Which form is used to convert tax declaration from monthly to quarterly in Vietnam?

Which form is used to convert tax declaration from monthly to quarterly in Vietnam?

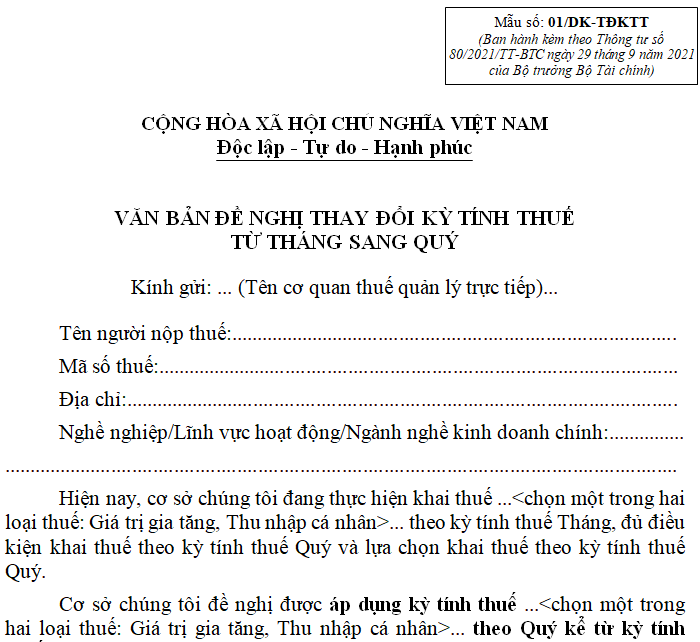

The form used to convert tax declaration from monthly to quarterly is Form No. 01/DK-TDKTT as stipulated in Appendix 2 issued together with Circular 80/2021/TT-BTC.

Download the form used to convert tax declaration from monthly to quarterly to review the detailed content of the form here.

Which form is used to convert tax declaration from monthly to quarterly in Vietnam? (Image from the Internet)

What is the deadline for submitting monthly and quarterly tax declaration dossiers in Vietnam?

The deadline for submitting tax declaration dossiers for taxes declared on a monthly or quarterly basis is stipulated in Article 44 of the 2019 Law on Tax Administration as follows:

Deadline for submitting tax declaration dossiers

1. The deadline for submitting tax declaration dossiers for taxes declared on a monthly or quarterly basis is as follows:

a) No later than the 20th day of the month following the month in which the tax obligation arises for monthly declarations and payments;

b) No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly declarations and payments.

2. The deadline for submitting tax declaration dossiers for taxes calculated on an annual basis is as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for the annual tax finalization dossier; no later than the last day of the first month of the calendar year or fiscal year for the annual tax declaration dossier;

b) No later than the last day of the fourth month from the end of the calendar year for the personal income tax finalization dossier of individuals directly finalizing taxes;

c) No later than December 15 of the preceding year for the tax declaration dossier of business households and individuals that pay tax according to the presumptive method; in the case of new business households and individuals, the deadline for submitting the tax declaration dossier is no later than 10 days from the start of business.

...

According to the above provisions, the deadline for submitting tax declaration dossiers for taxes declared on a monthly or quarterly basis is specifically determined as follows:

- No later than the 20th day of the month following the month in which the tax obligation arises for monthly declarations and payments;

- No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly declarations and payments.

Note:

- The deadline for submitting a tax declaration dossier for taxes declared and paid per each tax obligation occurrence is no later than the 10th day from the date of the tax obligation occurrence.

- The deadline for submitting a tax declaration dossier in the case of ceasing activities, terminating contracts, or reorganizing the enterprise is no later than the 45th day from the day the event occurs.

Which types of taxes and fees are declared quarterly in Vietnam?

According to Clause 2, Article 8 of Decree 126/2020/ND-CP, the types of taxes and other revenues attributed to the state budget, declared quarterly include:

- Value-added tax, personal income tax for cases where the taxpayer chooses to declare quarterly meeting the criteria stipulated in Article 9 of Decree 126/2020/ND-CP.

- Corporate income tax for foreign airlines, reinsurance from abroad.

- Value-added tax, corporate income tax, and personal income tax for credit institutions or third parties authorized by credit institutions to exploit secured assets pending processing, declaring on behalf of the taxpayer with secured assets.

- Personal income tax for organizations and individuals paying income subject to tax withholding according to the law on personal income tax, where the income-paying organization or individual opts to declare value-added tax quarterly and chooses to declare personal income tax quarterly; individuals earning income from wages and salaries directly declaring tax with the tax authority and choosing to declare personal income tax quarterly.

- Other types of taxes and revenues attributed to the state budget declared and paid by organizations or individuals on behalf of individuals, where those organizations or individuals opt to declare value-added tax quarterly and choose to declare tax on behalf of the individuals quarterly, except as stipulated in point g, Clause 4 of this Article.

- Surcharge when crude oil prices fluctuate (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

- Vietnam: How to purchase from the 2025 Trade Union Tet Market online? How much is the labor union fee for members?

- What is the online "2025 Trade Union Tet Market" program in Vietnam? What types of taxes do online sellers have to pay?

- What is taxable income? How to distinguish taxable income and income subject to tax in Vietnam?

- Shall owners of household businesses with tax debt be subject to exit suspension in Vietnam from January 1, 2025?

- What are the changes in tax refund procedures in Vietnam from 2025?

- What tax enforcement measures will be applied for taxpayers that owe tax debt in Vietnam from January 1, 2025?

- What 08 financial, banking, securities trading, and commercial services shall be exempt from VAT in Vietnam from July 1, 2025?

- Are healthcare services and veterinary services exempt from VAT in Vietnam from July 1, 2025?

- What is the total income between 02 declarations in Vietnam? What does the tax declaration dossier for individuals paying tax under periodic declarations Include?

- What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?