Vietnam: What is the PIT finalization declaration form - Form 05/QTT-TNCN about?

What is the PIT finalization declaration form - Form 05/QTT-TNCN in Vietnam about?

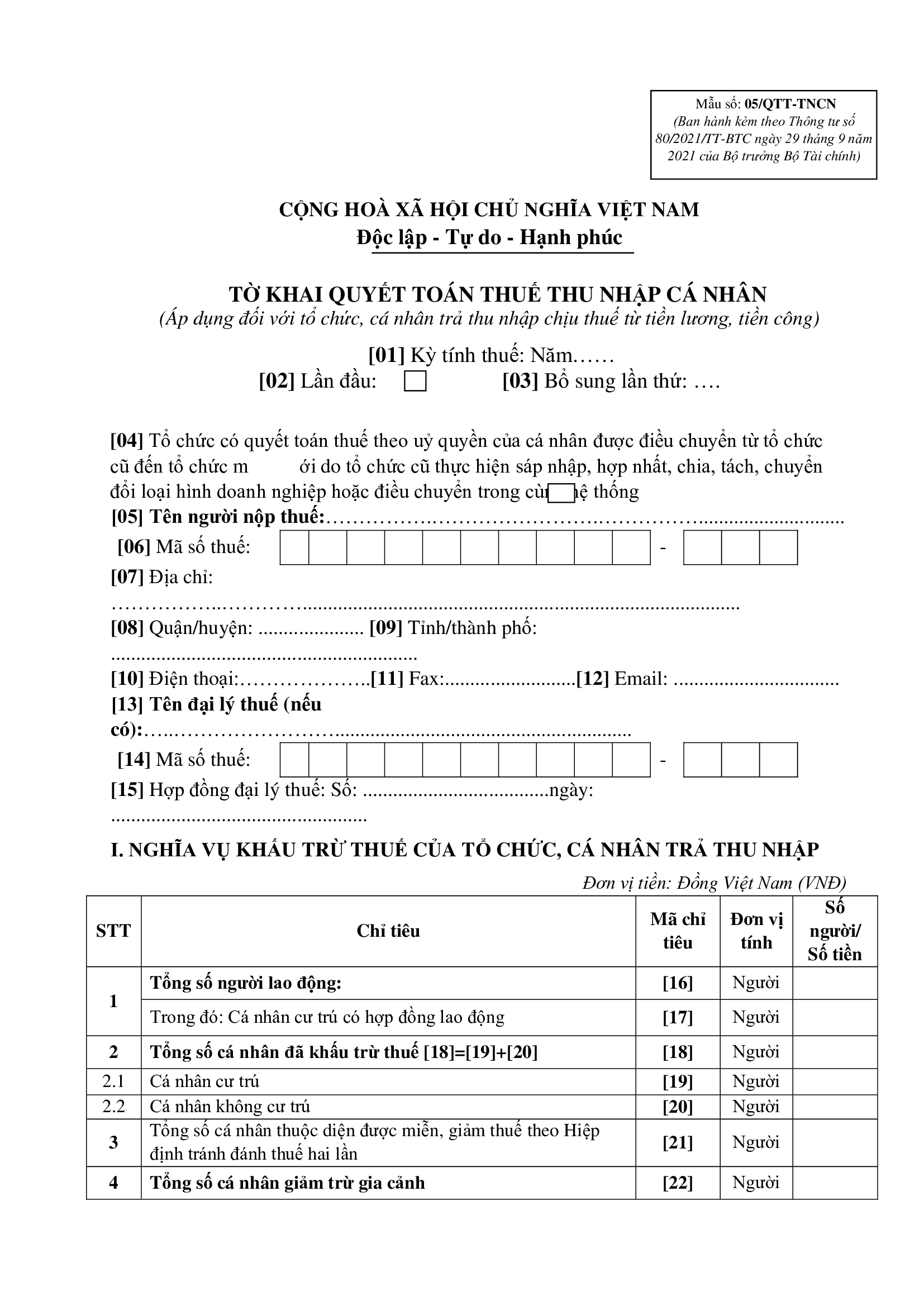

The PIT finalization declaration form applicable to organizations and individuals paying taxable income from salaries and remunerations is stipulated in Form No. 05/QTT-TNCN issued together with Circular 80/2021/TT-BTC as follows:

Download the PIT finalization declaration form - Form 05/QTT-TNCN: here

What is the PIT finalization declaration form - Form 05/QTT-TNCN in Vietnam about? (Image from the Internet)

What are the appendixes showing statements accompanying Form 05/QTT-TNCN?

