What are guidelines on lookibng up outstanding PIT in Vietnam?

What are guidelines on lookibng up outstanding PIT in Vietnam?

(1) Checking outstanding PIT on the General Department of Taxation's Electronic Portal

Step 1: Access the General Department of Taxation's Electronic Portal

Visit the page: https://thuedientu.gdt.gov.vn/ on your web browser.

Step 2: Log in

Select the "Individual" tab on the main interface.

Choose "Log in" and use the Electronic Identification account of the Ministry of Public Security or the E-Tax account.

If you do not have an account, you can register using your tax code and citizen identification number.

Step 3: Check outstanding PIT

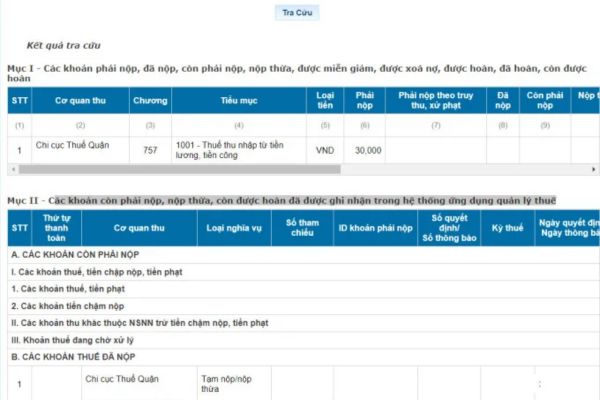

After logging in, go to the Information Inquiry section.

Select Check Tax Debt or Tax Obligations Inquiry to view your outstanding PIT information.

Step 4: Check the Results

The system will display detailed information on outstanding personal income taxes, if any. You can view information such as payable tax amount, payment time, and penalties (if any).

(2) Checking outstanding PIT on the eTax Mobile Application

Step 1: Download and Install the eTax Mobile Application

Access the App Store (iOS) or Google Play (Android) to download the General Department of Taxation's eTax Mobile application.

Install the application on your phone.

Step 2: Log into the Application

Open eTax Mobile and select "Log in".

Log in using the E-Tax account registered with the General Department of Taxation.

If you do not have an account, you can register a new account directly on the application, using your tax code and citizen identification number.

Step 3: Check outstanding PIT

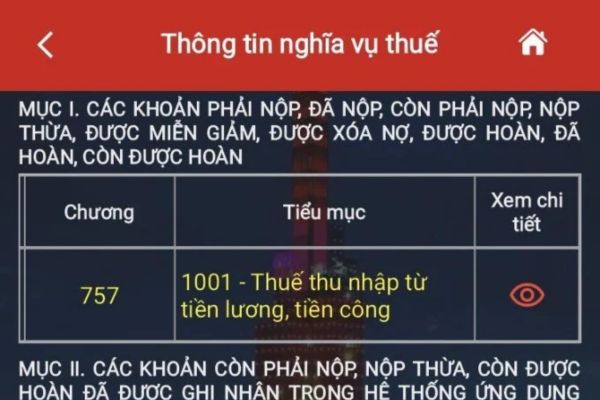

After logging in, go to the Main Menu and select the Tax Obligations Inquiry or Tax Debt Inquiry section.

Select Personal Income Tax to view details of your outstanding taxes.

Step 4: Check the Inquiry Results

The system will display detailed information about outstanding PIT, including outstanding tax amounts, payment deadlines, and any accrued fees or fines (if any).

Vietnam: Shall individuals who are dead have their outstanding PIT cancelled?

According to Article 85 of the Law on Tax Administration 2019, the following cases are eligible for the cancellation of outstanding PIT, including late payment penalties and fines:

Cases Eligible for Debt Cancellation of Taxes, Late Payment Penalties, and Fines

- Enterprises or cooperatives declared bankrupt after fulfilling payments in accordance with bankruptcy law, with no remaining assets to pay taxes, late payment penalties, and fines.

- Individuals who have died or been declared dead, lost civil act capacity by court ruling, and have no assets, including inherited assets, to pay taxes, late payment penalties, and fines owed.

...

Thus, under the above provision, a deceased individual is eligible for outstanding PIT cancellation.

What is the application for cancellation of outstanding PIT in Vietnam?

As per Article 86 of the Law on Tax Administration 2019, the application for cancellation of outstanding PIT includes the following documents:

- Request for Debt Cancellation Document

This is a document prepared by the direct tax management agency, requesting debt cancellation for taxpayers eligible for the cancellation of tax debts, late payment penalties, and fines.

- Other Related Documents

These documents support the debt cancellation request and may include certificates, documents proving the justification and conditions for debt cancellation, such as a death certificate (if the taxpayer has passed away), a court decision (if the taxpayer has lost civil act capacity), or documents proving damage due to natural disasters or pandemics.

What are guidelines on lookibng up outstanding PIT in Vietnam? (Image from the Internet)

Which income is exempt from personal income tax in Vietnam?

According to Article 4 of the Law on Personal Income Tax 2007 amended by Clause 2 Article 1 of the Amended Law on Personal Income Tax 2012, supplemented by clause 3 Article 2 of the Amendment Law on Tax Laws 2014, regulations on personal income exempt from tax include:

- Income from real estate transfers between spouses; birth parents and biological children; adoptive parents and adopted children; parents-in-law and daughter-in-law; parents-in-law and son-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

- Income from the transfer of housing, residential land use rights, and assets associated with a single residence or residential land of which the individual only has one.

- Income from land use rights value given by the State.

- Income from inheritance or gifts as real estate between spouses; birth parents and biological children; adoptive parents and adopted children; parents-in-law and daughter-in-law; parents-in-law and son-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

- Income of households, individuals directly engaged in agricultural production, forestry, salt-making, aquaculture, and capture fisheries not yet processed into other products or only subjected to preliminary processing.

- Income from the conversion of agricultural land given by the State for production.

- Income from interest on deposits at credit institutions, interest from life insurance contracts.

- Income from remittances.

- Night shift salary or overtime salary paid higher than daytime working salary as per legal regulations.

- Pension paid by the Social Insurance Fund; voluntary retirement pension paid monthly.

- Income from scholarships, including:

+ Scholarships received from the state budget;

+ Scholarships received from domestic and international organizations as part of that organization's charitable and support programs.

- Income from life insurance, non-life insurance contract compensation, labor accident compensation, state compensation, and other compensations as per legal regulations.

- Income received from charitable funds established or recognized by competent state agencies, operating for charitable, humanitarian, and non-profit purposes.

- Income received from foreign aid for charitable and humanitarian purposes in the form of government and non-government programs approved by competent state agencies.

- Income from wages, salaries of Vietnamese crewmembers working for foreign shipping companies or Vietnamese shipping companies engaged in international transportation.

- Income of individuals who are ship owners, individuals utilizing ships, and individuals working on ships from activities providing goods and services directly serving offshore fishing and catching activities.