What income does the PIT declaration form - Form 06/TNCN in Vietnam apply to?

What income does the PIT declaration form - Form 06/TNCN in Vietnam apply to?

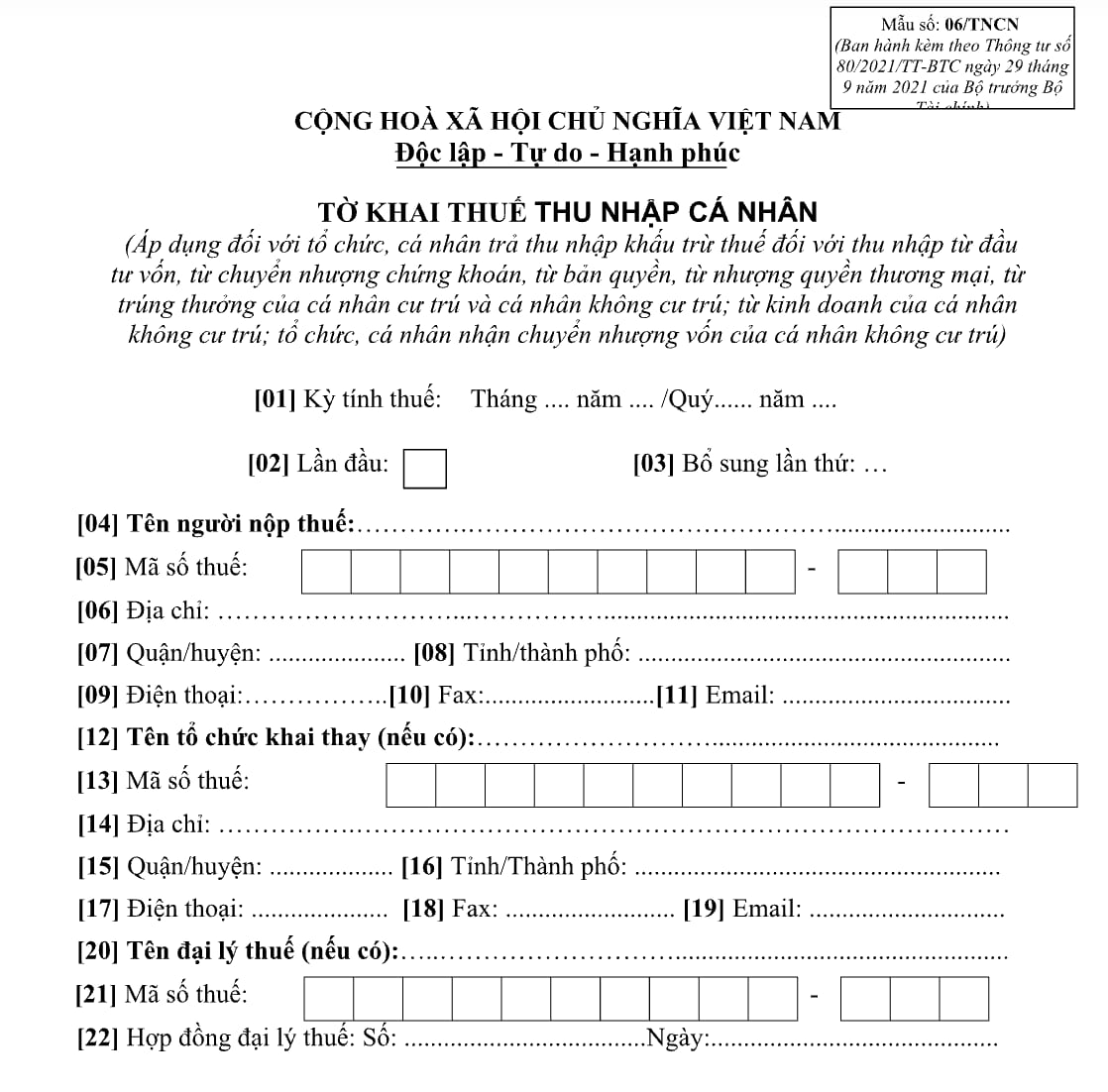

PIT declaration form - Form 06/TNCN applies to organizations and individuals that pay income and are required to withhold tax on income from capital investment, securities transfer, royalties, franchising, and winning prizes of residents and non-residents; from the business of non-residents; and organizations and individuals receiving capital transfers from non-residents. It is issued together with Appendix 2 promulgated together with Circular 80/2021/TT-BTC

