Can a public company in Vietnam carry out scrip issue when there is no post-tax profit?

Can a public company in Vietnam carry out scrip issue when there is no post-tax profit?

Pursuant to Article 60 of Decree No. 155/2020/ND-CP stipulating as follows:

Conditions for to scrip issue by public companies

1. There is a scrip issue plan which is approved by the General Meeting of Shareholders.

2. The undistributed post-tax profit is sufficient to pay dividend according to the latest annual financial statement audited by an accredited audit organization. In case the issuer is a parent company, the distributed profit must not exceed the undistributed post-tax profit on the latest audited consolidated financial statement. In case the distributed profit is lower than undistributed post-tax profit on the consolidated financial statement and higher than the undistributed post-tax profit on the separate financial statement of the parent company, profit shall only be distributed after profits from subsidiary companies are transferred to the parent company.

3. There is a plan for settlement of fractional shares and fractional shares (if any) which is approved by the General Meeting of Shareholders or Board of Directors.

4. State Bank of Vietnam has approved the increase in charter capital in accordance with regulations of law on credit institutions in case the issuer is a credit institution; The Ministry of Finance has approved the increase in charter capital in accordance with regulations of law on insurance business in case the issuer is an insurer.

Thus, one of the conditions for a public company to be allowed to issue shares to pay dividends is that the company must have undistributed post-tax profit according to the latest annual financial statement audited by an accredited audit organization.

In case the issuer is a parent company, the distributed profit must not exceed the undistributed post-tax profit on the latest audited consolidated financial statement.

In case the distributed profit is lower than undistributed post-tax profit on the consolidated financial statement and higher than the undistributed post-tax profit on the separate financial statement of the parent company, profit shall only be distributed after profits from subsidiary companies are transferred to the parent company.

Can a public company in Vietnam carry out scrip issue when there is no post-tax profit?

What documents should be included in the reporting scrip issue of a public company in Vietnam?

Pursuant to Article 61 of Decree No. 155/2020/ND-CP stipulating the reporting scrip issue of a public company in Vietnam as follows:

- The report form No. 16 in the Appendix of Decree No. 155/2020/ND-CP.

- The decision of the General Meeting of Shareholders to approve the issuance plan.

- The decision of the Board of Directors to execute the issuance plan.

- The latest annual financial statement audited by an accredited audit organization.

- The decision of the competent authority of the subsidiary company to approve the distribution of profits, the statements confirmed by the banks proving that profits have been transferred from the subsidiary companies to the parent company in case the distributed profit is lower than undistributed post-tax profit on the consolidated financial statement and higher than the undistributed post-tax profit on the separate financial statement of the parent company.

- The decision of the General Meeting of Shareholders or Board of Directors to approve the plan for settlement of fractional shares and fractional shares (if any).

- The State Bank of Vietnam’s written approval for increase in charter capital in accordance with regulations of law on credit institutions in case the issuer is a credit institution; The Ministry of Finance’s written approval for increase in charter capital in accordance with regulations of law on insurance business in case the issuer is an insurer.

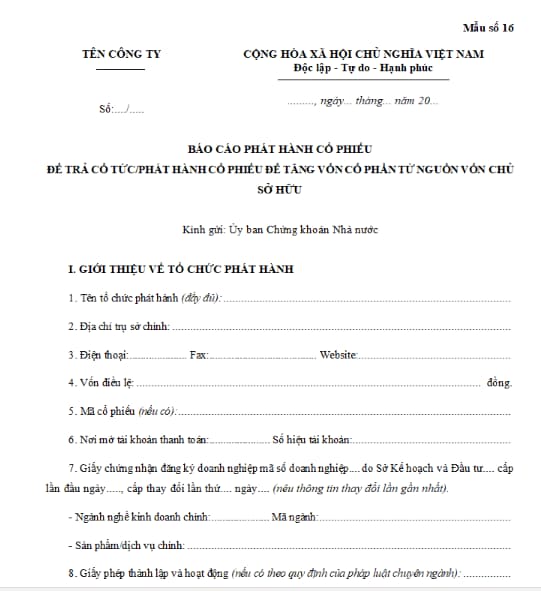

What are the regulations on the form of reporting scrip issue of a public company in Vietnam?

The form of reporting scrip issue of a public company in Vietnam is specified in Form No. 16 of the Appendix issued with Decree No. 155/2020/ND-CP as follows:

Download the form of reporting scrip issue of a public company in Vietnam: Click here.

LawNet