Which plastic bag is subject to environmental protection tax in Vietnam?

Which plastic bag is subject to environmental protection tax in Vietnam?

Based on Article 2 of the Law on Environmental Protection Tax 2010, the definition of plastic bags subject to environmental protection tax is as follows:

Terminology Explanation

In this Law, the following terms shall be understood as follows:

1. Environmental protection tax is an indirect tax collected on products and goods (hereinafter referred to as goods) that, when used, adversely affect the environment.

2. Absolute tax rate is the tax rate specified by the amount of money calculated per taxable unit of goods.

3. Plastic bags subject to tax are bags and packaging made from single polyethylene film, technically known as foam plastic bags.

4. Hydro-chloro-fluoro-carbon (HCFC) solution is a group of ozone-depleting substances used as refrigerants.

Thus, according to the above regulation, plastic bags subjected to environmental protection tax are bags and packaging made from single polyethylene film, technically known as foam plastic bags.

Plastic bags subject to environmental protection tax in Vietnam (Image from the Internet)

What is the tax rate for plastic bags subjected to environmental protection tax in Vietnam?

Based on Article 8 of the Law on Environmental Protection Tax 2010, the regulation on the tax rate framework is as follows:

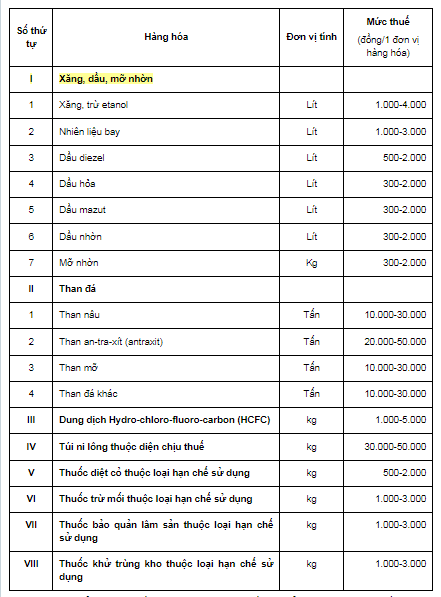

- The absolute tax rate is specified according to the Tax Rate Framework below:

- Based on the Tax Rate Framework specified in clause 1 of Article 8 of the Law on Environmental Protection Tax 2010, the Standing Committee of the National Assembly specifies the specific tax rate for each type of taxable goods ensuring the following principles:

+ The tax rate for taxable goods is appropriate to the State's socio-economic development policy in each period;+ The tax rate for taxable goods is determined according to the degree of adverse environmental impact of the goods.

Thus, the tax rate for plastic bags subjected to environmental protection tax is from VND 30,000 to VND 50,000 per unit of goods, with the unit being kg.

What are the taxable subject and un-taxable object to environmental protection tax in Vietnam?

* Taxable subject (Article 3 of the Law on Environmental Protection Tax 2010)

- Gasoline, oil, grease, including:

+ Gasoline, except ethanol;

+ Jet fuel;

+ Diesel oil;

+ Kerosene;

+ Mazut oil;

+ Lubricating oil;

+ Grease.

- Coal, including:

+ Brown coal;

+ Anthracite (anthraxite) coal;

+ Fat coal;

+ Other types of coal.

- Hydro-chloro-fluoro-carbon (HCFC) solution.

- Plastic bags subjected to tax.

- Herbicides under restricted use.

- Termite control chemicals under restricted use.

- Forestry preservation chemicals under restricted use.

- Warehouse disinfection chemicals under restricted use.

- If it is deemed necessary to add other taxable subjects suitable for each period, the Standing Committee of the National Assembly will consider and regulate.

The Government of Vietnam shall detail this Article.

taxable subject to environmental protection tax are also guided by Article 2 of Decree 67/2011/ND-CP (amended by Article 1 of Decree 69/2012/ND-CP) as follows:

Taxable subjects are implemented according to the regulations in Article 3 of the Law on Environmental Protection Tax 2010.

- For gasoline, oil, and grease specified in clause 1 of Article 3 of the Law on Environmental Protection Tax 2010, they are fossil-based products. For mixed fuels containing biofuels and fossil-based gasoline, oil, and grease, the environmental protection tax is only calculated on the fossil-based portion.

- For hydro-chloro-fluoro-carbon (coded as HCFC) solution specified in clause 3 of Article 3 of the Law on Environmental Protection Tax 2010, it is the type of gas used as a refrigerant in cooling equipment and the semiconductor industry.

- For taxable plastic bags (plastic bags) specified in clause 4 of Article 3 of the Law on Environmental Protection Tax 2010, they are thin plastic bags with a bag shape (with a bag mouth, a bag bottom, bag sides, and can hold products inside) made from single HDPE (high density polyethylene resin), LDPE (Low density polyethylene), or LLDPE (Linear low density polyethylene resin) film, except for pre-packaged goods and plastic bags meeting environmental friendliness criteria set by the Ministry of Natural Resources and Environment.

Pre-packaged goods specified in this clause (including those with and without a bag shape) include:

+ Pre-packaged imported goods;+ Packaging that organizations, households, and individuals produce or import themselves to package products they produce, process, or buy for repackaging or packing services;+ Packaging that organizations, households, and individuals purchase directly from manufacturers or importers to package products they produce, process, or buy for repackaging or packing services.

- For herbicides, termite control chemicals, forestry preservation chemicals, and warehouse disinfection chemicals under restricted use specified in clauses 5, 6, 7, and 8 of Article 3 of the Law on Environmental Protection Tax 2010: Implementation details follow Resolution 1269/2011/UBTVQH12 dated July 14, 2011, of the Standing Committee of the National Assembly on the environmental protection tax schedule.

* Un-taxable object (Article 4 of the Law on Environmental Protection Tax 2010)

- Goods not specified in Article 3 of the Law on Environmental Protection Tax 2010 are not subject to environmental protection tax.

- Goods specified in Article 3 of the Law on Environmental Protection Tax 2010 are not subject to environmental protection tax in the following cases:

+ Goods in transit through or transshipped at Vietnamese ports and borders as regulated by law, including goods transported from the exporting country to the importing country through Vietnamese ports but not cleared for import into Vietnam and not cleared for export from Vietnam; goods in transit through Vietnamese ports based on an agreement signed between the Government of Vietnam and a foreign government or agreement between authorized agencies or representatives of the Government of Vietnam and a foreign government as regulated by law;

+ Temporarily imported goods, re-exported goods within the time limit prescribed by law;

+ Goods directly exported by production facilities or entrusted to export business facilities for export, except in cases where organizations, households, and individuals buy goods subject to environmental protection tax for export.