What is the Form 02/CC on enforcement by deducting money from the taxpayer’s salary or income in Vietnam?

Who is subject to the enforcement by deducting money from the taxpayer’s salary or income in Vietnam?

According to Clause 1, Article 32 of Decree 126/2020/ND-CP, the enforcement by deducting money from the taxpayer’s salary or income is applied to taxpayers who are individuals subject to enforcement of administrative decisions on tax management, receiving salaries, wages, or income at a state agency or organization under staff regulations or labor contracts of six months or more, or receiving retirement or disability benefits.

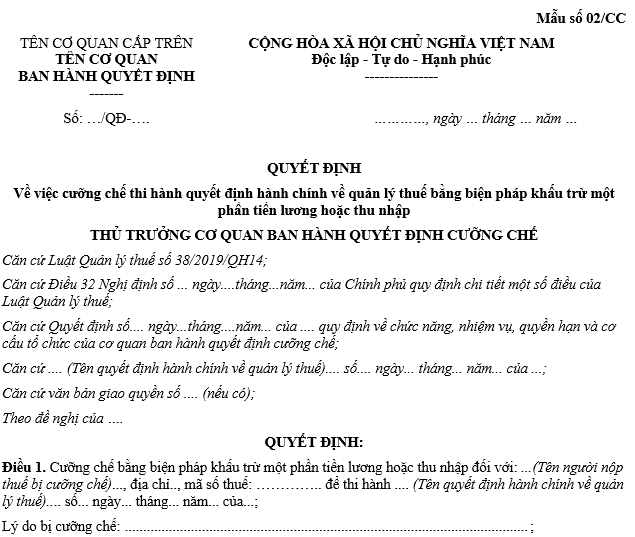

What is the Form 02/CC on enforcement by deducting money from the taxpayer’s salary or income in Vietnam? (Image from the Internet)

What is Form 02/CC on enforcement by deducting money from the taxpayer’s salary or income in Vietnam?

Based on Clause 3, Article 32 of Decree 126/2020/ND-CP, the regulations are as follows:

Enforcement by deducting money from the taxpayer’s salary or income

...

3. Decision on enforcement by deducting money from the taxpayer’s salary or income

a) The enforcement decision is made according to Form No. 02/CC in Appendix III issued with this Decree. The enforcement decision for deducting money from the taxpayer’s salary or income must clearly state: Name, address, tax identification number of the taxpayer being enforced; reason for enforcement; amount to be enforced; name, address of the agency or organization managing the salary or income of the individual being enforced; name, address, and account number for depositing into the state treasury; method of transferring the enforced amount to the state treasury.

...

The enforcement decision on administrative decisions on tax management by deducting money from the taxpayer’s salary or income is Form 02/CC in Appendix 3 issued with Decree 126/2020/ND-CP:

Download Form 02/CC on Enforcement by deducting money from the taxpayer’s salary or income: Here

Who shall receive the enforcement decision on deducting money from the taxpayer’s salary or income in Vietnam?

According to Article 32 of Decree 126/2020/ND-CP, the enforcement decision on deducting money from the taxpayer’s salary or income is sent to the following subjects:

- The individual being enforced, the agency, organization managing the salary or income of the individual being enforced;

- Relevant agencies, organizations immediately on the day of the enforcement decision issuance and updated on the electronic information portal of the tax or customs sector.

Note:

- The enforcement decision is sent electronically in cases where electronic transactions in the field of tax management are possible;

+ In cases where electronic transactions in the field of tax management are not yet possible, the enforcement decision is sent by registered mail via postal service or directly delivered.

- If the decision is delivered directly and the organization, individual being enforced does not receive it, the competent person or tax official, customs official responsible for delivering the enforcement decision shall make a record of the organization or individual’s refusal to receive the decision, with certification from local authorities where the organization or individual has a registered address with the tax management agency, the decision is considered delivered.

- In cases where the decision is sent via postal service by registered mail, if after 10 days from the date the enforcement decision was sent by postal service for the third time and returned due to the organization or individual being enforced not receiving it;

+ If the enforcement decision has been posted at the headquarters of the organization or the residence of the individual being enforced, or if there is reason to believe that the taxpayer being enforced is evading and not receiving the enforcement decision, it is considered delivered.

- When is the deadline for paying tax, duty payment guarantee and tax deposit in Vietnam?

- Are natural aquatic resources exempt from severance tax in Vietnam?

- Are natural swallow's nests subject to severance tax in Vietnam?

- What are the principles for developing a List of goods to be imported free of duty in Vietnam?

- How long is the CIT period of the first year in Vietnam?

- Shall individuals be entitled to tax refund if their taxed incomes do not reach a tax-liable level in Vietnam?

- What are regulations on responsibilities of income payer regarding PIT refund when being delegated to settle tax in Vietnam?

- Is it necessary to terminate the tax identification number when a business temporarily suspends its operations in Vietnam?

- What is the value-added tax declaration form for 2024 in Vietnam?

- What are forms for declaring corporate income tax in Vietnam?