When may a tax agent employee practice in Vietnam?

When may a tax agent employee practice in Vietnam?

Based on the regulations in Clause 1, Article 15, Circular 10/2021/TT-BTC regarding registration for practicing of tax agent employees, as follows:

Registration for Practicing of Tax Agent Employees

- Principles for Registration for Practicing of Tax Agent Employees

a) The registration for practicing services in tax procedures is carried out through the tax agent where the individual applying for practice is the legal representative of the tax agent or has a labor contract to work there.

b) A tax agent employee is allowed to practice from the date on which the Tax Department announces that the conditions for practicing tax procedure services are met.

c) At one point in time, an individual with a certificate for practicing tax procedure services is only allowed to practice at one tax agent.

d) A tax agent employee is not allowed to practice during the period of suspension or termination of tax procedure service practices.

...

Therefore, the time at which a tax agent employee is allowed to practice is from the date the Tax Department announces that the conditions for practicing tax procedure services are met.

Note: A tax agent employee is not allowed to practice during the period of suspension or termination of tax procedure service practices.

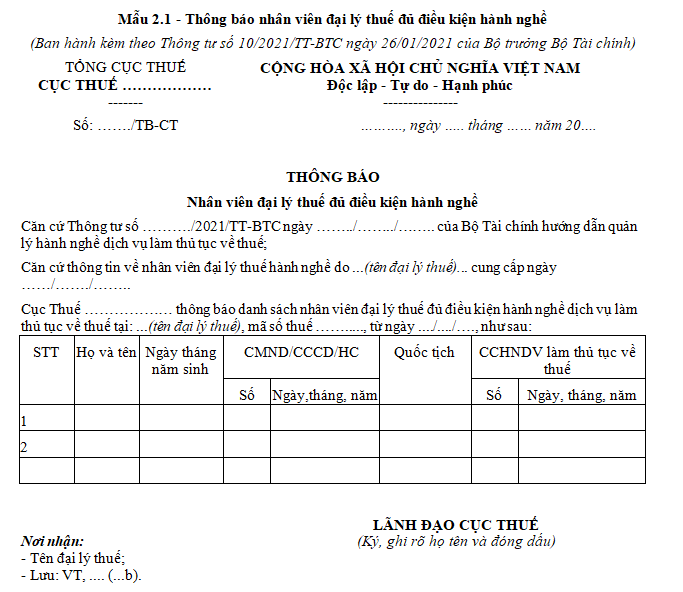

What is the notice form of eligibility for tax procedure practice in Vietnam?

The latest 2024 notice form of eligibility for tax procedure practice is applied according to Form 2.1 in the Appendix issued along with Circular 10/2021/TT-BTC.

DOWNLOAD >> Notice of eligibility for tax procedure practice (latest 2024)

When may a tax agent employee practice in Vietnam? (Image from the Internet)

What are regulations on publishing details about tax agent employees eligible for tax procedure practice in Vietnam?

Based on the regulations in Clause 5, Article 16, Circular 10/2021/TT-BTC about the public information of tax agent employees meeting conditions for practicing tax procedure services as follows:

Management of Practice for Tax Agent Employees

...

5. Public Information on Tax Agent Employees

Within 3 working days from the date the Tax Department issues the notice or decision as prescribed in Clauses 1, 3, and 4 of this Article, the Tax Department will publicly disclose on the General Department of Taxation's electronic portal information about tax agent employees as follows:

a) Public information on tax agent employees meeting practice conditions includes: full name, date of birth, identification card/citizenship card/passport (for foreigners); information about the practice certificate for tax procedure services and the accountant certificate (if any); information about the tax agent where the individual registers to practice.

b) Public information on tax agent employees suspended from practice includes: full name, date of birth, identification card/citizenship card/passport (for foreigners); information about the practice certificate; information about the tax agent where the individual registers to practice; information about the suspension notice.

c) Public information on tax agent employees terminated from practice includes: full name, date of birth, identification card/citizenship card/passport (for foreigners); information about the practice certificate; information about the tax agent where the individual registers to practice; information about the termination decision.

Thus, within 3 working days from the date the Tax Department issues the notice of the tax agent employee meeting the conditions for practicing tax procedure services, the Tax Department must publicly disclose on the General Department of Taxation's electronic portal information about the tax agent employee.

Public information on agent employees eligible for tax procedure practice includes:

[1] Full name, date of birth, identification card/citizenship card/passport (for foreigners);

[2] Information about the practice certificate for tax procedure services and the accountant certificate (if any);

[3] Information about the tax agent where the individual registers to practice.

- What is the guidance on registering for transactions with the tax authority (General Department of Taxation of Vietnam) via electronic means?

- Is a sole proprietorship in Vietnam issued a 10-digit or 13-digit TIN?

- Are goods imported as humanitarian aid subject to value-added tax in Vietnam?

- Vietnam: Shall the operation of tax inspectorates be supervised simultaneously?

- Shall wood cabinet manufacturers be entitled to value-added tax deferral in Vietnam?

- What are cases of personal income tax refund in Vietnam in 2024?

- What are guidelines for declaring registration fees for motorcycles online in Vietnam?

- What are guidelines on lookibng up outstanding PIT in Vietnam?

- Does the Director of the Tax Department have the authority to impose taxes? What are cases of tax liability imposition in Vietnam?

- Which entities are VAT payers in Vietnam? Where is the place to submit VAT declarations in Vietnam?