According to the instruction of the General Department of Taxation in Vietnam, when preparing form 05/QTT-TNCN issued together with Circular 80/2021/TT-BTC, the appendices issued together with 05/QTT-TNCN include:

- Appendix showing statements on individuals subject to tax calculation according to the progressive tax rate schedule.

- Appendix showing statements on individuals subject to tax calculation according to the full tax rate.

- Appendix showing statements on dependents eligible for personal deduction.

What is the deadline for PIT finalization for 2024 in Vietnam?

Based on point a and point b, clause 2, Article 44 of the Law on Tax Administration 2019 as follows:

2. For taxes declared annually:

a) For annual tax statement dossiers: the last day of the 3rd month from the end of the calendar year or fiscal year. For annual tax declaration dossiers: the last day of the first month from the end of the calendar year or fiscal year

b) For annual personal income tax statements prepared by income earners: the last day of the 4th month from the end of the calendar year;

c) For presumptive tax declarations prepared by household businesses and individual businesses: the 15th of December of the preceding year. For new household businesses and individual businesses: within 10 days from the date of commencement of the business.

The PIT finalization deadline in 2024 is determined as follows:

- For income payers: no later than March 31, 2024.

- For individuals directly finalizing taxes: April 30, 2024.

Note: If the last day of the filing deadline coincides with a prescribed holiday, the due date is considered the next working day following the holiday.

What are the cases in which PIT finalization for employees in Vietnam is not required?

Under the instructions of the General Department of Taxation in Section 2 of Official Dispatch 883/TCT-DNNCN in 2022, the regulations are as follows:

II. ENTITIES NOT REQUIRED TO FINALIZE TAX

1. For individuals

Individuals earning income from salaries and remunerations in the following cases are not required to finalize personal income tax:

- Individuals having an additional personal income tax payable after finalization of each year of 50,000 VND or less. Individuals exempt from tax in this case determine the exempted tax amount themselves, are not required to submit a PIT finalization dossier, and are not required to submit a tax exemption dossier. In the case of tax finalization periods from 2019 and earlier that have been finalized before the effective date of Decree 126/2020/ND-CP, retrospection does not apply;

- Individuals with personal income tax payable smaller than the pre-paid tax amounts and do not request a tax refund or offsetting against the following tax declaration period;

- Individuals earning income from salaries and remunerations under a labor contract of 3 months or more at one unit, concurrently with casual income at other places with an average monthly income not exceeding 10 million VND and has been subjected to personal income tax withholding at a rate of 10%, if no request, then they are not required to finalize tax for this part of the income;

- Individuals for whom the employer purchases life insurance (excluding voluntary pension insurance) or non-compulsory insurance with an accumulated insurance premium where the employer or insurer has withheld personal income tax at a rate of 10% on the insurance premium amount corresponding to the part purchased or contributed by the employer, then the individual is not required to finalize personal income tax for this income.

…

Thus, employees are not required to finalize personal income tax on income from salaries and remunerations in the following four cases:

- After yearly finalization if the employee has an additional personal income tax amount payable of 50,000 VND or less. In this case, individuals exempt from tax self-determine the exempted tax amount, are not required to submit a PIT finalization dossier, and are not required to submit a tax exemption dossier.

- The individual's personal income tax payable is smaller than the pre-paid tax amount, and there is no request for a tax refund or offsetting against the next tax declaration period.

- Income from salaries and remunerations under a labor contract of 3 months or longer and casual income of the employee averaging less than 10 million VND per month and subject to personal income tax withholding at a rate of 10%.

- The employer purchases life insurance or non-compulsory insurance with accumulated insurance premiums, and the personal income tax on the premium amount has been withheld at a rate of 10% corresponding to the part purchased or contributed by the employer.

- When is the deadline for paying tax, duty payment guarantee and tax deposit in Vietnam?

- Are natural aquatic resources exempt from severance tax in Vietnam?

- Are natural swallow's nests subject to severance tax in Vietnam?

- What are the principles for developing a List of goods to be imported free of duty in Vietnam?

- How long is the CIT period of the first year in Vietnam?

- Shall individuals be entitled to tax refund if their taxed incomes do not reach a tax-liable level in Vietnam?

- What are regulations on responsibilities of income payer regarding PIT refund when being delegated to settle tax in Vietnam?

- Is it necessary to terminate the tax identification number when a business temporarily suspends its operations in Vietnam?

- What is the value-added tax declaration form for 2024 in Vietnam?

- What are forms for declaring corporate income tax in Vietnam?