Download PIT declaration form - Form 06/TNCN: Here

What income does the PIT declaration form - Form 06/TNCN in Vietnam apply to? (Image from the Internet)

What are the instructions for filling out Form 06/TNCN in Vietnam?

Instructions for preparing Form 06/TNCN are noted on Form 06/TNCN issued together with Appendix 2 promulgated together with Circular 80/2021/TT-BTC as follows:

General information section:

[01] Tax period: Clearly state the month, year, quarter, or year of the tax declaration. If declaring monthly, strike through the quarter, if declaring quarterly, strike through the month.

[02] Initial declaration: If the tax declaration is the first-time declaration, check the box with "x".

[03] Additional declaration number: If this is not the initial declaration, it is considered an additional declaration and the declaration number should be noted in the blank space. The number of supplementary declarations should be noted in natural numbers (1, 2, 3…).

[04] Name of taxpayer: Clearly and fully write the name of the tax withholding organization according to the Establishment Decision or Business Registration Certificate or taxpayer registration certificate. In the case of individuals withholding and declaring tax, clearly and fully write the first and last name according to the taxpayer registration certificate or ID/CCCD/Passport of the individual.

[05] TIN: Clearly and fully write the TIN of the tax withholding organization/individual.

[06] Address: Clearly and fully write the address of the tax withholding organization/individual.

[07] District: Clearly and fully write the name of the district of the tax withholding organization/individual.

[08] Province/municipality: Clearly and fully write the name of the Province/municipality of the tax withholding organization/individual.

[09] Phone number: Clearly and fully write the phone number of the tax withholding organization/individual.

[10] Fax: Clearly and fully write the fax number of the tax withholding organization/individual.

[11] Email: Clearly and fully write the email address of the tax withholding organization/individual.

[12] Name of the substitute declaring organization (if any): Clearly and fully write the name of the substitute declaring organization according to the Establishment Decision or Business Registration Certificate or taxpayer registration certificate.

[13] TIN: Clearly and fully write the TIN of the substitute declaring organization, substituting tax payment (if [12] is declared).

[14] Address: Clearly and fully write the address of the substitute declaring organization, substituting tax payment (if [12] is declared).

[15] District: Clearly and fully write the name of the district of the substitute declaring organization, substituting tax payment (if [12] is declared).

[16] Province/municipality: Clearly and fully write the name of the Province/municipality of the substitute declaring organization, substituting tax payment (if [12] is declared).

[17] Phone number: Clearly and fully write the phone number of the substitute declaring organization, substituting tax payment (if [12] is declared).

[18] Fax: Clearly and fully write the fax number of the substitute declaring organization, substituting tax payment (if [12] is declared).

[19] Email: Clearly and fully write the email address of the substitute declaring organization, substituting tax payment (if [12] is declared).

[20] Name of Tax Agent (if any): In case the tax withholding organization/individual authorizes a Tax Agent to declare tax, clearly and fully write the name of the Tax Agent according to the Establishment Decision or Business Registration Certificate of the Tax Agent.

[21] TIN: Clearly and fully write the TIN of the Tax Agent (if [20] is declared).

[22] Tax Agent Contract: Clearly and fully write the number and date of the Tax Agent Contract between the individual and the Tax Agent (current contract) (if [20] is declared).

