Which Agency Collects Road Use Fees? What Is the Latest Road Use Fee Amount?

Which Authority Collects Road Use Fees?

Pursuant to Decree 90/2023/ND-CP on fees, policies on collection, payment, exemption, management, and use of road use fees.

Article 4 of Decree 90/2023/ND-CP stipulates the payment of road use fees as follows:

Fee Payers and Fee Collecting Organizations

1. Organizations and individuals owning, using, or managing vehicles (hereinafter collectively referred to as vehicle owners) subject to road use fees under the provisions of Article 2 of this Decree are the payers of road use fees.

2. Fee collecting organizations include:

a) The Vietnam Road Administration collects fees from automobiles under the management of defense and police forces.

b) Registration units collect fees from automobiles registered by organizations and individuals in Vietnam (except for automobiles under the management of defense and police forces as specified in point a of this clause). The Vietnam Register consolidates the fees collected by registration units, declares, and pays fees according to regulations.

Thus, under the mentioned regulations, automobiles registered by individuals and organizations in Vietnam shall pay road use fees at registration units.

The Vietnam Road Administration collects fees from automobiles under the management of defense and police forces.

Which authority collects road use fees? What is the latest road use fee? (Image from the Internet)

Who Is Subject to Road Use Fees?

According to the provisions of Article 2 of Decree 90/2023/ND-CP, the subjects subject to road use fees are registered and inspected road motor vehicles, including:

- Automobiles;- Trailers;- Other similar vehicles.

Except for the following cases which are not subject to fees:

- Destroyed due to accidents or natural disasters.- Confiscated or revoked vehicle registration certificates, license plates.- Vehicles that are not operational due to accidents requiring repair for 30 days or more.- Transport business vehicles of enterprises, cooperatives, or cooperative unions temporarily suspending operation for 30 days or more.- Vehicles of enterprises not participating in traffic, not using roads within the road traffic system (only issued with Vehicle Inspection Certificates and not with Inspection Stamps according to regulations on technical safety and environmental protection of road motor vehicles of the Ministry of Transport) or vehicles participating in traffic, using roads within the road traffic system (already issued with Vehicle Inspection Certificates and Inspection Stamps according to regulations on technical safety and environmental protection of road motor vehicles of the Ministry of Transport) converted to not participating in traffic, not using roads within the road traffic system, only used within the scope of:+ Driving test centers;+ Stations;+ Ports;+ Mineral extraction areas; aquaculture, production, processing areas for agriculture, forestry, and fisheries;+ Construction sites (transport, irrigation, energy).- Vehicles registered and inspected in Vietnam but operated abroad continuously for 30 days or more.- Vehicles stolen for 30 days or more.

Note:

Road use fees are not collected from cars with foreign license plates (including cases where vehicles are issued with temporary registration certificates and temporary license plates) allowed by competent authorities to temporarily import and re-export for a limited period according to the law.

Vehicles in cases not subject to road use fees must have sufficient documentation as prescribed in Article 8 of Decree 90/2023/ND-CP. If the road use fee has already been paid, the vehicle owner will be reimbursed the paid fee or it will be deducted from the fee amount due in the next period corresponding to the time not using the road.

What Are the Road Use Fees According to Decree 90/2023/ND-CP?

Pursuant to Decree 90/2023/ND-CP on collection, policies on collection, payment, exemption, management, and use of road use fees.

