What is the deadline for submitting the VAT return for the third quarter of 2024 in Vietnam?

What is the extended deadline for VAT payment for the third quarter of 2024 in Vietnam?

According to Article 4 of Decree 64/2024/ND-CP stipulating the extension of VAT payment deadlines, it is as follows:

Extension of tax payment and land rent deadlines

1. For value-added tax (excluding value-added tax on imports)

a) Extension of the tax payment deadline for the payable value-added tax (including the amount allocated to other provincial localities where the taxpayer has its headquarters, the tax amount to be paid on each arising occasion) for the tax calculation period from May to September 2024 (for the case of monthly VAT declaration) and the tax calculation periods of Q2 2024 and Q3 2024 (for the case of quarterly VAT declaration) for businesses and organizations mentioned in Article 3 of this Decree. The extension is five months for the VAT amount of May 2024, June 2024, and Q2 2024; four months for the VAT amount of July 2024; three months for the VAT amount of August 2024; two months for the VAT amount of September 2024 and Q3 2024. The extension period mentioned here is calculated from the due date of VAT payment as prescribed by the tax management law.

Businesses and organizations eligible for the extension must still declare, submit VAT declarations monthly and quarterly as per current legal regulations but are not required to pay the payable VAT amount stated in the declared VAT returns. The extended VAT payment deadlines for the month and quarter are as follows:

...

The deadline for VAT payment for the tax period of Q2 2024 is no later than December 31, 2024.

The deadline for VAT payment for the tax period of Q3 2024 is no later than December 31, 2024.

...

The extended deadline for VAT payment for the third quarter of 2024 is December 31, 2024 (Extended by 2 months).

What is the extended deadline for VAT payment for the third quarter of 2024 in Vietnam?(Image from the Internet)

What is the deadline for submitting the VAT return for the third quarter of 2024 in Vietnam?

According to the provisions of Article 8 of Decree 126/2020/ND-CP on monthly, quarterly, annual tax declarations, per arising tax obligations, and tax finalization declarations:

Types of taxes declared monthly, declared quarterly, declared annually, declared per arising occasions of tax obligations, and declared tax finalization

1. Types of taxes and other amounts collected by the state budget under the management of tax authorities, declared monthly, include:

a) Value-added tax, personal income tax. In cases where taxpayers meet the criteria set out in Article 9 of this Decree, they may opt for quarterly declarations.

....

According to Article 44 of the Tax Administration Law 2019, the deadline for submitting tax declarations is stipulated as follows:

Deadlines for tax declaration submission

1. The deadlines for submitting tax declarations for monthly and quarterly declarations are stipulated as follows:

a) No later than the 20th day of the following month for monthly declarations;

b) No later than the last day of the first month of the following quarter for quarterly declarations.

2. The deadlines for submitting tax declarations for taxes calculated annually are stipulated as follows:

a) No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization; no later than the last day of the first month of the calendar year or fiscal year for annual tax declarations;

b) No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization declared directly by individuals;

c) No later than December 15 of the preceding year for presumptive tax declarations by household businesses, individual businesses paying tax by the presumptive method; if new household businesses, individual businesses start their business, the deadline is no later than 10 days from the start date of the business.

...

Therefore, the deadline for submitting the VAT return for the third quarter of 2024 is October 31, 2024.

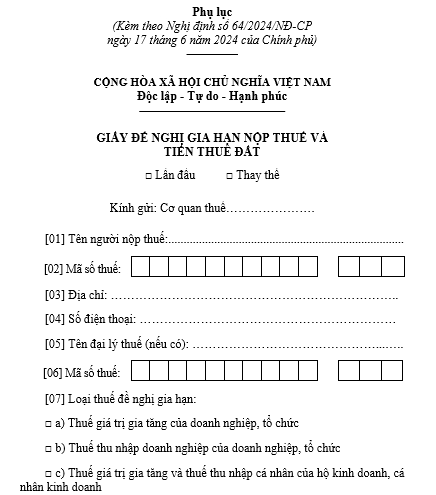

Application Form for Extension of VAT Payment in 2024?

The application form for the extension of VAT payment in 2024 is the form included in the Appendix issued with Decree 64/2024/ND-CP.

>> Download Application Form for Extension of VAT Payment in 2024: Download

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?