What is the maximim reduction rate of excise tax in Vietnam?

What is the maximim reduction rate of excise tax in Vietnam?

Firstly, cases eligible for excise tax reduction are stipulated in Clause 1, Article 52 of Circular 80/2021/TT-BTC, which regulates cases when the tax authority notifies, decides on tax exemption, and reduction as follows:

- Exemption of personal income tax for incomes as prescribed in Clause 1, Clause 2, Clause 3, Clause 4, Clause 5, Clause 6, Article 4 of the Personal Income Tax Law;

- Tax reduction as prescribed for individuals, business households, individuals in business facing difficulties due to natural disasters, fire, accidents, serious illnesses affecting their ability to pay tax;

- Reduction of excise tax for taxpayers manufacturing goods subject to excise tax facing difficulties due to natural disasters, unexpected accidents as per the law on excise tax;

- Exemption or reduction of resource tax for taxpayers facing natural disasters, fire, unexpected accidents causing losses to declared resources upon which tax has been paid;

- Exemption or reduction of non-agricultural land use tax;

- Exemption or reduction of agricultural land use tax as per the Agricultural Land Use Tax Law and National Assembly Resolutions;

- Exemption, reduction of land rent, land surface rent, and land levy;

- Exemption of registration fees.

Simultaneously, according to Article 9 of the Law on excise tax 2008, stipulations for reduction of excise tax are as follows:

Tax Reduction

Taxpayers producing goods subject to excise tax facing difficulties due to natural disasters, unexpected accidents, are eligible for tax reduction.

The tax reduction level is determined based on actual losses caused by natural disasters, unexpected accidents, but not exceeding 30% of the tax payable for the year in which the loss occurs and not exceeding the value of assets lost after compensation (if any).

Thus, it can be seen that the regulation is very clear that the tax reduction will not exceed 30% of the tax payable for the year in which the loss occurs and not exceed the value of the assets lost after compensation (if any).

This reduction will be determined based on actual losses caused by natural disasters or unexpected accidents.

What is the maximim reduction rate of excise tax in Vietnam? (Image from Internet)

What entities are excise taxpayers in Vietnam according to law?

Based on Article 2 of the Law on excise tax 2008, amended by Clause 1, Article 1 of the Amended Law on excise tax 2014, 16 types of products are subject to excise tax as per current legal provisions, as follows:

Group 1. Goods:

- Cigarettes, cigars, and other products made from tobacco for smoking, inhaling, chewing, sniffing, and sucking;

- Alcohol;

- Beer;

- Automobiles under 24 seats, including vehicles with dual purposes (carrying both people and goods) with at least two rows of seats, with a fixed partition between the passenger and goods compartments;

- Motorbikes, three-wheeled motor vehicles with engine displacement above 125cm3;

- Aircraft, yachts;

- Various types of gasoline;

- Air conditioners with a capacity of 90,000 BTU or less;

- Playing cards;

- Votive papers, votive offerings.

Group 2. Services:

- Nightclub businesses;

- Massage, karaoke businesses;

- Casino businesses; electronic games with prizes including jackpot machines, slot machines, and similar machines;

- Betting businesses;

- Golf businesses including selling membership cards, golf tickets;

- Lottery businesses.

What are regulations on tax rates applied to specific goods subject to excise tax in Vietnam?

According to Article 5 of the Law on excise tax 2008, regulations on calculating excise tax are as follows:

Tax Base

The tax base for excise tax is the tax-calculation price of goods and services subject to tax and the tax rate. The excise tax payable is equal to the excise tax-calculation price multiplied by the excise tax rate.

Moreover, the excise tax payable for goods is determined by the following formula:

excise tax = excise tax-Calculation Price x Tax Rate

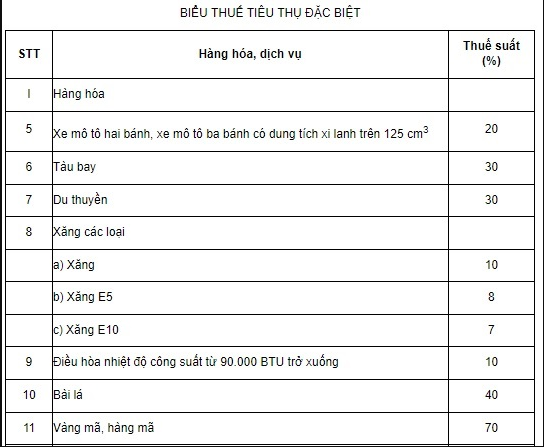

Simultaneously, according to Article 7 of the Law on excise tax 2008 (amended by Clause 4, Article 1 of the Amended Law on excise tax 2014, Clause 2, Article 2 of the Amended Law on Value Added Tax, excise tax, and Tax Management 2016, and Article 8 of the Law Amending the Law on Public Investment, Investment under Public-Private Partnership, Investment Law, Housing Law, Bidding Law, Electricity Law, Enterprise Law, Law on excise tax, and Civil Judgment Enforcement Law 2022) stipulate the excise tax rates for goods as follows:

Tax Rate

The excise tax rate for goods and services is regulated according to the following excise tax Tariff:

...

Thus, according to the regulations, depending on the type of goods, the tax rate will vary accordingly.

- Download the file to look up which goods are not eligible for VAT reduction in Vietnam under Decree 72

- How to download the latest 2024 HTKK software (version 5.2.4) from the General Department of Taxation of Vietnam?

- Is there a Draft outline for the Law on Personal Income Tax replacing the Law on Personal Income Tax 2007 in Vietnam?

- What is the reference number of the tax receipt in Vietnam? What is the use of a reference number of the tax receipt when the tax receipt is burned?

- What is a form number of the receipt in Vietnam? Does the report on the use of receipts include the contents of the form number of the receipt?

- What is the environmental protection fee for natural gas obtained in the process of extraction of crude oil in Vietnam?

- What are cases of cancellation of outstanding tax in Vietnam?

- When are household businesses eligible for cancellation of outstanding tax in Vietnam?

- Is cell phone allowance subject to personal income tax in Vietnam?

- What is the VAT declaration form for computer-generated lottery business in Vietnam?