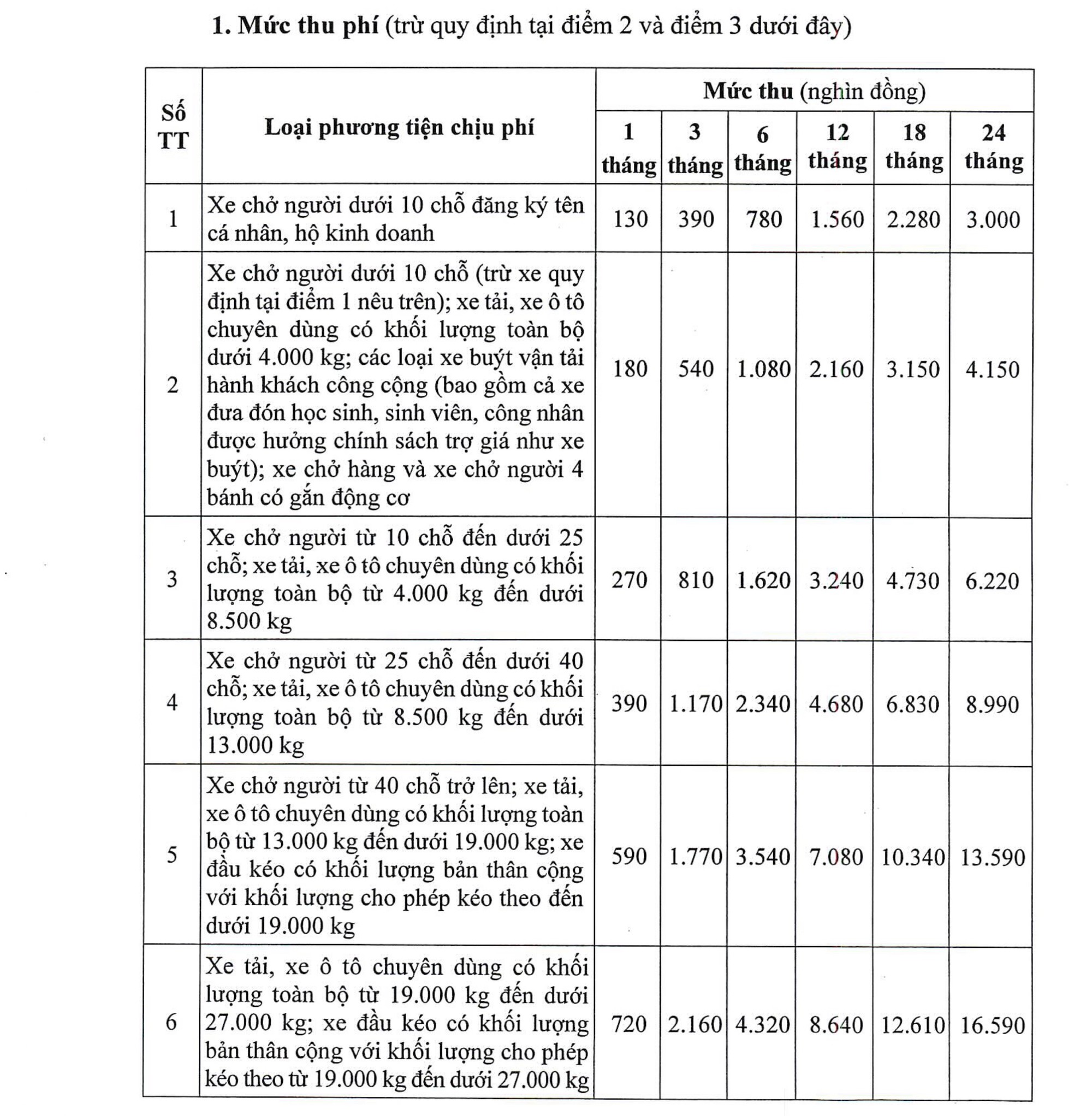

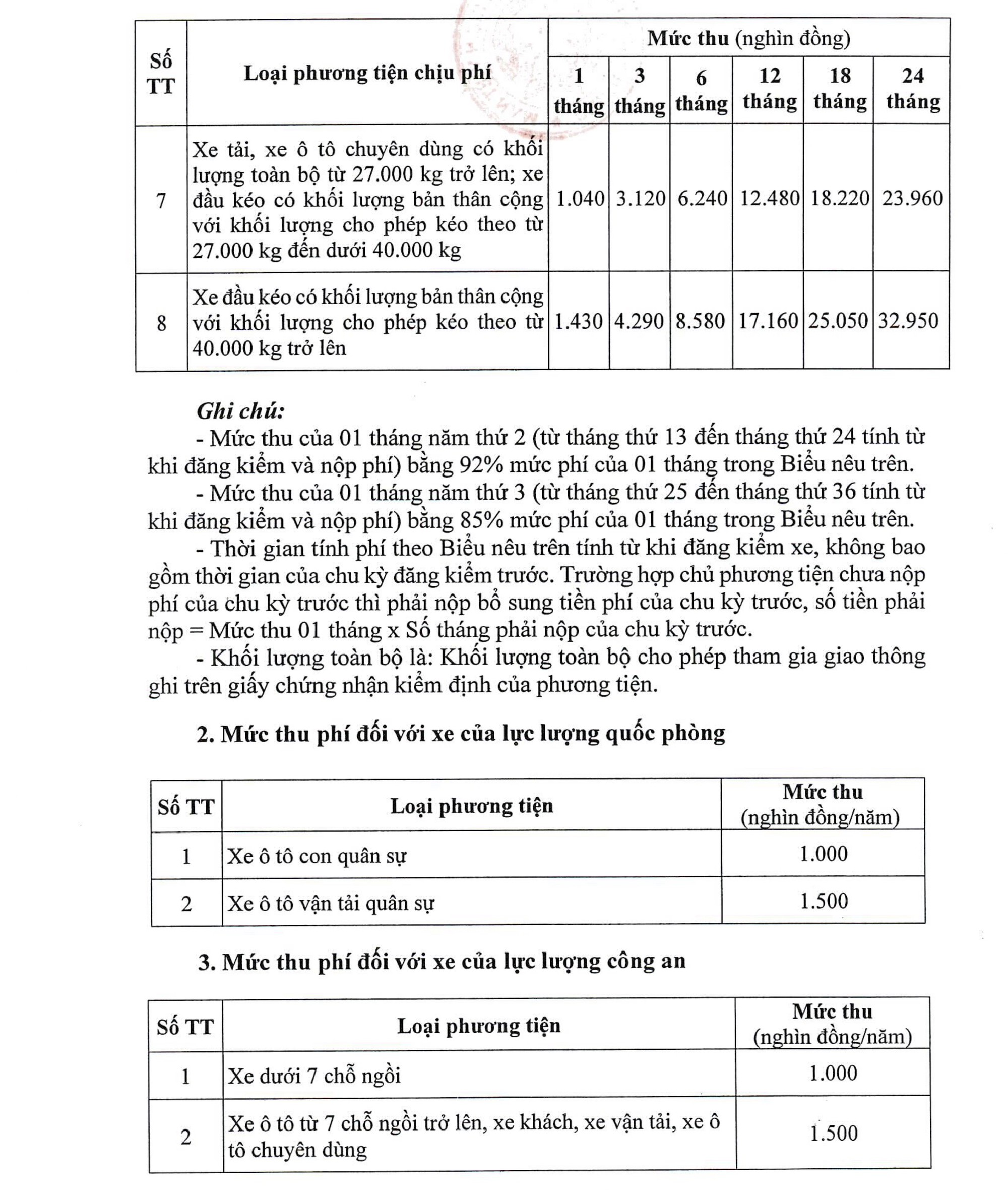

The road use fees are specified in Article 5 and Appendix I of Decree 90/2023/ND-CP.

Specifically, as follows:

Note: If the fee amount due is an odd amount, the fee collecting organization shall round the amount according to the principle that if the odd fee amount is less than 500 VND, it shall be rounded down, and if the odd fee amount is from 500 VND to less than 1,000 VND, it shall be rounded up to 1,000 VND.

Decree 90/2023/ND-CP will take effect from February 1, 2024.

LawNet