* Declaration section for table criteria:

I. Income from capital investment

[23] Total number of individuals with income:

incurred: is the total number of individuals with income from capital investment paid by the tax withholding organization/individual during the tax declaration period.

Accumulated: is the total number of individuals with income from capital investment withheld cumulatively from the beginning of the year to the tax declaration period.

[24] Total taxable income:

incurred: is the total income from capital investments under the regulations that the withholding organization/individual has paid to the individual during the tax declaration period.

Accumulated: is the total income from capital investments under the regulations that the withholding organization/individual has paid to the individual cumulatively from the beginning of the year to the tax declaration period.

[25] Total amount of personal income tax withheld:

incurred: is the total amount of personal income tax that the withholding organization/individual has withheld (5%) from capital investment income of individuals during the period. Criterion [25] = [24] x 5%.

Accumulated: is the total amount of personal income tax that the withholding organization/individual has withheld (5%) from capital investment income of individuals cumulatively to the declaration period.

II. Income from securities transfer

[26] Total number of individuals with income:

incurred: is the total number of individuals with income from securities transfer paid by the tax withholding organization/individual during the tax declaration period.

Accumulated: is the total number of individuals with income from securities transfer withheld cumulatively from the beginning of the year to the tax declaration period.

[27] Total taxable income:

incurred: is the total transaction value from securities transfer during the tax declaration period.

Accumulated: is the total transaction value from securities transfer cumulatively from the beginning of the year to the tax declaration period.

[28] Total amount of personal income tax withheld:

incurred: is the tax withheld at 0.1% on the total transaction value from securities transfer that the withholding organization has withheld during the period. Criterion [28] = [27] x 0.1%.

Accumulated: is the tax withheld at 0.1% on the total transaction value from securities transfer that the withholding organization has withheld cumulatively to the declaration period.

III. Income from royalties and franchise fees

[29] Total number of individuals with income:

incurred: is the total number of individuals with income from royalties and franchise fees paid by the tax withholding organization/individual during the tax declaration period.

Accumulated: is the total number of individuals with income from royalties and franchise fees withheld cumulatively from the beginning of the year to the tax declaration period.

[30] Total taxable income:

incurred: is the total income that the withholding organization/individual has paid to individuals during the period from royalties and franchise fees exceeding 10 million VND according to the transfer contract regardless of the number of times of payment or the amount received by the individual.

Accumulated: is the total income that the withholding organization/individual has paid to individuals during the period from royalties and franchise fees exceeding 10 million VND according to the transfer contract regardless of the number of times of payment or the amount received by the individual cumulatively to the declaration period.

[31] Total amount of personal income tax withheld:

incurred: is the tax withheld at 5% on the total taxable income from royalties and franchise fees. Criterion [31] = [30] x 5%.

Accumulated: is the tax withheld at 5% on the total taxable income from royalties and franchise fees cumulatively to the declaration period.

IV. Income from winnings

[32] Total number of individuals with income:

incurred: is the total number of individuals with income from winnings paid by the tax withholding organization/individual during the tax declaration period.

Accumulated: is the total number of individuals with income from winnings withheld cumulatively from the beginning of the year to the tax declaration period.

[33] Total taxable income:

incurred: is the total income from winnings exceeding 10 million VND that the income-paying organization/individual has actually paid to individuals during the period.

Accumulated: is the total income from winnings exceeding 10 million VND that the income-paying organization/individual has actually paid to individuals cumulatively to the declaration period.

[34] Amount of personal income tax withheld:

incurred: is the tax withheld at 10% on the total taxable income from winnings that the income-paying organization/individual has paid to individuals during the period. Criterion [34] = [33] x 10%.

Accumulated: is the tax withheld at 10% on the total taxable income from winnings that the income-paying organization/individual has paid to individuals cumulatively to the declaration period.

V. Business revenue of non-resident individuals:

[35] Total number of individuals with income:

incurred: is the total number of non-resident individuals with business income during the tax declaration period.

