What is the report form for the customs fee for import-export goods in Vietnam? What is the use of customs fees by customs authorities in Vietnam?

What is the report form for the customs fee for import-export goods in Vietnam?

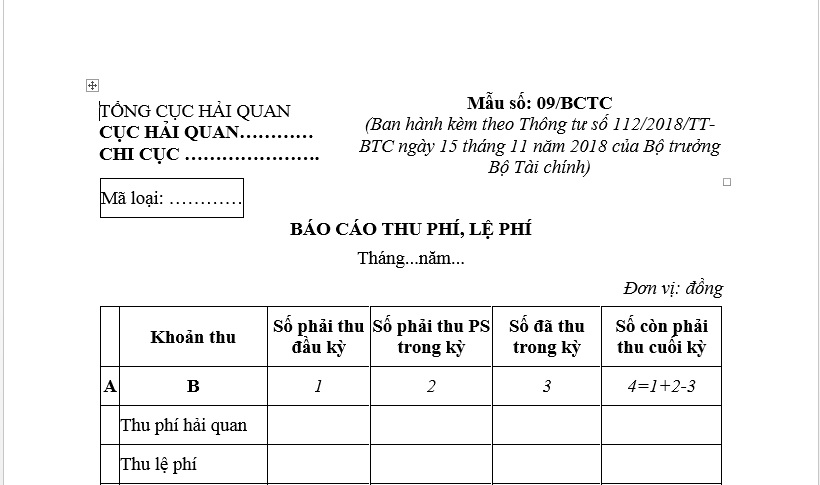

The report form for the customs fee for import-export goods is Form No. 09/BCTC stipulated in Appendix No. 04 issued together with Circular 112/2018/TT-BTC (amending and supplementing Form No. 09/BCTC issued together with Circular 174/2015/TT-BTC).

The report form for the customs fee for import-export goods is structured as follows:

The report form for the customs fee for import-export goods...Download

What is the report form for the customs fee for import-export goods in Vietnam? (Image from the Internet)

What is the use of customs fees by customs authorities in Vietnam?

Pursuant to Clause 1, Article 8 of Circular 14/2021/TT-BTC regulating the management and use of customs fees as follows:

- The customs authorities are permitted to retain the entire amount of collected fees to cover the expenses for service provision and fee collection.

The retained fee amount is managed and utilized following regulations stipulated in Decree No. 120/2016/ND-CP dated August 23, 2016, of the Government of Vietnam detailing and guiding the implementation of a number of articles of the Law on Fees and charges; in which other expenses serving fee collection include: Payment of fee collection authorization costs, portions extracted from customs revenue of customs authorities.

The fee for the authorized collection party is determined by agreement between the customs authority and the authorized collection party according to the regulations in Article 39 of Decree No. 126/2020/ND-CP.

- The Customs Departments of provinces and centrally governed cities shall prepare revenue and expenditure estimates to ensure mission performance, consolidate them into the annual state budget revenue and expenditure estimates of their units, and submit them to the General Department of Customs for appraisal and consolidation into the annual state budget revenue and expenditure estimates, which the General Department of Customs submits to the Ministry of Finance.

Which entities are customs fee payers in Vietnam?

According to Clause 1, Article 2 of Circular 14/2021/TT-BTC, those subject to customs fee and charge payments are as follows:

- Customs fee payers stipulated in this Circular include:

+ Organizations, individuals that declare and submit customs declarations or substitute documents (hereinafter referred to as declarations) for export, import goods, vehicles exiting, or entering.

+ Organizations, individuals requesting the issuance of temporary importation licenses (ATA carnet) for temporarily exported and re-imported goods according to Decree No. 64/2020/ND-CP dated June 10, 2020, of the Government of Vietnam guiding the implementation of the temporary importation mechanism following the Istanbul Convention.

+ Intellectual property right holders protected or their lawful authorized persons submitting applications to the customs authority to examine, supervise, or suspend customs procedures for export or import goods suspected of violating intellectual property rights as per the laws on intellectual property and customs laws.

- Persons liable to pay charges for goods and vehicles in transit are organizations, individuals declaring and submitting declarations for goods and vehicles transiting through Vietnam.

Which entities are exempt from customs fees and charges in Vietnam?

Pursuant to Article 3 of Circular 14/2021/TT-BTC, customs fees and charges for goods and vehicles in transit are exempt for organizations, individuals executing customs procedures for exporting, importing, and transiting goods, exiting, entering, and transiting vehicles in the following cases:

(1) Humanitarian aid, nonrefundable aid; gifts to state agencies, political organizations, socio-political organizations, social organizations, social-professional organizations, armed forces units, individuals (tax-exempt within limits as prescribed); gifts for humanitarian and charity purposes; personal items of foreign organizations and individuals liable to diplomatic immunity; personal luggage; postal items, packages tax-exempt according to current legal regulations.

(2) Export, import goods sent via courier services with a value not exceeding 1,000,000 VND or total taxes (applicable taxes) less than 100,000 VND.

(3) Export, import goods with a customs value less than 500,000 VND or total taxes (applicable taxes) payable less than 50,000 VND for each export, import occasion.

(4) Goods for trade and exchange by border residents within the prescribed limits.

(5) Vehicles frequently crossing the border, managed by recording, not by declarations.

(6) Goods and vehicles in transit exempted from fees and charges according to international treaties to which Vietnam is a member or commitments by the Government of Vietnam.