What is the application form for cancellation of outstanding tax, late payment interest and fines in Vietnam?

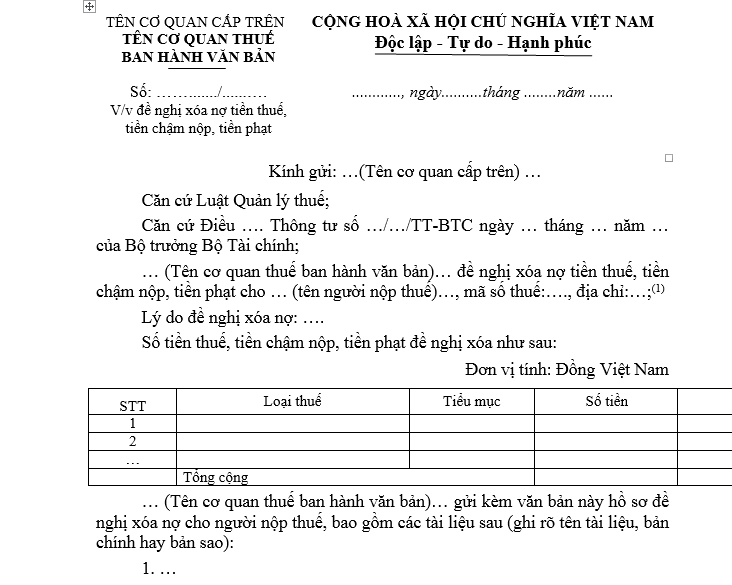

Application form for cancellation of outstanding tax, late payment interest and fines in Vietnam

The application form for cancellation of outstanding tax, late payment interest and fines is Form 01/XOANO issued along with Circular 80/2021/TT-BTC.

Download the application form for cancellation of outstanding tax, late payment interest and fines here: Here

Application for cancellation of outstanding tax, late payment interest and fines in Vietnam

What are cases eligible for cancellation of outstanding tax, late payment interest and fines in Vietnam?

Pursuant to Article 85 of the Tax Administration Law 2019, cases eligible for cancellation of outstanding tax, late payment interest and fines include:

- Enterprises, cooperatives declared bankrupt that have settled payments as prescribed by the law on bankruptcy but no longer have assets to pay taxes, late payment interest, and fines.

- Individuals who have died or have been declared dead by the court, lost civil act capacity, and have no assets, including those inherited, to pay unsettled taxes, late payment interest, and fines.

- Outstanding tax, late payment interest and fines of taxpayers not falling under the provisions of Clauses 1 and 2 of Article 85 of the Tax Administration Law 2019 where the tax authority has applied enforcement measures stipulated in Point g, Clause 1 of Article 125 of the Tax Administration Law 2019 and these debts have been outstanding for more than 10 years from the due date without the ability to recover.

Taxpayers being individuals, small business owners, household heads, sole proprietors, and single-member limited liability companies have had outstanding tax, late payment interest and fines written off under Clause 3 of Article 85 of the Tax Administration Law 2019. Before resuming business or establishing a new business entity, they must repay the debts previously written off to the State.

- Tax, late payment, and fines affected by natural disasters, disasters, and widespread epidemics that have been considered for exemption of late payment as stipulated in Clause 8 of Article 59 of the Tax Administration Law 2019 and have had tax deferral under Point a, Clause 1, Article 62 of the Tax Administration Law 2019 but still face significant damage, unable to recover production, business, and unable to pay taxes, late payment interest, and fines.

Documents for cancellation of outstanding tax, late payment interest and fines in Vietnam

According to Article 16 of Circular 06/2021/TT-BTC, the documents required for cancellation of outstanding tax, late payment, and fines include:

(1). Official Dispatch cancellation of outstanding tax, late payment interest and fines:

- Official Dispatch cancellation of outstanding tax, late payment interest and fines from the Customs Department where the taxpayer owes tax, late payment, and penalty (for cases under the jurisdiction of the Director-General of General Department of Customs, Minister of Finance, Prime Minister of the Government of Vietnam) according to Form 16/TXNK Appendix 1 issued along with Circular 06/2021/TT-BTC: 01 original copy;

- Official Dispatch cancellation of outstanding tax, late payment interest and fines from the Customs Department or Customs Sub-department (at provinces where the Customs Department's headquarters are not located) where the taxpayer owes tax, late payment, and penalty (for cases under the jurisdiction of the Chairman of the Provincial People’s Committee) according to Form 16/TXNK Appendix 1 issued along with Circular 06/2021/TT-BTC: 01 original copy.

(2). Corresponding to the cases eligible for cancellation of outstanding tax, late payment interest and fines stipulated in Article 85 of the Tax Administration Law 2019, the debt cancellation dossier includes the following documents:

- Decision of the competent state agency declaring the bankruptcy of the enterprise for cases specified in Clause 1 of Article 85 of the Tax Administration Law 2019: 01 photocopy with the confirming stamp from the debt cancellation requesting agency;

- Death certificate, death notice or court decision declaring a person missing; court decision declaring loss of civil act capacity or documents from competent state agencies proving a person as deceased, missing, or lost civil act capacity for cases specified in Clause 2 of Article 85 of the Tax Administration Law 2019: 01 photocopy with the confirming stamp from the debt cancellation requesting agency;

- Notice from competent authority on the revocation of Business Registration Certificate, Business Registration Certificate, Cooperative Registration Certificate, Household Business Registration Certificate, Investment Certificate, Establishment and Operation License, Practicing License for cases specified in Clause 3 of Article 85 of the Tax Administration Law 2019: 01 photocopy with the confirming stamp from the debt cancellation requesting agency;

- Enforcement decisions or documents on enforcing the execution of an administrative decision on tax management against the taxpayer being enterprises and organizations (if any): 01 photocopy with the confirming stamp from the debt cancellation requesting agency;

- Documents from competent state agencies confirming cases affected by natural disasters, disasters, epidemics stipulated in Clause 4 of Article 85 of the Tax Administration Law 2019: 01 photocopy with the confirming stamp from the debt cancellation requesting agency.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?