When do tax authorities inform TINs to taxpayers instead of taxpayer registration certificates in Vietnam?

- How long does it take for the tax authority to issue taxpayer registration certificates in Vietnam?

- What is included in taxpayer registration certificate in Vietnam?

- When do tax authorities inform TINs to taxpayers instead of taxpayer registration certificates?

- What is the latest form of taxpayer registration certificate in Vietnam?

How long does it take for the tax authority to issue taxpayer registration certificates in Vietnam?

Pursuant to Clause 1, Article 34 of the 2019 Law on Tax Administration in Vietnam stipulating:

Issuance of taxpayer registration certificate in Vietnam

1. Tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law. Information on a taxpayer registration certificate shall include:

a) Name of the taxpayer;

b) TIN;

c) Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

Thus, tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law.

When do tax authorities inform TINs to taxpayers instead of taxpayer registration certificates in Vietnam?

What is included in taxpayer registration certificate in Vietnam?

Pursuant to the provisions of Clause 1, Article 34 of the 2019 Law on Tax Administration in Vietnam, the contents of the taxpayer registration certificate are:

Issuance of taxpayer registration certificate in Vietnam

1. Tax authorities shall issue taxpayer registration certificates to taxpayers within 03 working days starting from the date of receipt of taxpayers’ satisfactory taxpayer registration application as prescribed by law. Information on a taxpayer registration certificate shall include:

a) Name of the taxpayer;

b) TIN;

c) Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

Thus, the contents of the taxpayer registration certificate include:

- Name of the taxpayer;

- TIN;

- Number, date of the business registration certificate or establishment and operation license or investment registration certificate for business organizations and individuals; number, date of the establishment decision for organizations not required to apply for business registration; information of identity card, citizen identification or passport for individuals not subject to business registration;

When do tax authorities inform TINs to taxpayers instead of taxpayer registration certificates?

Pursuant to Clause 2, Article 34 of the 2019 Law on Tax Administration in Vietnam stipulating:

Issuance of taxpayer registration certificate in Vietnam

...

2. Tax authorities shall inform TINs to taxpayers instead of taxpayer registration certificates in the following cases:

a) An individual authorizes his/her income payer to apply for taxpayer registration on behalf of the individual and his/her dependants;

b) An individual applies for taxpayer registration through the tax declaration dossier;

c) An organization or individual applies for taxpayer registration so as to deduct and pay tax on taxpayers’ behalf;

d) An individual applies for taxpayer registration for his/her dependant(s).

Thus, tax authorities shall inform TINs to taxpayers instead of taxpayer registration certificates in one of the above cases.

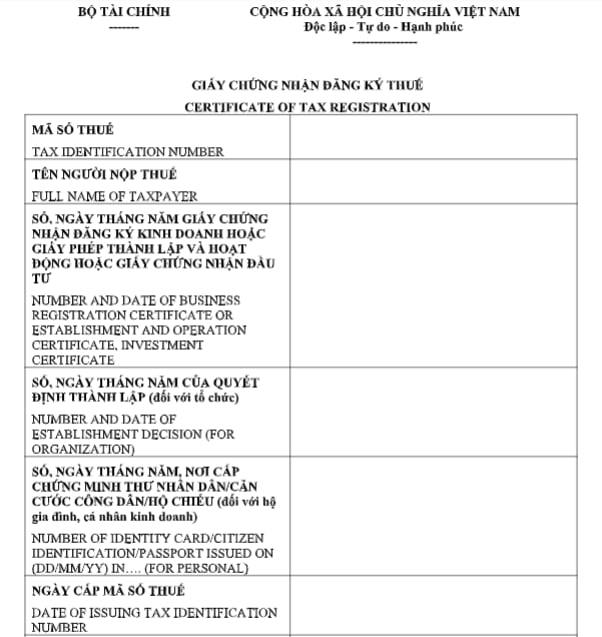

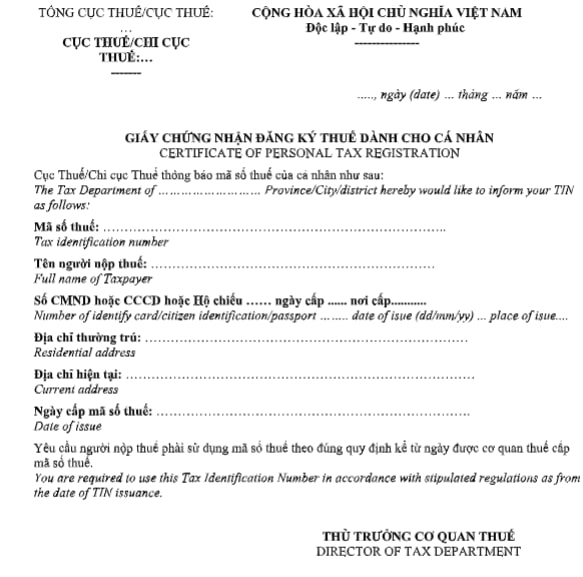

What is the latest form of taxpayer registration certificate in Vietnam?

The form of a taxpayer registration certificate for organizations, household/individual businesses is specified in form No. 10-MST issued together with Circular No. 105/2020/TT-BTC:

Download the form of a taxpayer registration certificate for organizations, household/individual businesses: Click here

The form of a taxpayer registration certificate for individuals - form No. 12-MST issued together with Circular No. 105/2020/TT-BTC for individuals:

Download the form of a taxpayer registration certificate for individuals: Click here

LawNet