Hanoi Department of Taxation Announces the List of Support Phone Numbers for Personal Income Tax Finalization for the Tax Year 2022

Who is eligible to authorize personal income tax finalization for 2022?

At Subsection 3, Section I of Official Dispatch 13762/CTHN-HKDCN in 2023, the Hanoi Tax Department provides guidelines for finalizing personal income tax for the 2022 tax period, recognizing the subjects eligible to authorize personal income tax finalization for 2022 as follows:

Resident individuals with income from salaries and wages can authorize the organization or individual paying the income to finalize their personal income tax. Specifically:

- Individuals with income from salaries and wages having employment contracts of 3 months or more at one place and actually working there at the time the organization or individual paying the income finalizes the tax, even if they do not work for the entire 12 months in the calendar year.

In cases where individuals are employees transferred from an old organization to a new organization due to the old organization’s merger, consolidation, division, separation, conversion of business types, or where the old and new organizations are within the same system, the individual can authorize the new organization to finalize their tax.

- Individuals with income from salaries and wages having employment contracts of 3 months or more at one place and actually working there at the time the organization or individual paying the income finalizes the tax, even if they do not work for the entire 12 months in the calendar year; concurrently, individuals with average monthly incidental income in the year not exceeding 10 million VND from other places and having been withheld 10% personal income tax should they not request tax finalization for this income portion.

- After authorizing tax finalization, if the paying organization has finalized the tax on behalf of the individual but later realizes that the individual should directly finalize the tax with the tax authorities, the paying organization should not adjust its tax finalization but only issue a tax withholding certificate to the individual based on the finalized amount and note at the bottom left corner of the tax withholding certificate: “The company... has finalized personal income tax on behalf of Mr./Mrs.... (authorized) at line (number) ... of Appendix Report 05-1/BK-TNCN” for the individual to directly finalize the tax with the tax authorities.

In cases where the organization or individual paying income uses electronic personal income tax withholding certificates, they should print a copy converted from the original electronic withholding certificate and note the aforementioned content onto the printed copy to provide to the taxpayer.

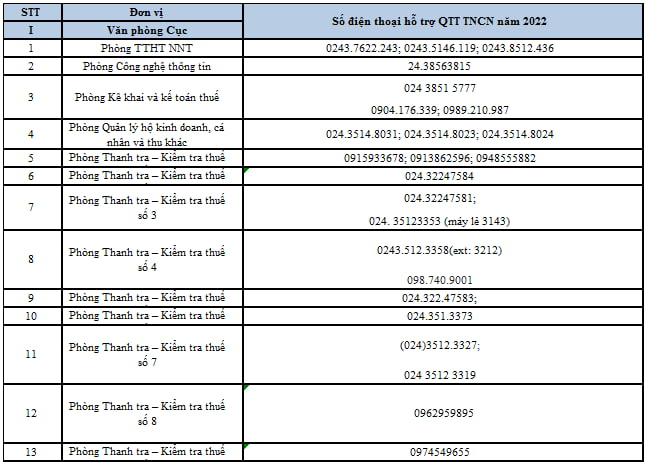

Hanoi Tax Department announces the list of phone numbers for personal income tax finalization support for the 2022 tax period

When is the deadline to submit the personal income tax finalization dossier?

According to the guidance at Section V of Official Dispatch 13762/CTHN-HKDCN in 2023, the specific deadline for submitting the personal income tax finalization dossier is as follows:

Based on the provisions at points a and b, clause 2, Article 44 of Law on Tax Administration 2019, the deadlines for declaring and submitting personal income tax finalization dossiers in 2023 are as follows:

- For income-paying organizations: The deadline for submitting the tax finalization declaration dossier is no later than the last day of the third month from the end of the calendar year.

- For individuals directly finalizing tax: The deadline for submitting the tax finalization dossier is no later than the last day of the fourth month from the end of the calendar year. In cases where individuals incur personal income tax refunds but delay submitting the tax finalization declaration according to regulations, no administrative fines for late tax finalization filing will be applied.

- If the deadline for submitting the tax finalization dossier coincides with a holiday as prescribed, the deadline for submitting the dossier will be the next working day following the holiday, as prescribed by the Civil Code.

- Thus, the deadline for submitting the personal income tax finalization dossier for the 2022 tax period is March 31, 2023, for income-paying organizations and May 4, 2023, for individuals directly finalizing with the tax authorities.

List of phone numbers for personal income tax finalization support at the Tax Departments and Sub-Departments in Hanoi?

Recently, to support individuals and organizations with personal income tax finalization, the Hanoi Tax Department announced a list of phone numbers for personal income tax finalization support at the Tax Departments and Sub-Departments:

View the entire list of phone numbers for personal income tax finalization support for the 2022 tax period here: download

List of support phone numbers here: download

LawNet