What are the 04 cases of cancellation of customs declarations in Vietnam?

What are the 04 cases of cancellation of customs declarations in Vietnam?

Under Article 22 of Circular 38/2015/TT-BTC amended by Clause 11 Article 1 of Circular 39/2018/TT-BTC, customs declarations will be canceled in the following cases:

[1] The customs declaration is not valid for completing customs procedures in the following cases:

- The imports do not arrive at the checkpoint of import within 15 days from the day on which the import declaration is registered;

- The exports are exempt from document inspection and physical inspection but have not entered the CCA at the checkpoint of export within 15 days from the day on which the export declaration is registered;

- The exports have to undergo document inspection but the declarant has not submitted the customs dossier, or customs procedures have been completed but the goods have are not taken into the CCA at the checkpoint of export within 15 days from the day on which the export declaration is registered;

- The exports have to undergo physical inspection but the declarant fails submit documents and present goods to the customs authority for inspection within 15 days from the day on which the export declaration is registered;

- The customs declaration has been registered and the goods are subject to licensing by a competent authority but such a license is not available when the declaration is registered.

[2] The customs declaration has been registered, customs clearance is not granted because of an error of the e-customs system and the physical declaration has been granted customs clearance or conditional customs clearance or the goods have been put into storage;

[3] The customs declaration has been registered but the goods fail to meet certain requirements and have to be re-exported or destroyed;

[4] Cases in which cancellation of a customs declaration is requested by the declarant:

- The export procedures have been completed and goods have been taken into the CCA but the declarant wishes to take the goods back to the domestic market for repair or recycling;

- The declaration of in-country export has been granted customs clearance or conditional customs clearance but the exporter or importers cancels the transaction;

- Cases other than the following those in which the export declaration has been granted customs clearance or conditional customs clearance but goods are not exported in reality:

+ The exports are exempt from document inspection and physical inspection but have not entered the CCA at the checkpoint of export within 15 days from the day on which the export declaration is registered;

+ The exports have to undergo document inspection but the declarant has not submitted the customs dossier, or customs procedures have been completed but the goods have are not taken into the CCA at the checkpoint of export within 15 days from the day on which the export declaration is registered;

+ The exports have to undergo physical inspection but the declarant fails submit documents and present goods to the customs authority for inspection within 15 days from the day on which the export declaration is registered;

+ The export procedures have been completed and goods have been taken into the CCA but the declarant wishes to take the goods back to the domestic market for repair or recycling;

+ The declaration of in-country export has been granted customs clearance or conditional customs clearance but the exporter or importers cancels the transaction;

- The declarant provides in correct information on the declaration, unless the import declaration has been granted customs clearance or conditional customs clearance and goods have been released from the CCA; the export declaration has been granted customs clearance or conditional customs clearance and the goods have been exported in reality.

What are the 04 cases of cancellation of customs declarations in Vietnam? (Image from the Internet)

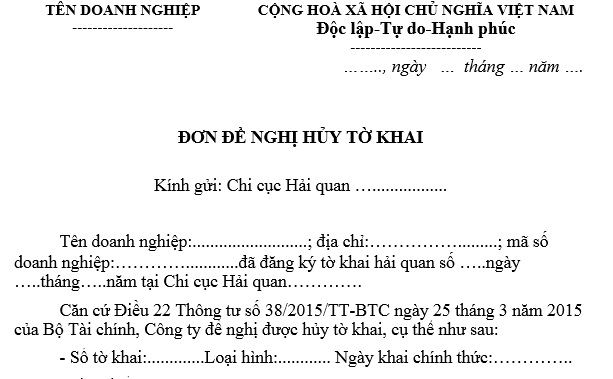

What is the newest application for cancellation of customs declaration in Vietnam?

Currently, the newest application for cancellation of customs declaration in Vietnam is Form No. 04/HTK/GSQL in Appendix 5 issued together with Circular 38/2015/TT-BTC (amended and supplemented in Appendix 2 issued together with Circular 39/2018/TT-BTC):

Form No. 04/HTK/GSQL: DOWNLOAD

Which customs authorities are tax authorities in Vietnam?

According to Article 2 of the Tax Administration Law 2019:

Regulated entities

1. Taxpayers include:

a) Organizations, households, household businesses and individuals paying taxes in compliance with provisions on taxation;

b) Organizations, households, household businesses, individuals paying other amounts to the state budget;

c) Organizations and individuals deducting tax from income.

2. Tax authorities, including:

a) General Department of Taxation, Departments of Taxation of provinces, and Sub-departments of Taxation of districts;

b) General Department of Vietnam Customs, Departments of Customs, Post Clearance Audit Departments, Sub-department of Customs.

3. Tax officials and customs officials (hereinafter referred to as “tax officials”).

4. Other relevant state agencies, organizations and individuals

Thus, customs authorities being tax authorities include the General Department of Vietnam Customs, Departments of Customs, Post Clearance Audit Departments, and Sub-department of Customs.

- How to determine the effective tax rate and top-up tax percentage in Vietnam?

- Will there be penalties imposed for supplementing a tax return before a tax audit in Vietnam?

- When shall a fine which is 2 times as much as the amount of evaded tax be imposed for the act of tax evasion in Vietnam?

- What are cases of distribution of corporate income tax in Vietnam?

- Is a person who assists in tax evasion subject to publishing of information about taxpayers in Vietnam?

- What are conditions for not imposing anti-dumping duties on products whose dumping margin are not more than 2 % of export price in Vietnam?

- From December 16, 2024, what will be the preferential import tax duty for e-cigarettes in Vietnam?

- What is the guidance for looking up online land tax on the e-portal of the General Department of Taxation of Vietnam?

- Is the credit-invoice method applied by the taxpayer that earns at least 1 billion VND in annual revenue in Vietnam?

- Shall enterprises be entitled for VAT deferral in Vietnam for October 2024 according to Decree 64?