Vietnam: Can collaborators sign employment contracts? What is the labor contract form for collaborators?

Can collaborators sign employment contracts in Vietnam?

Pursuant to the provisions of Clause 1, Article 13 of the Labor Code 2019 of Vietnam stipulates as follows:

Article 13. Employment contract

1. An employment contract is an agreement between an employee and an employer on a paid job, salary, working conditions, and the rights and obligations of each party in the labor relations.

A document with a different name is also considered an employment contract if it contains the agreement on the paid job, salary, management and supervision of a party.

2. Before recruiting an employee, the employer shall enter into an employment contract with such employee.

Accordingly, a labor contract is an agreement between an employee and an employer on paid employment, wages, labor conditions, rights and obligations of each party in labor relations.

Thus, when there is a need to manage, administer and directly supervise the performance of the work of collaborators, the parties can sign labor contracts.

This means that employers and collaborators will bind obligations to each other:

Corresponding to the right to supervise and manage collaborators to perform work, employers must also create conditions for collaborators to exercise rights as prescribed by labor Vietnam Law such as salary, bonus, social insurance regime, leave.

In addition to the labor contract, can you sign a service contract with a collaborator in Vietnam?

Pursuant to the provisions of Article 513 of the Civil Code 2015, the provisions on service contracts are as follows:

Contract for services means an agreement between parties whereby a service provider performs an act for a client which pays a fee for that act.

Accordingly, the object of the service contract is work that can be performed, does not violate the prohibitions of the Vietnam Law, is not contrary to social ethics.

The content of the service contract will be agreed upon by the collaborator with the enterprise and the employer. Service contracts may have contents according to Clause 2, Article 398 of the Civil Code 2015, specifically:

- Subject matter of the contract;

- Quantity and quality;

- Price and method of payment;

- Time limit, place and method of performing the contract;

- Rights and obligations of the parties;

- Liability for breach of contract;

- Methods of settlement of disputes.

Thus, with the type of service contract, collaborators are comfortable and flexible in performing work, as long as they complete the assigned tasks, the enterprise hiring collaborators will pay corresponding remuneration.

Accordingly, depending on the wishes of the parties when participating in the hiring relationship, how the collaborators want responsibilities, rights and obligations to choose the appropriate type of contract.

Vietnam: Can collaborators sign employment contracts? What is the labor contract form for collaborators?

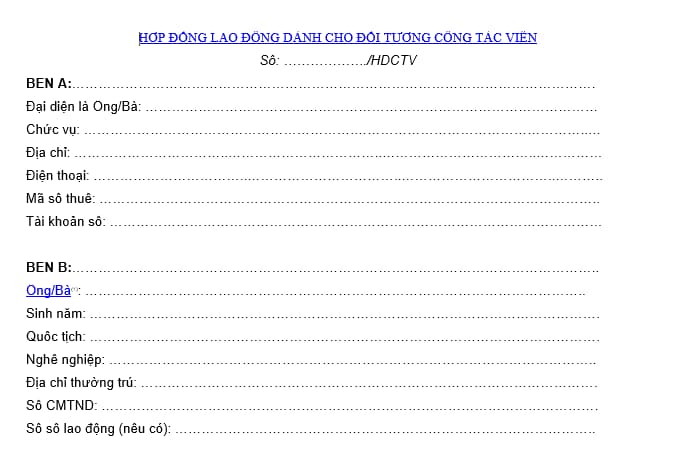

Sample employment contract for collaborators in Vietnam?

Based on the provisions of the Labor Code 2019 of Vietnam, the labor contract form includes the following contents:

View details and download the labor contract form for collaborators: Here.

Do collaborators working under contracts have to pay social insurance in Vietnam?

Pursuant to Clause 1, Article 2 of the Vietnam Law on Social Insurance 2014 stipulates this content as follows:

Article 2. Subjects of application

1. Employees being Vietnamese citizens shall be covered by compulsory social insurance, including:

a/ Persons working under indefinite-term labor contracts, definite-term labor contracts, seasonal labor contracts or contracts for given jobs with a term of between full 3 months and under 12 months, including also labor contracts signed between employers and at-Vietnam Law representatives of persons aged under 15 years in accordance with the labor Vietnam Law;

b/ Persons working under labor contracts with a term of between full 1 month and under 3 months;

c/ Cadres, civil servants and public employees;

d/ Defense workers, public security workers and persons doing other jobs in cipher organizations;

...

Thus, in the above-mentioned entities, only when the collaborator contract is considered a labor contract, the employee who signs the collaborator contract will be subject to compulsory social insurance contributions.

LawNet