Accumulated: is the total number of non-resident individuals with business income cumulatively from the beginning of the year to the tax declaration period.

[36] Total taxable revenue paid to individuals:

incurred: is the total amount that the organization/individual has paid to non-resident individuals for providing goods and services during the period.

Accumulated: is the total amount that the organization/individual has paid to non-resident individuals for providing goods and services cumulatively to the declaration period.

[37] Total amount of personal income tax withheld:

incurred: is the total amount of tax that the organization/individual has withheld from the revenue paid to non-resident individuals, excluding taxes exempted or reduced in the economic zone (if any).

Accumulated: is the total amount of tax that the organization/individual has withheld from the revenue paid to non-resident individuals cumulatively to the declaration period, excluding taxes exempted or reduced in the economic zone (if any).

VI. Income from capital transfers of non-resident individuals

[38] Total number of individuals with income:

incurred: is the total number of non-resident individuals with income from capital transfers during the tax declaration period.

Accumulated: is the total number of non-resident individuals with income from capital transfers cumulatively from the beginning of the year to the tax declaration period.

[39] Total capital transfer value:

incurred: is the total value of capital transfer that the organization/individual has actually received transfer from non-resident individuals during the period according to the transfer contract.

Accumulated: is the total value of capital transfers that the organization/individual has actually received transfer from non-resident individuals according to the transfer contract cumulatively to the declaration period.

[40] Total amount of tax withheld:

incurred: is the amount of tax that the organization/individual receiving the capital transfer has withheld at 0.1% on the total capital transfer value during the period. Criterion [40] = [39] x 0.1%.

Accumulated: is the amount of tax that the organization/individual receiving the capital transfer has withheld at 0.1% on the total capital transfer value cumulatively to the declaration period.

What are the responsibilities of taxpayers in Vietnam?

According to Article 17 of the Law on Tax Administration 2019, taxpayers have the following responsibilities:

- Apply for taxpayer registration and use TINs as prescribed by law.

- Declare tax accurately, honestly and adequately and submitting tax dossiers on time; take legal responsibility for the accuracy, honesty and adequacy of tax dossiers.

- Pay tax, late payment interest and/or penalties fully, on schedule and at the right location.

- Conform to regulations on accounting, statistics and management, use of invoices and records as prescribed by law.

- Truthfully and fully record the taxable activities and transactions.

- Issue and deliver invoices and records to buyers with the correct quantity, type and actual payment amount when selling goods and/or providing services as prescribed by law.

- Provide information and/or materials related to the determination of tax liabilities accurately, fully and promptly, including information on investment value; transaction IDs and contents of accounts opened at commercial banks and/or other credit institutions; explain declared tax and/or tax payment as requested by tax authorities.

- Comply with decisions, notifications and requests of tax authorities, tax officials as prescribed by law.

- Take responsibility for the fulfillment of tax liabilities as prescribed by law in case the taxpayer’s legal representative or authorized representative fails to follow tax procedures.

- Taxpayers operating businesses in areas with available information technology infrastructure must declare and pay tax and carry out transactions with tax authorities electronically as prescribed by law.

- Based on the availability of information technology equipment, the Government shall specify the documents that regulatory authorities already have and thus can be excluded from tax declarations, applications for tax refund and other tax dossiers.

- Develop, manage and operate systems of technical infrastructure so as to ensure e-transactions with tax authorities; sharing information related to the fulfillment of tax liabilities with tax authorities

- Taxpayers who have entered into related-party transactions have the responsibility to create, retain, declare and provide documents on taxpayers and their related parties, including information on related parties residing in foreign countries or territories according to the Government's regulations.

- When is the timing for determining overpaid tax for offsetting or refunding in Vietnam?

- What are VAT calculation methods in Vietnam?

- When is an e-invoice issued without the a valid seller's digital signature in Vietnam?

- Vietnam: Shall a VAT invoice include 02 foreign currencies?

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?