Which entities use the VAT declaration form - Form 04/GTGT in Vietnam?

Which entities use the VAT declaration form - Form 04/GTGT in Vietnam?

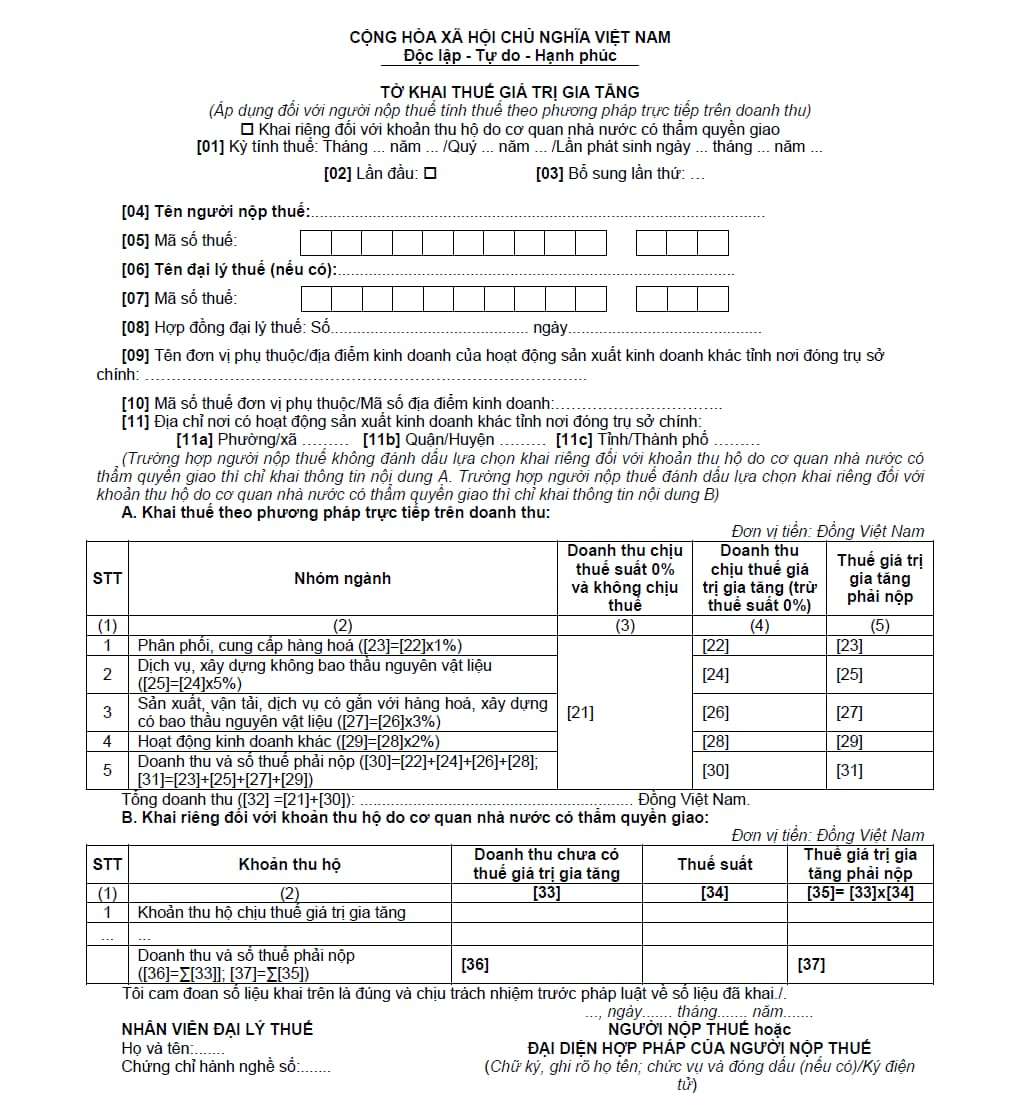

The VAT declaration form applies to taxpayers who calculate tax on revenue using the direct method as stipulated in Form 04/GTGT issued in conjunction with Circular 80/2021/TT-BTC as follows:

Download Form 04/GTGT: Here

Which entities use the VAT declaration form - Form 04/GTGT in Vietnam? (Image from the Internet)

Which entities apply the method of direct calculation of VAT on revenue in Vietnam?

