What should enterprises do in case suffering a loss after submission of tax statement dossiers in Vietnam?

What is the deadline for submission of tax statement dossiers?

Pursuant to the provisions of Clause 2, Article 44 of the Law on Tax Administration 2019 regarding the deadline for submission of tax statement dossiers 2024 as follows:

Deadline for submitting tax declaration dossiers

...

- The deadline for submitting tax declaration dossiers for taxes calculated on an annual basis is as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax statement dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

b) No later than the last day of the fourth month from the end of the calendar year for individual income tax statement dossiers of individuals who directly finalize taxes;

c) No later than December 15 of the preceding year for the declaration dossiers of household businesses and individual businesses paying tax based on a presumptive method; in the case of new household businesses or individual businesses, the deadline for submitting presumptive tax declaration dossiers is no later than 10 days from the start of business operations.

...

Thus, the deadline for submission of tax statement dossiers is no later than the last day of the third month from the end of the calendar year or fiscal year for annual tax statement dossiers.

What should enterprises do in case suffering a loss after submission of tax statement dossiers in Vietnam? (Image from the Internet)

What should enterprises do in case suffering a loss after submission of tax statement dossiers in Vietnam?

Pursuant to the provisions of Clause 2, Article 9 of Circular 78/2014/TT-BTC on determining and carrying forward losses as follows:

Determination and carry forward of losses

...

- Enterprises that incur losses after finalizing taxes shall carry forward the entire loss to the taxable income (taxable income after deducting tax-exempt income) of subsequent years. The period for carrying forward losses continuously shall not exceed 5 years from the year following the year in which the loss arises.

Enterprises shall preliminarily carry forward the losses to the income of the quarters of the subsequent year when preparing provisional quarter declarations and officially carry forward the losses to the following year when preparing annual tax statement declarations.

Example 12: In 2013, Company A incurred a loss of VND 10 billion, in 2014 Company A had an income of VND 12 billion, so the entire loss of 2013 should be carried forward to the income of 2014.

Example 13: In 2013, Company B incurred a loss of VND 20 billion, in 2014 Company B had an income of VND 15 billion, so:

+ Company B must carry forward the entire loss of VND 15 billion to the income of 2014;

+ The remaining loss of VND 5 billion must be continuously monitored and carried forward in accordance with the principle of carrying forward losses of 2013 to subsequent years, but not exceeding 5 years from the year following the year in which the loss arises.

- Enterprises may offset losses between quarters within the same fiscal year. When finalizing CIT, enterprises must determine the annual loss and carry forward the entire loss to the taxable income of subsequent years in accordance with the above regulations.

- Enterprises must self-determine the deductible loss in accordance with the above principles. In cases where a further loss occurs during the carry forward period, the newly incurred loss (excluding previous period losses) shall be carried forward entirely and continuously for no more than 5 years from the year following the year in which the loss arises.

In cases where competent authorities inspect, audit, and finalize CIT and determine a different loss amount than that self-determined by the enterprise, the loss carried forward shall be determined according to the conclusions of the inspecting and auditing authorities, but must ensure the entire loss is carried forward continuously for no more than 5 years from the year following the year in which the loss arises by law.

If the 5-year period from the year following the year in which the loss arises elapses and the loss has not been completely carried forward, it shall not be carried forward to subsequent years' income.

...

Thus, if an enterprise incurs a loss after submission of tax statement dossiers, it shall carry forward the entire loss to the taxable income of subsequent years.

Note: The period for carrying forward losses continuously shall not exceed 5 years from the year following the year in which the loss arises.

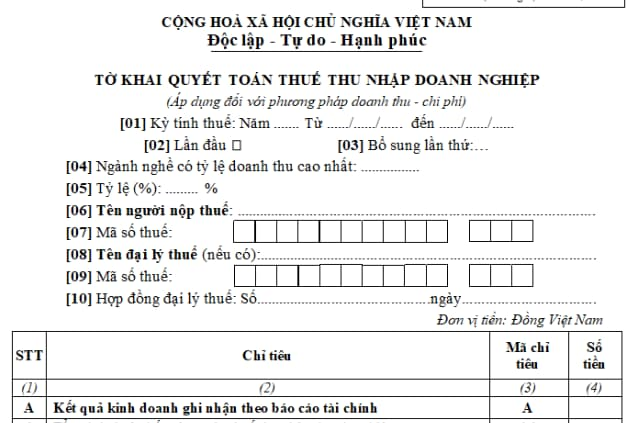

Where to download the CIT finalization form in Vietnam as per Circular 80?

The CIT finalization form (applicable to the revenue-cost method) is to be used according to Form 03/TNDN in Section VI of Appendix II issued with Circular 80/2021/TT-BTC.

DOWNLOAD >>> CIT finalization form (Form 03/TNDN)

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?