnam?

Is there a Draft Circular regulating adjustment of monthly salary and income as a basis for payment of social insurance in Vietnam?

Recently, the Minister of Labor, War Invalids and Social Affairs issued a Draft Circular stipulating the adjustment of salary and monthly income as a basis for payment of social insurance. Specifically, the subjects of salary adjustment for which social insurance premiums have been paid are as follows:

- Employees subject to the salary regime prescribed by the State start participating in social insurance from January 1, 2016 onwards, enjoy lump-sum social insurance, or die but their relatives are entitled to a lump-sum survivorship allowance for the period from January 1, 2023 to December 31, 2023.

- The employee pays social insurance premiums according to the salary regime decided by the employer, enjoys pension, lump-sum allowance upon retirement, lump-sum social insurance, or dies and his/her relatives are entitled to a lump-sum survivorship allowance for the period from January 1, 2023 to December 31, 2023.

- Subjects of adjustment of monthly income as a basis for payment of social insurance according to Clause 2, Article 4 of Decree No. 134/2015/ND-CP are social insurance participants who voluntarily enjoy pension or lump-sum allowance when retirement, lump-sum social insurance or death whose relatives are entitled to a lump-sum survivorship allowance for the period from January 1, 2023 to December 31, 2023.

Proposal for adjustment of monthly salary as the basis for payment of social insurance, adjustment of monthly income as a basis for payment of social insurance in Vietnam? (Image from the Internet)

How is the proposal to adjust the monthly salary as a basis for payment of social insurance?

In Article 2 of the Draft Circular stipulating the adjustment of monthly salary and income as a basis for payment of social insurance, there are provisions on adjustment of the monthly salary as the basis for payment of social insurance as follows:

- The monthly salary as the basis for payment of social insurance for the subjects specified in Clause 1, Article 1 of this Circular shall be adjusted according to the following formula:

Monthly salary on which social insurance premiums are based of each year = Total monthly salary on which social insurance premiums are based x Adjustment of salary for which social insurance premiums have been paid in the corresponding year

In which, the adjustment of the salary for which social insurance premiums have been paid for the corresponding year is made according to Table 1 below:

- For employees who both have time to pay social insurance premiums and are subject to the salary regime prescribed by the State and have time to pay social insurance premiums according to the salary regime decided by the employer:

Monthly salary on which social insurance premiums are based, for employees who start participating in social insurance according to the salary regime prescribed by the State from January 1, 2016 onwards and the monthly salary as the basis for payment of social insurance according to the salary regime decided by the employer and adjusted according to the provisions of Clause 1 of this Article.

How is the proposal to adjust the monthly income as a basis for payment of social insurance in Vietnam?

In Article 3 of the Draft Circular stipulating the adjustment of monthly salary and income as a basis for payment of social insurance, there are provisions on adjustment of monthly income as a basis for payment of social insurance as follows:

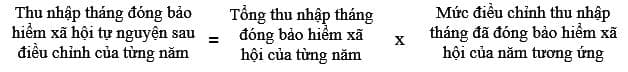

- The monthly income as a basis for payment of social insurance for the subjects specified in Clause 2, Article 1 of this Circular shall be adjusted according to the following formula:

- In which, the adjustment of monthly income as a basis for payment of social insurance for the corresponding year is made according to Table 2 below:

- For employees who both have time to pay compulsory social insurance and have time to pay voluntary social insurance, the monthly income for which voluntary social insurance premium has been paid shall be adjusted according to the provisions of Clause 1 of this Article;

The monthly salary for which compulsory social insurance has been paid shall be adjusted according to the provisions of Article 10 of Decree 115/2015/ND-CP and Article 2 of this Circular.

The average monthly salary and income for which social insurance premiums have been paid as a basis for calculation of pension, lump-sum allowance upon retirement, lump-sum social insurance and lump-sum survivorship allowance are calculated according to the provisions of Clause 4 Article 11 of Decree 115/2015/ND-CP and Clause 4 Article 5 of Decree 134/2015/ND-CP.

LawNet