Under Clause 2 Article 11 Law on Value-Added Tax 2008 amended by Clause 5 Article 1 Law on Amendments to the Law on Value-Added Tax 2013, the entities applying the method of direct calculation on revenue include:

- Enterprises and cooperatives of which the annual revenue is less than 1 billion VND, except for enterprises and cooperatives that voluntarily employ the deduction method according to Clause 2 Article 10 of Law on Value-Added Tax 2008;

- Business households and individuals;

- The foreign organizations and individuals, which/who do not have permanent establishments in Vietnam but earn revenues in Vietnam, that do not comply with the accounting regime, except for foreign organizations and individuals that provide goods and services that serve petroleum exploration and extraction and have their tax deducted and paid by the Vietnamese party;

- Other economic organizations, except for the organizations that voluntarily employ the deduction method in Clause 2 Article 10 of Law on Value-Added Tax 2008;

What is the calculation of VAT on revenue using the direct method in Vietnam?

According to the provisions of Clause 2 Article 13 Circular 219/2013/TT-BTC, the calculation of VAT on revenue using the direct method in Vietnam is specified as follows:

VAT payable = Revenue x Rate %

Where:

- The rate to calculate VAT on revenue is specified according to the following activities:

| Group | Activity | rate |

| 1 | Distribution, supply of goods: - Wholesale and retail of all kinds of goods (excluding the value of goods sold on consignment at fixed prices for which commissions are received). |

1% |

| 2 | Services, construction without supplying materials: - Hospitality services such as hotels, guesthouses, lodging houses; - Rental services for houses, land, stores, workshops, personal and household items; - Rental services for warehouses, machinery, transportation vehicles; Cargo handling and other supporting services related to transportation such as parking lot businesses, ticket sales, vehicle watching; - Postal, mail delivery services and parcel services; - Brokerage, auction, and agency commission services; - Legal consultancy, financial consultancy, accounting, auditing services; Tax and customs service agency procedures; - Data processing services, leasing of information portals, information technology, telecommunications equipment; - Office support services and other business support services; - Sauna, massage, karaoke, discotheque, billiards, internet, game services; - Tailoring, laundry services; Hair cutting, hairstyling, and shampooing services; - Other repair services, including: repair of computers and household items; - Consultancy, design, supervision of basic construction execution services; - Other services; - Construction, installation without supplying materials (including the installation of industrial machinery and equipment). |

5% |

| 3 | Manufacture, transportation, services associated with goods, construction with supplying materials: - Manufacture, processing, refining products and goods; - Mining, mineral processing; - Cargo, passenger transportation; - Services accompanying the sale of goods such as training, maintenance, technology transfer accompanying the sale of products; - Food and drink services; - Repair and maintenance services for machinery and equipment, transportation vehicles, cars, motorbikes, and other motor vehicles; - Construction, installation with supplying materials (including the installation of industrial machinery and equipment). |

3% |

| 4 | Other business activities: - Production of products subject to VAT according to the deduction method at the VAT rate of 5%; - Provision of services subject to VAT according to the deduction method at the VAT rate of 5%; - Other activities not listed in groups 1, 2, 3 mentioned above. |

2% |

- The taxable revenue is the total revenue from selling goods and services, which is written on the sale invoice for taxable goods and services, inclusive of the surcharges to which the seller is entitled.

The rates above are not applied to the revenue from selling the goods and services that are not subject to VAT and revenue from exported goods and services.

Note:

- If the taxpayer engages in various lines of business to which different rates are applied, they must be sorted by VAT rate. Otherwise, the highest rate among which shall apply.

- The rate to calculate VAT on revenue is specified according to the following activities:

+ Distribution, supply of goods: 1%;

+ Services, construction without supplying materials: 5%;

+ Manufacture, transportation, services associated with goods, construction with supplying materials: 3%;

+ Other business activities: 2%.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?