What is the latest end-of-year 2024 asset and income declaration form in Vietnam?

What is the latest end-of-year 2024 asset and income declaration form in Vietnam?

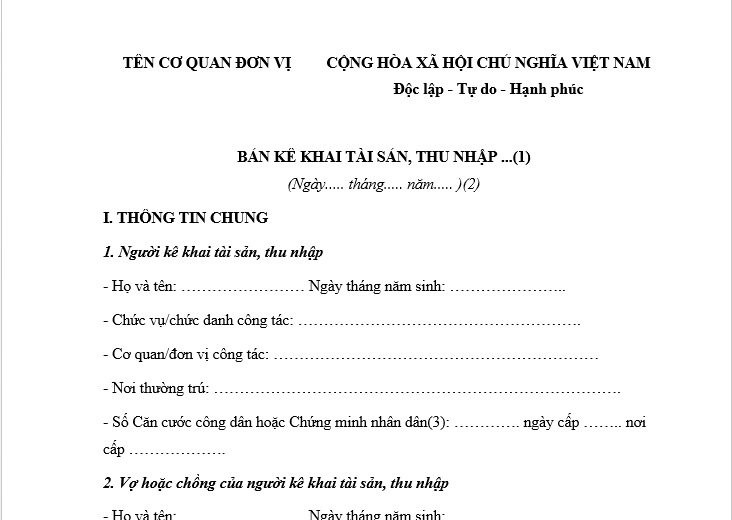

The latest end-of-year 2024 asset and income declaration form is stipulated in Appendix 1A issued together with Decree 130/2020/ND-CP.

The format of the end-of-year 2024 asset and income declaration form is as follows:

Download the latest end-of-year 2024 asset and income declaration form...Download

What is the latest end-of-year 2024 asset and income declaration form in Vietnam? (Image from the Internet)

How to fill out the end-of-year 2024 asset and income declaration form in Vietnam?

Based on Section B, Appendix 1 issued together with Decree 130/2020/ND-CP, guidance on the declaration of assets, initial collection, annual declarations, and declarations for official duties is provided as follows:

GENERAL NOTES

(1) Individuals obligated to declare assets and incomes must specify the method of declaration as prescribed in Article 36 of the Anti-Corruption Law 2018 (initial, annual, or official duty-specific declaration).

For the initial declaration, it is not necessary to declare Section 3 "Changes in assets, income; Explanation of the origin of increased assets, income", and the names or order of contents in this form should not be altered.

The declarant must sign each page and sign with fullname on the last page of the declaration form. The declarant must prepare 02 copies of the declaration to hand over to their managing agency, organization, or unit (01 copy to Asset, Income Control Agency, and 01 copy for the agency, organization, or unit’s management and public disclosure of the declaration). Personnel from the managing agency, organization, or unit receiving the declaration must check for completeness. Then sign and indicate the date of receipt.

(2) Record the date of completion of the declaration.

GENERAL INFORMATION

(3) Record national ID number. If no ID card has been issued, record personal identification card number and detail the date and place of issue.

(4) If the spouse of the declarant works regularly in an agency, organization, or business, specify the name of the agency/organization/business; if self-employed, retired, or involved in household duties, specify.

ASSET DESCRIPTION INFORMATION

(5) Assets to be declared are those under possessive, usage rights of the declarant, the spouse, and minor children, as per legal regulations.

(6) Actual land usage right refers to the declarant’s right to use a parcel, including both certified and uncertified land use rights.

(7) Residential land is land used for living purposes as per land legislation.

If a parcel is used for multiple purposes including residential, declare it under residential land.

(8) Specifically mention house number (if any), alley, lane, neighborhood, village, hamlet; commune, ward, commune-level town; district, district-level town, city within a province; province, centrally managed city.

(9) Record land area (m2) as per land use right certificate or actual measurement (if without land use right certificate).

(10) The value is original price in Vietnamese currency, specifically:

- For purchased or transferred assets, state the real payment and other taxes and fees;

- For self-built, crafted, or renovated assets, note total expenses plus any taxes or fees at asset creation;

- For gifted, donated, or inherited assets, provide market value at receipt, plus any taxes and fees noted as “estimated value”;

- If unable to estimate asset value due to age or lack of similar asset transactions, state “unable to determine value” with reason.

(11) If a parcel has a land use right certificate, note the certificate number and certificateholder or representative’s name (if it’s a joint certificate); if not certified, state “not certified”.

