What are codes of invoices and receipts issued by the Tax Departments of provinces and Tax Departments of major businesses in Vietnam?

What are codes of invoices and receipts issued by the Tax Departments of provinces and Tax Departments of major businesses in Vietnam?

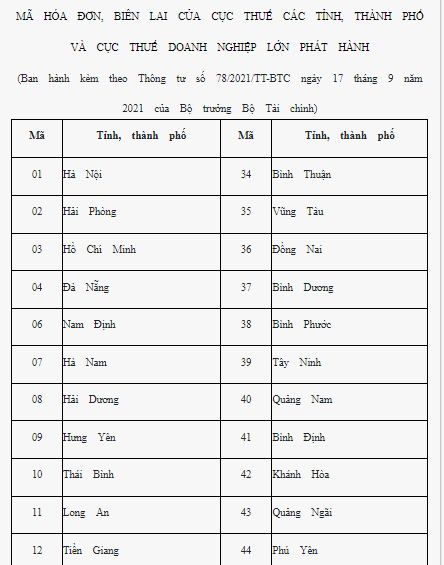

Based on Appendix 1A codes of invoices and receipts of the Tax Departments of provinces and Tax Departments of major businesses Issued, promulgated together with Circular 78/2021/TT-BTC, the codes of invoices and receipts of the Tax Departments of provinces and Tax Departments of major businesses issued are as follows:

Download Summary of codes of invoices and receipts of Tax Departments of provinces, and Tax Departments of major businesses Issued.

What are codes of invoices and receipts issued by the Tax Departments of provinces and Tax Departments of major businesses in Vietnam? (Image from the Internet)

What are the 2 components of e-invoice format in Vietnam?

The e-invoice format is stipulated in Article 12 of Decree 123/2020/ND-CP as follows:

e-invoice Format

1. The e-invoice format is a technical standard specifying data types, data length of information fields for the purpose of transmission, storage, and display of e-invoices. The e-invoice format uses XML (eXtensible Markup Language), which is designed to share e-data across IT systems.

2. The e-invoice format consists of two components: a component containing business transaction data of e-invoices and a component containing digital signature data. For e-invoices with tax authority codes, there is an additional component containing data related to the tax authority code.

3. The General Department of Taxation develops and publishes the components containing business transaction data of e-invoices, and components containing digital signature data, and provides tools to display the e-invoice content as stipulated in this Decree.

4. Organizations and businesses selling goods or providing services, when transmitting e-invoice data to the tax authority by direct transmission, must meet the following requirements:

a) Connect with the General Department of Taxation through a dedicated private channel or MPLS VPN Layer 3 channel, including one primary transmission line and one backup line. Each transmission line must have a minimum bandwidth of 5 Mbps.

b) Utilize Web Services or Message Queue (MQ) with encryption for the connection method.

c) Use SOAP protocol for data packaging and transmission.

5. e-invoices must be displayed fully and accurately to avoid misunderstandings so that buyers can read them with e-means.

Therefore, according to the above regulation, the 2 components of e-invoice format are the component containing business transaction data of e-invoices and the component containing digital signature data. For e-invoices with tax authority codes, there is an additional component containing data related to the tax authority code.

What are the prohibited acts related to invoices in Vietnam?

Based on Article 5 of Decree 123/2020/ND-CP, the prohibited acts in the field of invoices include:

- For tax officials:

+ Causing troubles or difficulties for organizations or individuals purchasing invoices or records;

+ Engaging in acts of cover-up or collusion with organizations or individuals to use illegal invoices or records;

+ Accepting bribes during invoice inspections or audits.

- For organizations or individuals selling, providing goods or services, organizations, or individuals with rights and obligations related to invoices:

+ Engaging in fraudulent acts such as using illegal invoices or using invoices illegally;

+ Obstructing tax officials in the performance of their duties, specifically acts causing harm to the health or dignity of tax officials during invoice inspections or audits;

+ Unauthorized access, alteration, or destruction of invoice information systems;

+ Offering bribes or engaging in other acts related to invoices or records for illicit gains.

What are regulations on the use of illegal invoices and records in Vietnam?

Based on Clause 2, Article 4 of Decree 125/2020/ND-CP, the acts of using illegal invoices and records include:

- Fake invoices or records;

- Invoices or records not yet valid for use or expired;

- Invoices suspended during enforcement measures by stopping using invoices, except when permitted by tax authority notice;

- e-invoices not registered for use with the tax authority;

- e-invoices without a tax authority code in cases where e-invoices with tax authority codes are required;

- Invoices for goods or services showing a date of issue after the date on which the tax authority determined that the seller is not operating at the registered business address with the competent state authority;

- Invoices or records for goods or services showing a date of issue before the determination date that the invoice or record issuer is not operating at the registered business address or before notification by the tax authority that the issuer is not operating at the registered business address but it is concluded by the tax authority or the police or other competent agencies that these are illegal invoices or records.

Additionally, the following cases are acts of using invoices and records illegally:

- Invoices or records not fully indicating all obligatory information as required; tampered or modified invoices without conformity;

- Fictitious invoices or records (invoices or records with completed economic transaction criteria and information but the transaction for goods or services is partially or entirely non-existent); invoices reflecting incorrect actual transaction values or fake invoices issued;

- Discrepancies or errors in required information fields between the different copies of an invoice;

- Invoices reused for circulating goods or using one service's invoice to justify another service's goods;

- Invoices or records of another organization or individual (excluding invoices of tax authorities and cases of authorized invoice issuance) to legitimize purchased or sold goods or services;

- Invoices or records deemed to be illegally utilized by tax authorities, the police, or other competent agencies.

- Shall the TIN of dependant be changed to a personal TIN in Vietnam?

- Shall an employee with a contract of less than 6 months be subject to enforcement by deduction of money from the taxpayer’ salary or income in Vietnam?

- How long is the tax enforcement decision effective in Vietnam?

- What is the deadline for submitting taxes of the fourth quarter in Vietnam? What types of taxes are declared quarterly in Vietnam?

- Do Lunar New Year gifts valued at 2 million for employees subject to personal income tax in Vietnam?

- What are cases where non-refundable ODA project owners are entitled to refund of VAT in Vietnam?

- What is the form for notification of payment of land and housing registration fee by tax authority in Vietnam according to Decree 126?

- What are 03 conditions for VAT deduction in Vietnam from July 1, 2025?

- Is the e-tax transaction code generated uniformly in Vietnam?

- What crime will be imposed for tax evasion with an amount of from VND 100,000,000 in Vietnam?