Circular 75/2022/TT-BTC of Vietnam: What are the regulations on the fees in 2023 for permanent residence registration, temporary residence registration, temporary residence extension, household separation?

How much is the residence registration fee in Vietnam from 2023?

On December 22, 2022, the Ministry of Finance of Vietnam issued Circular 75/2022/TT-BTC regulating the collection rate, collection, payment and management of residence registration fee in Vietnam.

Pursuant to Article 5 of Circular 75/2022/TT-BTC of Vietnam, the rate of residence registration fee collection shall comply with the provisions of the residence registration fee schedule enclosed with this Circular.

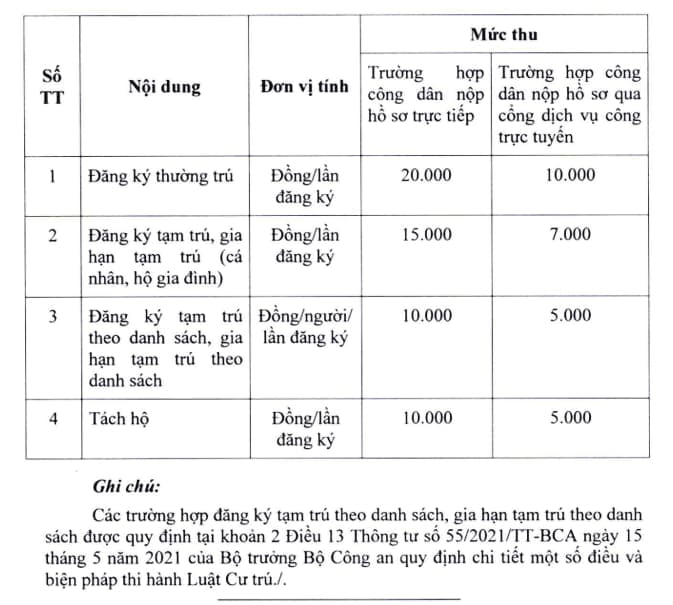

According to that, according to the Schedule of Fees for Residence Registration enclosed with Circular 75/2022/TT-BTC of Vietnam, the fees for Residence Registration (Permanent Residence Registration, Temporary Residence Registration, Temporary Residence Extension, separation of households) are adjusted from February 5, 2023, specifically as follows:

Thus, the fee for permanent residence registration is 20,000 VND/time for citizens applying directly and VND 10,000/time for citizens applying online.

For temporary residence registration and extension of temporary residence for individuals and households, the fee is VND 15,000/time for citizens submitting directly and VND 7,000/time for citizens submitting online applications.

In case of temporary residence registration, temporary residence extension according to the list, the fee will be VND 10,000/person/time when submitting the application directly and VND 5,000/person/time when submitting the online application.

In addition, the fee when the citizen separates from the household is VND 10,000/time when submitting the application in person and VND 5,000/time when submitting the application online.

Circular 75/2022/TT-BTC of Vietnam: What are the regulations on the fees in 2023 for permanent residence registration, temporary residence registration, temporary residence extension, household separation?

When is the residence registration fee waived?

Pursuant to Article 4 of Circular 75/2022/TT-BTC of Vietnam stipulating as follows:

Cases of fee waivers

Cases of fee waivers include:

1. Children as prescribed in the Law on Children; the elderly according to the provisions of the Law on Elderly; people with disabilities under the provisions of the Law on Persons with Disabilities.

2. People with meritorious services to the revolution and relatives of people with meritorious services to the revolution as prescribed in the Ordinance on Incentives for People with meritorious services to the revolution.

3. Ethnic minorities in communes with extremely difficult socio-economic conditions; citizens permanently residing in border communes; citizens permanently residing in island districts; citizens of poor households as prescribed by law.

4. Citizens from full 16 years old to under 18 years old are orphans of both parents.

Thus, cases of residence registration fee exemption from February 5, 2023 include:

- Children according to the provisions of the Law on Children;

- The elderly according to the provisions of the Law on Elderly;

- People with disabilities according to the provisions of the Law on People with Disabilities.

- People with meritorious services to the revolution and relatives of people with meritorious services to the revolution as prescribed in the Ordinance on Incentives for People with meritorious services to the revolution.

- Ethnic minorities in communes with extremely difficult socio-economic conditions;

- Citizens permanently residing in border communes;

- Citizens permanently residing in island districts;

- Citizens of poor households as prescribed by law.

- Citizens aged between full 16 and under 18 are orphans of both parents.

Which authority collects the residence registration fee?

Pursuant to Article 3 of Circular 75/2022/TT-BTC of Vietnam stipulating as follows:

Organization of fee collection

The residence registration authority prescribed in Clause 4, Article 2 of the Law on Residence, which receives the application for permanent residence registration, temporary residence registration, temporary residence extension, or separation of households, is the organization that collects the registration fee prescribed in this Circular.

Thus, based on Clause 4, Article 2 of the 2020 Law on Residence of Vietnam, “residence registration authority” means a residence authority directly processing residence registration of citizens, including commune police and police of districts where there is no commune-level administrative unit.

How to declare, collect and pay residence registration fee according to new regulations?

Pursuant to Article 6 of Circular 75/2022/TT-BTC of Vietnam stipulates as follows:

Declaration, collection and payment of fees

1. The fee payer shall pay the fee when submitting the application for residence registration and shall be received by the residence registration authority.

2. Fee payers shall pay fees and fee-collecting organizations shall declare, collect and pay fees collected according to the provisions of Circular No. 74/2022/TT-BTC dated December 22, 2022 of The Minister of Finance shall stipulate the form and time limit for the collection, payment and declaration of charges and fees within the competence prescribed by the Ministry of Finance of Vietnam.

3. The fee-collecting organization shall pay 100% of the collected fees into the state budget (central budget) according to chapters and subsections of the current State Budget Index. The source of expenses for fee collection shall be arranged by the state budget (central budget) in the estimate of the collecting organization according to the regime and norms of state budget expenditure as prescribed by law.

Thus, the declaration, collection and payment of residence registration fee from February 5, 2023 is carried out as follows:

- The fee payer shall pay the fee when submitting the application for residence registration and being received by the residence registration authority.

- Fee payers shall pay fees and fee-collecting organizations shall declare, collect and pay collected fees according to the provisions of Circular 74/2022/TT-BTC

- The fee-collecting organization shall pay 100% of the collected fees into the state budget (central budget) according to chapters and subsections of the current State Budget Index. The source of expenses for fee collection shall be arranged by the state budget (central budget) in the estimate of the collecting organization according to the regime and norms of state budget expenditure as prescribed by law.

Circular 75/2022/TT-BTC of Vietnam takes effect from February 5, 2023.

LawNet