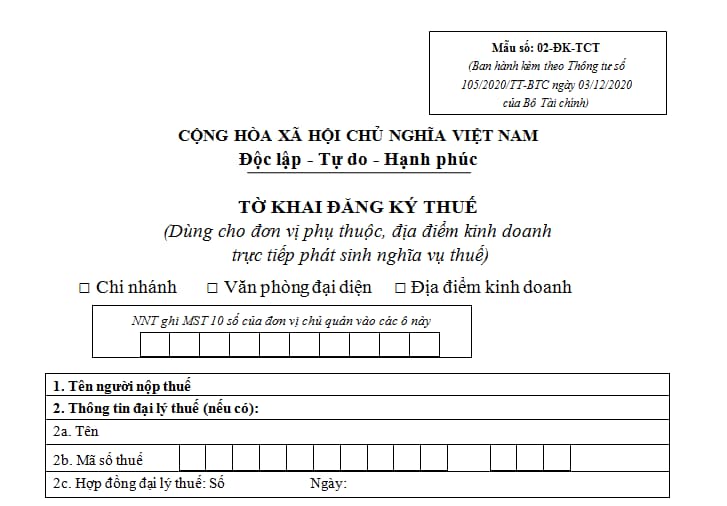

What is the application form for taxpayer registration - Form 02-DK-TCT under Circular 105 in Vietnam about?

What is the application form for taxpayer registration - Form 02-DK-TCT under Circular 105 in Vietnam about?

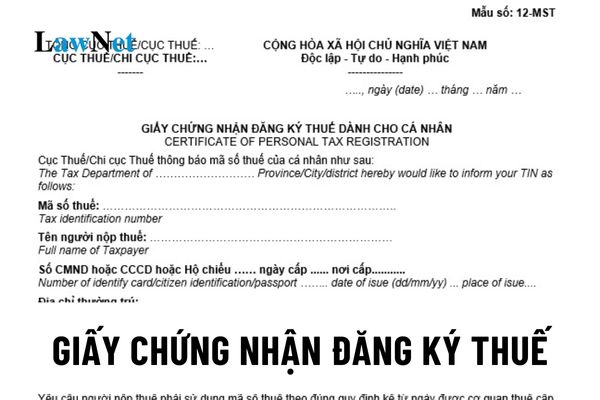

The application form for taxpayer registration - Form 02-DK-TCT issued together with Circular 105/2020/TT-BTC applies to dependent units and business locations directly incurring tax liability as follows:

>> Download the application form for taxpayer registration - Form No. 02-DK-TCT issued together with Circular 105/2020/TT-BTC: Download

What are the dependent units and business locations of an enterprise in Vietnam?

Under Article 44 of the Enterprise Law 2020:

Branches, representative offices and business locations of an enterprise

1. A branch of an enterprise is its dependent unit which has some or all functions of the enterprise, including authorized representative. The business lines of a branch shall match those of the enterprise.

2. A representative office of an enterprise is its dependent unit which acts as the enterprise’s authorized representative, represents and protect the enterprise’s interests. A representative office shall not do business.

3. A business location of an enterprise is the place at which specific business operations are carried out.

Thus, the dependent units of an enterprise are branches and representative offices of the enterprise.

A business location of an enterprise is the place at which specific business operations are carried out.

What is the application form for taxpayer registration - Form 02-DK-TCT under Circular 105 in Vietnam about? (Image from the Internet)

What are the procedures for first-time taxpayer registration for taxpayers being dependent units in Vietnam?

Under sub-item 2, Section 2 of the administrative procedures issued with Decision 2589/QD-BTC in 2021, the procedures for first-time taxpayer registration for taxpayers being dependent units in Vietnam are caried out as follows:

Step 1: Within 10 working days from the date of establishment or equivalent document issuance, the taxpayer (NNTtaxpayer) prepares a complete taxpayer registration application according to conformable regulations and sends it to the tax authority for taxpayer registration procedures at the following locations:

- Dependent units of an economic organization (excluding cooperatives) as stipulated at Points a and b, Clause 2, Article 4 of Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance, submit the first-time taxpayer registration application at the Tax Department where the headquarters are located;

- Dependent units of other organizations as stipulated at Point c and Point n, Clause 2, Article 4 of Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance, submit the first-time taxpayer registration application at the Tax Department where the organization’s headquarters are located, for organizations established by central and provincial-level authority decisions;

- For electronic taxpayer registration applications: The taxpayer accesses the web portal of their choice (the General Department of Taxation’s web portal/the competent state authority's web portal including the National Public Service Portal, Public Service Portal at the ministry and provincial levels as per the regulations on the single-window system for administrative procedures, connected to the General Department of Taxation's web portal/the web portal of the T-VAN service provider) to fill in the declaration form and attach the required electronic documents (if any), electronically sign and send to the tax authority through the chosen web portal;

The taxpayer submits the application (the taxpayer registration application together with the business registration application through the interlinked single-window system) to the competent state management authority as stipulated. The competent state management authority sends the received application information of the taxpayer to the tax authority via the General Department of Taxation’s web portal.

Step 2: The tax authority receives:

- For physical taxpayer registration applications:

+ If the application is submitted directly at the tax authority: The tax officer receives and stamps the receipt date on the taxpayer registration application, logs the date of receipt, and the number of documents as per the checklist of the application submitted directly at the tax authority. The tax officer issues a receipt note showing the return date and the processing time for the received applications;

+ If the taxpayer registration application is sent by postal service: The tax officer stamps the receipt date, logs the date of receipt on the application, and records the tax authority's document number;

The tax officer checks the taxpayer registration application. If the application is incomplete and requires explanation or additional information, the tax authority informs the taxpayer using Form No. 01/TB-BSTT-NNT in Appendix II issued with Decree 126/2020/ND-CP dated October 19, 2020 of the Government of Vietnam within 2 working days from the date of receiving the application.

- For electronic taxpayer registration applications:

The tax authority receives the application via the General Department of Taxation’s web portal, checks, and processes the application through the tax authority’s electronic data processing system:

+ Receiving the application: The General Department of Taxation’s web portal sends a receipt notification to the taxpayer within 15 minutes from receiving the taxpayer's electronic registration application through the chosen web portal (the General Department of Taxation’s web portal/the competent state authority’s portal or the T-VAN service provider’s portal);

+ Checking and processing the application: The tax authority checks and processes the taxpayer’s application as per the legal regulations on taxpayer registration and issues the resolution result through the chosen web portal of the taxpayer:

+ If the application is complete and in accordance with the procedures, the tax authority sends the resolution result to the chosen web portal of the taxpayer within the stipulated period according to Circular 105/2020/TT-BTC dated December 3, 2020, of the Ministry of Finance;

+ If the application is incomplete or does not comply with the procedures, the tax authority sends a notice of application rejection through the web portal chosen by the taxpayer within 2 working days from the date on the receipt notification.

- When is an e-invoice issued without the a valid seller's digital signature in Vietnam?

- Vietnam: Shall a VAT invoice include 02 foreign currencies?

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?