What is the Form No. 01-1/KHBS on additional declaration in Vietnam?

What is the Form No. 01-1/KHBS on additional declaration in Vietnam?

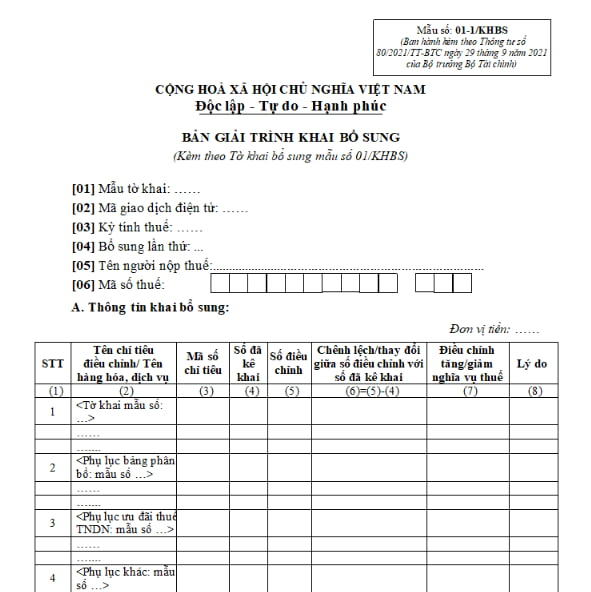

The Form No. 01-1/KHBS on additional declaration in Annex II issued in conjunction with Circular 80/2021/TT-BTC is as follows:

Download the supplementary tax declaration explanation here

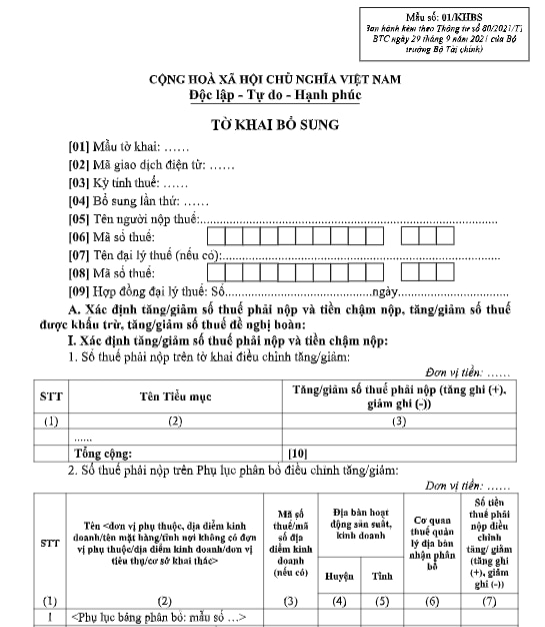

Additionally, the additional declaration according to Form 01/KHBS issued in conjunction with Circular 80/2021/TT-BTC is as follows:

Download the additional declaration here

What is the Form No. 01-1/KHBS on additional declaration in Vietnam? (Image from the Internet)

Vietnam: What is the time limit for supplementing a tax declaration dossier if it is erroneous or inadequate?

Pursuant to Article 47 of the Law on Tax administration 2019 as follows:

Additional declaration of tax declaration dossiers

1. Taxpayers who find errors or omissions in the tax declaration dossiers submitted to the tax authorities may supplement the tax declaration dossiers within 10 years from the expiration date for submitting the tax declaration dossiers of the tax period in which the errors or omissions occurred, but before the tax authorities or competent authorities announce a decision on inspection or audit.

2. When the tax authorities or competent authorities have announced a decision on tax inspection or audit at the taxpayer's office, the taxpayer may still supplement the tax declaration dossiers; the tax authorities shall impose administrative penalties for violations in tax management as stipulated in Articles 142 and 143 of this Law.