(12) Detail actual management and usage state (e.g., registrant holds rights but asset belongs to another); or transfer, assignment, and current usage status like lease or loan.

(13) Declare non-residential purpose lands as per the Land Law.

(14) State “apartment” for collective or condominiums; “single dwelling” for independently constructed houses.

(15) Provide total floor area (m2) of all single dwelling, villa floors including basements, half-basements, technical floors, attic and roof space. For apartments, cite ownership certificate or contract details.

(16) Other constructions are non-residential buildings.

(17) Declare land-affixed assets with estimated value of each type reaching 50 million and above.

(18) Perennial trees are those planted once, growing and yielding over years: long-term industrial, perennial fruit, timber-producing, ornamental, and shade trees. Trees in production forests are excluded.

(19) Production forests are planted forests.

(20) Record gold, diamonds, platinum and other precious metals and stones with value from 50 million dong upward.

(21) Money (in Vietnamese currency or foreign) includes cash, loans, prepaid, deposits domestically or abroad, totalling from 50 million dong. If foreign currency, state amount and conversion to Vietnamese currency.

(22) Detail each form of business investment, direct and indirect.

(23) Include other valuable papers like fund certificates, promissory notes, checks, etc.

(24) Vehicles like cars, motorcycles, motorbikes (bulldozers, excavators, other machinery), ships, aircraft, boats and registrable movables of each type valued from 50 million dong and above.

(25) Other assets like ornamental plants, furniture, art, and other assets each valued from 50 million dong equivalent.

(26) Declare foreign assets by type similar to sections 1 to 7 of Part 2, specify which country they reside in.

(27) Declare foreign bank accounts; other non-bank foreign accounts capable of monetary, asset transactions (such as foreign securities company accounts, foreign gold exchange accounts, foreign e-wallets...).

(28) Declare total income of the declarant, spouse, and minor children; if communal income cannot be separated, record total communal income. Convert foreign income and assets to Vietnamese currency (includes salary, benefits, bonuses, fees, gifts, inheritances, proceeds from asset sales, income from investments or inventions, other income).

Initial declarations don’t need total income records between two declarations. From the second declaration onwards, records from the prior declaration to one day before the current declaration.

CHANGES IN ASSETS, INCOME; EXPLANATION OF THE ORIGIN OF ADDITIONAL ASSETS, INCOME

(29) Declare increased or decreased assets at declaration compared to prior declarations and explain the origin of additional assets, income during the period for the second declaration onwards. If no asset changes, note "No changes" following Section 3 name.

(30) If assets increase, enter plus (+) sign and asset increase in the "asset quantity" column, value increase in "asset, income value" column, and explain reason for increase in "explanation of source of asset increase and total income".

(31) If assets decrease, enter minus (-) in "asset quantity" column, decrease value in "asset, income value" column, and explain reason for asset decrease in "explanation of source of asset increase and total income".

(32) Record total income between two declarations in "asset, income value" column and specify each income item during the declaration period.

Vietnam: What does the end-of-year 2024 asset and income declaration of tax officials include?

Based on Section 1, Part 2 of the Administrative Procedures under the State Management Scope of the Government Inspectorate of Vietnam issued with Decision 70/QD-TTCP 2021, the end-of-year asset and income declaration for tax officials includes:

(1) Directives for organizing the declaration implementation;

(2) List of subjects required to declare as prescribed;

(3) Asset, income declarations of subjects required to declare (02 copies);

(4) Logbook for tracking the handover and reception of declarations.

- Vietnam: How to purchase from the 2025 Trade Union Tet Market online? How much is the labor union fee for members?

- What is the online "2025 Trade Union Tet Market" program in Vietnam? What types of taxes do online sellers have to pay?

- What is taxable income? How to distinguish taxable income and income subject to tax in Vietnam?

- Shall owners of household businesses with tax debt be subject to exit suspension in Vietnam from January 1, 2025?

- What are the changes in tax refund procedures in Vietnam from 2025?

- What tax enforcement measures will be applied for taxpayers that owe tax debt in Vietnam from January 1, 2025?

- What 08 financial, banking, securities trading, and commercial services shall be exempt from VAT in Vietnam from July 1, 2025?

- Are healthcare services and veterinary services exempt from VAT in Vietnam from July 1, 2025?

- What is the total income between 02 declarations in Vietnam? What does the tax declaration dossier for individuals paying tax under periodic declarations Include?

- What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam? Where are the places of tax payment for enterprises in Vietnam?