What is the licensing fee declaration form - Form 01/LPMB in Vietnam?

What is the licensing fee declaration form - Form 01/LPMB in Vietnam?

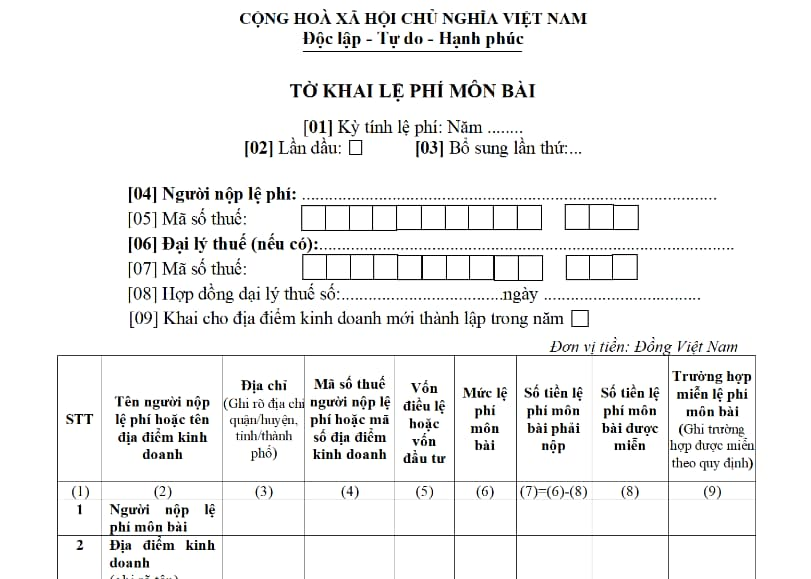

Pursuant to the Appendix issued together with Circular 80/2021/TT-BTC, the licensing fee declaration form - Form 01/LPMB in Vietnam is regulated as follows:

Download the licensing fee declaration form - Form 01/LPMB in Vietnam: Here

What is the licensing fee declaration form - Form 01/LPMB in Vietnam? (Image from the Internet)

What are the current licensing fees in Vietnam?

(1) licensing fees for organizations engaged in the production and business of goods and services

licensing fees for organizations engaged in the production and business of goods and services are regulated under Clause 1, Article 4 of Decree 139/2016/ND-CP. To be specific:

(1) Organizations with charter capital or investment capital over 10 billion VND: 3,000,000 VND/year;

(2) Organizations with charter capital or investment capital of 10 billion VND or less: 2,000,000 VND/year;

Note: The licensing fee for the two organizations above is based on the charter capital recorded in the business registration certificate; in case there is no charter capital, it is based on the investment capital recorded in the investment registration certificate.

If there is a change in charter capital or investment capital, the basis for determining the licensing fee is the charter capital or investment capital of the previous year relative to the licensing fee calculation year.

(3) Branches, representative offices, business locations, public service providers, and other economic organizations: 1,000,000 VND/year.

(2) licensing fees for individuals and households engaged in the production and business of goods and services

licensing fees for individuals and households engaged in the production and business of goods and services according to Clause 2, Article 4 of Decree 139/2016/ND-CP (Supplemented by Point a, Clause 2, Article 1 of Decree 22/2020/ND-CP). Specifically:

(i) Individuals, groups of individuals, households with annual revenue over 500 million VND: 1,000,000 VND/year.

(ii) Individuals, groups of individuals, and households with annual revenue over 300 to 500 million VND: 500,000 VND/year.

(iii) Individuals, groups of individuals, and households with annual revenue over 100 to 300 million VND: 300,000 VND/year.

The revenue basis for determining the licensing fee for individuals, groups of individuals, and households is as guided by the Ministry of Finance.

(3) licensing fees in certain other cases:

According to Clause 3, Article 4 of Decree 139/2016/ND-CP (Amended by Point b, Clause 2, Article 1 of Decree 22/2020/ND-CP):

(3.1) Small and medium enterprises converted from household businesses (including branches, representative offices, business locations) when the exemption period for licensing fees ends (the fourth year from the date of enterprise establishment):

- If the period ends in the first 6 months of the year, the licensing fee for the entire year must be paid.