3. After the tax authorities or competent authorities have issued a conclusion or decision on handling taxes after inspection or audit at the taxpayer's office, the additional declaration of tax declaration dossiers is regulated as follows:

a) Taxpayers may supplement the tax declaration dossiers in cases where the additional declaration increases the amount of tax payable, reduces the amount of tax deductible, or reduces the amount of tax exempted, reduced, or refunded and shall be administratively penalized for the violations in tax management stipulated in Articles 142 and 143 of this Law;

b) In cases where taxpayers discover errors or omissions in the tax declaration dossiers, if the additional declaration reduces the tax payable amount or increases the amount of deductible tax, tax exemption, reduction, or refund, it shall be resolved according to the regulations on tax complaint settlement.

4. The additional declaration of tax declaration dossiers includes:

a) The additional declaration form;

b) The explanation of the additional declaration and related documents.

5. For exported and imported goods, the additional declaration of tax declaration dossiers shall comply with the regulations of the customs law.

Within 10 years from the expiration date for submitting the tax declaration dossiers of the tax period in which the errors or omissions occurred, taxpayers may supplement the tax declaration dossiers, but the supplement must be made before the tax authorities or competent authorities announce a decision on inspection or audit.

What is the deadline for tax payment when supplementing tax declaration dossiers in Vietnam?

Pursuant to Article 55 of the Law on Tax administration 2019 as follows:

Tax Payment Deadline

1. If taxpayers calculate the tax themselves, the tax payment deadline is the last day of the deadline for submitting the tax declaration dossiers. In cases of supplementary tax declaration dossiers, the payment deadline is the deadline for submitting the tax declaration dossiers of the tax period in which the errors occurred.

For corporate income tax, the provisional payment by quarter, the tax payment deadline is the 30th day of the first month of the following quarter.

For crude oil, the resource tax, and corporate income tax payment for each sale of crude oil, the deadline is 35 days from the sale date for domestic sales or from the customs clearance date for exported crude oil as stipulated by the customs law.

For natural gas, the resource tax, and corporate income tax payment is monthly.

2. If the tax authorities calculate the tax, the payment deadline is the deadline stated on the tax notification.

3. For other revenues belonging to the state budget from land, fees for the right to exploit water resources, mineral resources, registration fees, and license fees, the deadline shall be in accordance with the regulations of the Government of Vietnam.

...

In cases of supplementary tax declaration dossiers, the payment deadline is the deadline for submitting the tax declaration dossiers of the tax period in which the errors occurred.

How do tax management authorities receive tax declaration dossiers?

According to Article 48 of the Law on Tax administration 2019 regulating the responsibility of tax management authorities in receiving tax declaration dossiers as follows:

Responsibilities of Tax Management Authorities in Receiving tax declaration dossiers

1. Tax management authorities receive tax declaration dossiers from taxpayers through the following methods:

a) Direct receipt at the tax management authority;

b) Receipt by postal service;

c) Electronic receipt through the electronic transaction portal of the tax management authority.

2. Tax management authorities receiving tax declaration dossiers shall notify the receipt of tax declaration dossiers; if the returns are not legal, not complete, or not in the prescribed form, they shall notify the taxpayers within 3 working days from the date of receipt.

Thus, tax management authorities receive tax declaration dossiers from taxpayers through the following three methods:

- Direct receipt at the tax management authority;- Receipt by postal service;- Electronic receipt through the electronic transaction portal of the tax management authority.

- How to handle the case where there is a conflict of interest of office holders in taxation in Vietnam?

- What are cases of conflict of interest of office holders in taxationation in Vietnam?

- What is the classification of digital certificates in taxation in Vietnam?

- What is the import and export tariff schedule of Vietnam in 2024? Which goods are subject to export duties?

- What is the Form for corporate income tax for real estate transfer in Vietnam according to Circular 80?

- Vietnam: What does the supplementary personal income tax declaration dossier include?

- What are the educational requirements for tax agent employees in Vietnam?

- Shall the tax for use of collateral pending settlement be declared quarterly or monthly in Vietnam?

- Which income of a Vietnamese non-resident is subject to personal income tax?

- What is the Form for declaring a 20% reduction in the VAT rate in Vietnam according to Decree 72?