What are the procedures for initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam?

What are the procedures for initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam?

Under Subsection 3 Section 2 of the administrative procedures promulgated with Decision 2589/QD-BTC in 2021, the procedures for initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam include the following steps:

Step 1: Within 10 working days from the date of arising tax refund claim, the organization or individual eligible for the VAT refund shall submit the application to the Tax Department where the organization is headquartered or where the individual's permanent residential address is in Vietnam.

For electronic taxpayer registration application: The taxpayer (taxpayer) accesses the web portal of their choice (General Department of Taxation’s web portal/competent state authority’s web portal, including the National Public Service Portal, Ministry-level Public Service Portal, Provincial Public Service Portal, as per the regulation on single-window system and interlinked single-window system in administrative procedure settlement, and connected with the web portal of the General Department of Taxation/web portal of the T-VAN service provider) to complete the declaration and send required documents in electronic form (if any), sign electronically, and submit to the tax authority via the chosen web portal.

The taxpayer submits the application (taxpayer registration application simultaneously with the business registration application under the single-window system) to the competent state authority as regulated. The competent state authority sends the information of the accepted application from the taxpayer to the tax authority via the web portal of the General Department of Taxation.

Step 2: The tax authority receives:

- For physical taxpayer registration application:

+ If submitted directly at the tax authority: The tax official receives and stamps the receipt on the taxpayer registration application, specifying the receipt date, and number of documents as per the list of enclosed applications for direct submissions. The tax official issues an appointment note indicating the return date and the processing time of the received application;+ If sent via postal service: The tax official stamps the receipt, notes the receipt date on the application, and records the entry number of the tax authority;

The tax official checks the taxpayer registration application. If the application is incomplete and requires explanation or additional information, the tax authority notifies the taxpayer using Form 01/TB-BSTT-taxpayer in Appendix II attached to Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 02 (two) working days from the date of receipt of the application.

- For electronic taxpayer registration application:

The tax authority receives the application via the web portal of the General Department of Taxation, and examines, and processes the application through the tax authority’s electronic data processing system:

+ Receive application: The web portal of the General Department of Taxation sends a receipt notification to the taxpayer within 15 minutes from the time of receiving the taxpayer's electronic taxpayer registration application via the chosen web portal;

+ Review and resolve application: The tax authority reviews and resolves the taxpayer’s application according to tax registration laws and returns the result via the chosen web portal:

++ If the application is complete and complies with procedures and the result needs to be returned: The tax authority sends the resolved application result to the chosen web portal as per the regulated time in Circular No. 105/2020/TT-BTC dated December 03, 2020, from the Ministry of Finance guiding taxpayer registration;

++ If the application is incomplete or non-compliant with procedures, the tax authority sends a disapproval notification to the chosen web portal within 02 (two) working days from the date of the Receipt Notification.

What are the procedures for initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam? (Image from the Internet)

What are the methods of initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam?

Under Subsection 3 Section 2 of the administrative procedures promulgated with Decision 2589/QD-BTC in 2021, there are 03 methods of initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam:

- Submitting directly at the Tax Authority office;

- Or sending via postal system;

- Or electronically through the web portal of the General Department of Taxation/competent state authority’s web portal, including the National Public Service Portal, Ministry-level Public Service Portal, Provincial Public Service Portal as per the regulation on single-window system and interlinked single-window system in administrative procedure settlement, connected with the General Department of Taxation’s web portal/web portal of the T-VAN service provider as regulated in Circular No. 19/2021/TT-BTC dated March 18, 2021, of the Ministry of Finance guiding electronic transactions in the field of taxation.

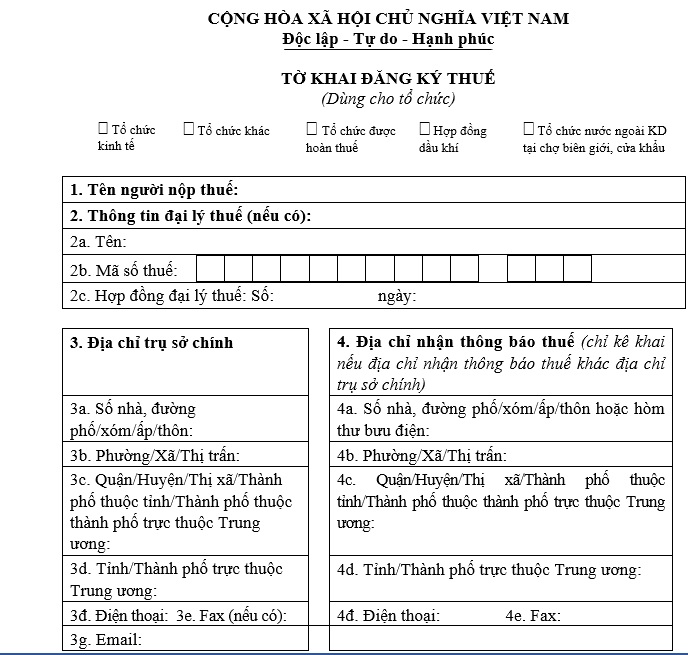

Where to download the newest application form for initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam - Form 01-DK-TCT?

The newest application form for initial taxpayer registration for owners of ODA projects eligible for VAT refund in Vietnam - Form 01-DK-TCT is issued with Circular 105/2020/TT-BTC as follows:

>> Download the newest application form for initial taxpayer registration - Form 01-DK-TCT: Download

- When is the deadline for paying tax, duty payment guarantee and tax deposit in Vietnam?

- Are natural aquatic resources exempt from severance tax in Vietnam?

- Are natural swallow's nests subject to severance tax in Vietnam?

- What are the principles for developing a List of goods to be imported free of duty in Vietnam?

- How long is the CIT period of the first year in Vietnam?

- Shall individuals be entitled to tax refund if their taxed incomes do not reach a tax-liable level in Vietnam?

- What are regulations on responsibilities of income payer regarding PIT refund when being delegated to settle tax in Vietnam?

- Is it necessary to terminate the tax identification number when a business temporarily suspends its operations in Vietnam?

- What is the value-added tax declaration form for 2024 in Vietnam?

- What are forms for declaring corporate income tax in Vietnam?