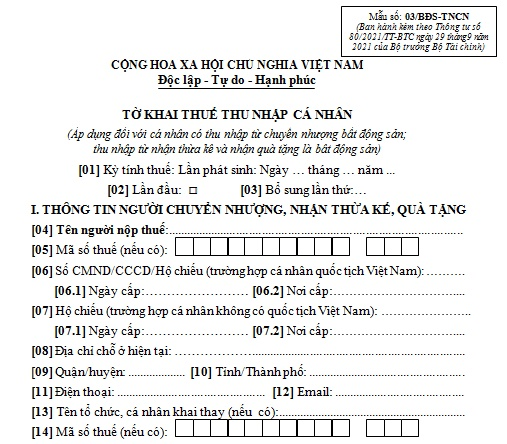

What is the PIT declaration form - Form 03/BDS-TNCN for income from real estate transfer or receipt of real estate as inheritance or gifts in Vietnam?

What is the PIT declaration form - Form 03/BDS-TNCN for income from real estate transfer or receipt of real estate as inheritance or gifts in Vietnam?

The PIT declaration form - Form 03/BDS-TNCN for income from real estate transfer or receipt of real estate as inheritance or gifts is issued with Appendix 2 Circular 80/2021/TT-BTC as follows:

Download Form 03/BDS-TNCN: Here

What is the PIT declaration form - Form 03/BDS-TNCN for income from real estate transfer or receipt of real estate as inheritance or gifts in Vietnam? (Image from the Internet)

What is the PIT rate on income from real estate transfer in Vietnam in Vietnam?

Under Article 12 of Circular 111/2013/TT-BTC amended by Article 17 of Circular 92/2015/TT-BTC, the basis for calculating personal income tax on real estate transfer is as follows:

Basis for calculating tax on incomes from real estate transfer

The basis for calculating tax on incomes from real estate transfer is the price of each transfer and tax rate.

...

2. Tax rate

Tax on real estate transfer is 2% of the transfer price or sublease price.

3. Time for taxing real estate transfer is determined as follows:

- If the transfer contract does not require the buyer to pay tax on behalf of the seller, the taxing time is the effective date of the transfer contract as prescribed by law;

- If the transfer contract requires the buyer to pay tax on behalf of the seller, the taxing time is time of registration of the right to own or right to use the real estate. In case the person receives an off-the-plan house or land use right associated with off-the-plan constructions, the taxing time is the time the person submits tax declaration documents to the tax authority.

4. Tax calculation

a) PIT on income from real estate transfer is calculated as follows:

PIT payable

=

Transfer price

x

2% tax

b) In case the transferred real estate in under a co-ownership, the tax liability incurred by each taxpayer is proportional to their portions of real estate ownership. The basis for determining the portion of ownership is legal documents such as the initial capital contribution agreements, the testament, or the decision on division made by the court, etc. If no legitimate documents are provided, the tax liability incurred by each taxpayer shall be evenly divided.”

Thus, the basis for calculating tax on incomes from real estate transfer is the price of each transfer and tax rate.

The personal income tax rate for real estate transfers is 2% of the transfer price or sublease price.

Moreover, the tax calculation time for real estate transfers is determined as follows:

- If the transfer contract does not require the buyer to pay tax on behalf of the seller, the taxing time is the effective date of the transfer contract as prescribed by law;

- If the transfer contract requires the buyer to pay tax on behalf of the seller, the taxing time is time of registration of the right to own or right to use the real estate.

- In case the person receives an off-the-plan house or land use right associated with off-the-plan constructions, the taxing time is the time the person submits tax declaration documents to the tax authority.

What are the responsibilities of taxpayers in Vietnam?

According to Article 17 of the Law on Tax Administration 2019, taxpayers have the following responsibilities:

- Apply for taxpayer registration and use TINs as prescribed by law.

- Declare tax accurately, honestly and adequately and submitting tax dossiers on time; take legal responsibility for the accuracy, honesty and adequacy of tax dossiers.

- Pay tax, late payment interest and/or penalties fully, on schedule and at the right location.

- Conform to regulations on accounting, statistics and management, use of invoices and records as prescribed by law.

- Truthfully and fully record the taxable activities and transactions.

- Issue and deliver invoices and records to buyers with the correct quantity, type and actual payment amount when selling goods and/or providing services as prescribed by law.

- Provide information and/or materials related to the determination of tax liabilities accurately, fully and promptly, including information on investment value; transaction IDs and contents of accounts opened at commercial banks and/or other credit institutions; explain declared tax and/or tax payment as requested by tax authorities.

- Comply with decisions, notifications and requests of tax authorities, tax officials as prescribed by law.

- Take responsibility for the fulfillment of tax liabilities as prescribed by law in case the taxpayer’s legal representative or authorized representative fails to follow tax procedures.

- Taxpayers operating businesses in areas with available information technology infrastructure must declare and pay tax and carry out transactions with tax authorities electronically as prescribed by law.

- Based on the availability of information technology equipment, the Government shall specify the documents that regulatory authorities already have and thus can be excluded from tax declarations, applications for tax refund and other tax dossiers.

- Develop, manage and operate systems of technical infrastructure so as to ensure e-transactions with tax authorities; sharing information related to the fulfillment of tax liabilities with tax authorities

- Taxpayers who have entered into related-party transactions have the responsibility to create, retain, declare and provide documents on taxpayers and their related parties, including information on related parties residing in foreign countries or territories according to the Government's regulations.

- When is the timing for determining overpaid tax for offsetting or refunding in Vietnam?

- What are VAT calculation methods in Vietnam?

- When is an e-invoice issued without the a valid seller's digital signature in Vietnam?

- Vietnam: Shall a VAT invoice include 02 foreign currencies?

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?