What is the latest form for year-end 2024 assessment and classification for performance of Vietnamese officials? Which officials are subject to personal income tax?

What is the latest form for year-end 2024 assessment and classification for performance of Vietnamese officials?

Based on Clause 1, Article 18 of Decree 90/2020/ND-CP, the regulations are as follows:

Procedures for assessing and classifying official performance

- For officials who are the heads of agencies, organizations, or units:

a) Self-assessment and classification by the official

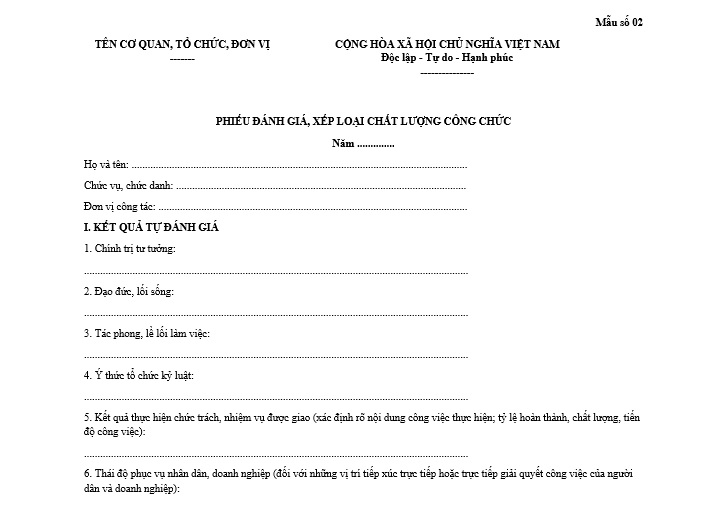

The official prepares a self-assessment report and determines their classification of work results based on the responsibilities and tasks assigned, in accordance with Form No. 02 of the Annex issued with this Decree.

b) Comments and assessment of the official

A meeting is organized at the agency or unit where the official works to provide comments and assess the official.

Participants in the meeting include all officials from the agency, organization, or unit.

In the case of agencies, organizations, or units with constituting units, participants include the leadership collective of the agency, organization, or unit, representatives of the party committee, trade union, youth union at the same level, and heads of the constituting units. For large-scale agencies, organizations, or units, heads of the constituting units can contribute opinions in writing.

The official presents the self-assessment report of work results at the meeting, and participants contribute opinions. All opinions must be recorded in the minutes and approved at the meeting.

Thus, the form for the year-end 2024 official performance assessment is used according to Form No. 02 issued with Decree 90/2020/ND-CP.

The form for the year-end 2024 official performance assessment is as follows:

form for the year-end 2024 official performance assessment...Download

What is the latest form for year-end 2024 assessment and classification for performance of Vietnamese officials?(Image from the Internet)

When is the time for annual assessment and classification for performance for Vietnamese officials?

According to Article 20 of Decree 90/2020/ND-CP, the regulation on the timing for annual assessment and classification for performance for officials is as follows:

- The assessment and classification of the quality of officials and public employees are conducted annually.

For officials and public employees transferring work positions, the new agency, organization, or unit is responsible for assessment and classification. If they have worked at the previous agency, organization, or unit for 6 months or more, comments from the previous agency must be combined, unless the previous agency no longer exists.

- The timing for assessment and classification of the quality of officials and public employees is conducted before December 15 annually, prior to the assessment and classification of party members and the annual review of emulation and commendation of the agency, organization, or unit.

For public service providers operating in education, training, and other sectors concluding the working year before December annually, the head of the provider decides the timing of assessment and classification for public employees.

- At the time of assessment and classification, in cases of absence for legitimate reasons or maternity and medical leave policies according to law, officials and public employees must prepare self-assessment reports and determine their work result classification based on responsibilities and tasks assigned, and send it to the current agency, organization, or unit for assessment and classification according to this Decree.

Based on Clauses 1 and 2, Article 20 of Decree 90/2020/ND-CP and the specifics of the agency, organization, or unit, the leadership collective, together with the party committee at the same level, agrees on organizing a serious and effective assessment and classification meeting in their institution, avoiding superficiality and waste.

Which officials are subject to personal income tax in Vietnam from July 1, 2024?

Pursuant to Article 19 of Personal Income Tax Law 2007 (amended by Clause 4, Article 1 of Amended Personal Income Tax Law 2012 and Article 1 of Resolution 954/2020/UBTVQH14), the following is stipulated:

Family Circumstance Deductions

- Family circumstance deduction is the amount deducted from taxable income before calculating tax for income from wages, salaries of resident taxpayers. It includes two parts:

a. The deduction for the taxpayer is 11 million VND/month (132 million VND/year);

b. The deduction for each dependent is 4.4 million VND/month.

If the consumer price index (CPI) increases by over 20% compared to when the Law took effect or the last adjustment time, the Government of Vietnam proposes to the Standing Committee of the National Assembly to adjust the family circumstance deduction according to price fluctuations for the next tax calculation period.

- The determination of family circumstance deductions for dependents is subject to the principle that each dependent is counted once for one taxpayer.

- Dependents are persons the taxpayer has a responsibility to support, including:

a) Minors; disabled children unable to work;

b) Individuals with no or limited income, including adult children in college, vocational training; spouses unable to work; elderly parents or those unable to work; others without support relying on the taxpayer.

the Government of Vietnam delineates the income level and registration to determine dependents eligible for family circumstance deductions.

From July 1, 2024, officials with a total income from wages and salaries exceeding 11 million VND/month (132 million VND/year) after mandatory insurance contributions, and without dependents, will be subject to personal income tax.

Officials with a total income from wages exceeding 11 million VND/month (132 million VND/year) after mandatory social insurance, voluntary pension fund contributions, charitable contributions, and with dependents may not be subject to or may still be liable for personal income tax depending on the number of dependents and the official's salary.

- Does a merged enterprise have its TIN deactivated in Vietnam?

- What are cases where a taxpayer is subject to the enforcement measure of bank account freeze in Vietnam?

- Is it possible to extend the decision to impose anti-dumping duties in Vietnam?

- Are goods in transit required to pay export and import duties in Vietnam?

- What are cases where customs declarations are replaced with records in the customs dossier in Vietnam?

- What income is exempt from personal income tax in Vietnam?

- When are e-records converted into paper records in Vietnam?

- What are conditions of authenticated e-invoices in Vietnam?

- What is the latest end-of-year 2024 asset and income declaration form in Vietnam?

- What are regulations on carry-forward of losses when calculating corporate income tax in Vietnam?