Where is download a confirmation form for personal income under 1 million in Vietnam? What are principles for determining the personal exemption in Vietnam?

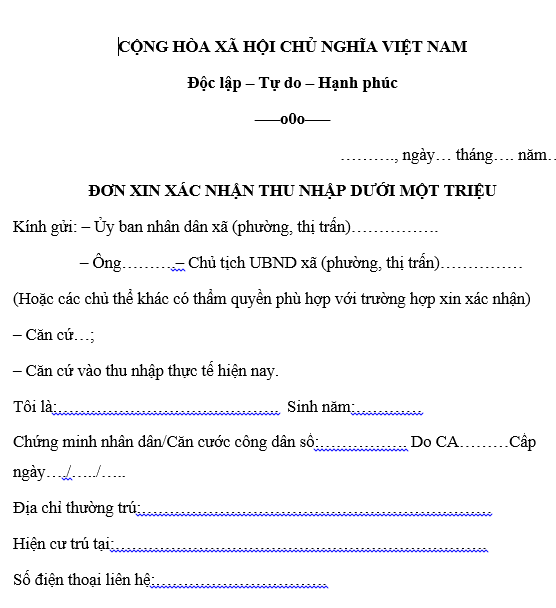

Where is download a confirmation form for personal income under 1 million in Vietnam?

The form for requesting confirmation of income under one million VND is a document used by individuals to present actual income information, usually for the purpose of:

- Declaring income for claiming personal income tax deductions.

- Applying for financial assistance or benefiting from support policies, subsidies under State policies.

- Completing documents to purchase social housing, serving social welfare programs.

- Availing preferences from commercial banks, such as reduced loan interest rates or other support.

Form for personal income confirmation under 1 million.... download here

Note: The information on downloading the form for personal income confirmation under 1 million is for reference only!

What are principles for determining the personal exemption in Vietnam?

According to Clause 2, Article 19 of the Law on Personal Income Tax 2007, there are specific provisions on personal exemptions as follows:

personal exemption

....

- The determination of the personal exemption level for dependants is carried out on the principle that each dependant is only deducted once for a single taxpayer.

- dependants are individuals whom the taxpayer is responsible for supporting, including:

a) Minor children; children with disabilities, unable to work;

b) Individuals with no income or with income not exceeding the prescribed limit, including adult children attending university, college, vocational secondary schools; spouse unable to work; parents beyond working age or unable to work; others without support whom the taxpayer directly supports.

the Government of Vietnam stipulates the income level, declaration for determining dependants eligible for personal exemption.

Thus, through the above regulation, the principle in determining the personal exemption level for dependants is that each dependant is only deducted once for a single taxpayer.

Download a form for personal income confirmation under 1 million? What principles must be adhered to in determining the personal exemption? (Image from the Internet)

How to determine dependants for personal exemptions in Vietnam?

According to Point d, Clause 1, Article 9 of Circular 111/2013/TT-BTC, personal exemptions applied from the tax calculation period 2020 are stipulated by Article 1 of Resolution 954/2020/UBTVQH14 (tax-related provisions on personal income tax from business at Article 9 Circular 111/2013/TT-BTC abolished by Clause 6, Article 25 Circular 92/2015/TT-BTC) include the following dependants:

(1) dependants who are the taxpayer's children

dependants who are the taxpayer's children include biological, adopted, extramarital children, the wife's stepchildren, or the husband's stepchildren, specified as:

- Children under 18 years old (fully calculated by months).

- Children 18 years old or older with disabilities, unable to work.

- Children studying in Vietnam or abroad at university, college, vocational secondary levels, including 18-year-old or older children still in high school (including during the time waiting for university exam results from June to September of grade 12) with no income or an average monthly income of not more than 1,000,000 VND from all sources.

(2) Other dependants of the taxpayer

- Spouse of the taxpayer meeting the condition at Point đ, Clause 1, Article 9 of Circular 111/2013/TT-BTC.

- Biological parents; parents-in-law (or parents-in-law); stepfather, stepmother; legally adoptive parents of the taxpayer meeting the condition at Point đ, Clause 1, Article 9 of Circular 111/2013/TT-BTC.

- Other individuals without support that the taxpayer must directly support and meet the conditions at Point đ, Clause 1, Article 9 of Circular 111/2013/TT-BTC including:

+ Siblings of the taxpayer.

+ Grandparents, aunts, uncles of the taxpayer.

+ The taxpayer's nephews or nieces including children of their siblings.

+ Any other individuals that the law requires to be directly supported.

How much is the salary level for personal income taxpayers without dependants to pay tax?

According to Clause 2, Article 2 of Circular 111/2013/TT-BTC amended and supplemented by Clause 1, Article 11 of Circular 92/2015/TT-BTC that specifically regulates taxable income as follows:

Taxable Income

…

- Income from wages, salaries

Income from wages and salaries is the income received by the employee from the employer, including:

a) Salary, wage and payment components having the nature of salary, wage in forms of money or non-monetary.

b) Allowances, subsidies, excluding the following allowances, subsidies:

b.1) Monthly preferential allowances and one-time subsidies according to the law on preferential treatment for people with meritorious services.

…

And according to Article 1 of Resolution 954/2020/UBTVQH14 regulations on personal exemptions are as follows:

personal exemption

Adjustment of personal exemption levels stipulated in Clause 1, Article 19 of the Law on Personal Income Tax No. 04/2007/QH12 amended by Law No. 26/2012/QH13 is as follows:

- Deduction level for taxpayers is 11 million VND/month (132 million VND/year);

- Deduction level for each dependant is 4.4 million VND/month.

Thus, according to the above regulations, individuals without dependants must pay personal income tax when having total income from wages and salaries exceeding 11 million VND/month.

- Does a merged enterprise have its TIN deactivated in Vietnam?

- What are cases where a taxpayer is subject to the enforcement measure of bank account freeze in Vietnam?

- Is it possible to extend the decision to impose anti-dumping duties in Vietnam?

- Are goods in transit required to pay export and import duties in Vietnam?

- What are cases where customs declarations are replaced with records in the customs dossier in Vietnam?

- What income is exempt from personal income tax in Vietnam?

- When are e-records converted into paper records in Vietnam?

- What are conditions of authenticated e-invoices in Vietnam?

- What is the latest end-of-year 2024 asset and income declaration form in Vietnam?

- What are regulations on carry-forward of losses when calculating corporate income tax in Vietnam?