- If the period ends in the last 6 months of the year, 50% of the annual licensing fee must be paid.

Households, individuals, and groups of individuals engaged in production and business that have dissolved and resume business in the first 6 months of the year must pay the licensing fee for the entire year, and in the last 6 months of the year must pay 50% of the annual licensing fee.

(3.2) Fee payers who are currently active and send a written request to the directly managing tax authority for temporary suspension of production and business activities during the calendar year are exempted from the annual licensing fee for the year of business suspension, provided: the written request for temporary suspension of production and business activities is submitted to the tax authority before the fee payment deadline (January 30 annually) and the licensing fee for the year of business suspension has not yet been paid.

If the temporary suspension of production and business activities does not meet the above conditions, the licensing fee for the entire year must be paid.

What are the cases of licensing fee exemption in Vietnam?

Pursuant to Article 3 of Decree 139/2016/ND-CP (Amended by points a, b, c, Clause 1, Article 1 of Decree 22/2020/ND-CP), the following cases are exempted from licensing fees:

(1) Individuals, groups of individuals, and households engaged in production and business with annual revenue of 100 million VND or less.

(2) Individuals, groups of individuals, households engaged in irregular production and business; without a fixed business location as guided by the Ministry of Finance.

(3) Individuals, groups of individuals, and households producing salt.

(4) Organizations, individuals, groups of individuals, and households engaged in aquaculture, seafood capture, and fishery logistic services.

(5) Village cultural postal points; press agencies (print newspapers, radio, television, electronic newspapers).

(6) Cooperatives, cooperative unions (including branches, representative offices, and business locations) operating in the agricultural sector as regulated by the law on agricultural cooperatives.

(7) People's credit funds; branches, representative offices, business locations of cooperatives, cooperative unions, and private enterprises operating in mountainous areas.

The mountainous area is determined according to the regulations of the Committee for Ethnic Minorities.

(8) licensing fee exemption during the first year of establishment or commencement of production and business activities (from January 1 to December 31) for:

- Newly established organizations (granted new TINs, new enterprise codes).

- Households, individuals, and groups of individuals commencing production and business activities for the first time.

- During the licensing fee exemption period, if organizations, households, individuals, groups of individuals establish branches, representative offices, business locations, such branches, representative offices, business locations are also exempt from licensing fees during the licensing fee exemption period of the organizations, households, individuals, groups of individuals.

(9) Small and medium enterprises converted from household businesses (according to Article 16 of Law on Supporting Small and Medium-sized Enterprises 2017) are exempt from licensing fees for 3 years from the date of receiving the first business registration certificate.

- During the licensing fee exemption period, if small and medium enterprises establish branches, representative offices, or business locations, such branches, representative offices, and business locations are also exempt from licensing fees during the licensing fee exemption period of the small and medium enterprises.

- Branches, representative offices, business locations of small and medium enterprises (under licensing fee exemption as per Article 16 of Law on Supporting Small and Medium-sized Enterprises 2017) formed before the effective date of this Decree, the exemption period is calculated from the effective date of this Decree to the end of the licensing fee exemption period for small and medium enterprises.

- Small and medium enterprises converted from household businesses before the effective date of this Decree shall be exempted from licensing fees as stated in Article 16 and Article 35 of the Law on Supporting Small and Medium-sized Enterprises 2017.

(10) Public general education institutions and public preschool institutions.

- When is the deadline for paying tax, duty payment guarantee and tax deposit in Vietnam?

- Are natural aquatic resources exempt from severance tax in Vietnam?

- Are natural swallow's nests subject to severance tax in Vietnam?

- What are the principles for developing a List of goods to be imported free of duty in Vietnam?

- How long is the CIT period of the first year in Vietnam?

- Shall individuals be entitled to tax refund if their taxed incomes do not reach a tax-liable level in Vietnam?

- What are regulations on responsibilities of income payer regarding PIT refund when being delegated to settle tax in Vietnam?

- Is it necessary to terminate the tax identification number when a business temporarily suspends its operations in Vietnam?

- What is the value-added tax declaration form for 2024 in Vietnam?

- What are forms for declaring corporate income tax in Vietnam?