Vietnam: Does the certificate of tax withholding include the taxpayer's nationality?

Vietnam: Does the certificate of tax withholding include the taxpayer's nationality?

Based on the provisions of Article 32 of Decree 123/2020/ND-CP as follows:

Contents of documents

1. certificate of tax withholding include the following contents:

a) Name of the tax deduction document, symbol of the tax deduction document template, code of the tax deduction document, serial number of the tax deduction document;

b) Name, address, tax identification number of the payer;

c) Name, address, tax identification number of the taxpayer (if the taxpayer has a tax identification number);

d) Nationality (if the taxpayer is not a Vietnamese national);

d) Income amount, time of income payment, total taxable income, deducted tax amount; net income;

e) Date of issuance of the tax deduction document;

g) Full name, signature of the income payer.

In the case of using e-certificate of tax withholding, the signature on the e-document is a digital signature.

2. Receipt

a) Type of receipt: Tax collection receipt, fee and charge receipt not with pre-printed face value; tax collection receipt, fee and charge receipt with pre-printed face value; tax collection receipt, fee and charge receipt.

b) Symbol of receipt template and receipt code.

Receipt template symbol represents the type of receipt name, serial number of the receipt link, and the order number of the template in a receipt type (a receipt type may have multiple templates).

The receipt code is a distinguishing mark of the receipt using the Vietnamese alphabetical system and the last two digits of the year.

For printed receipts, the last two digits of the year are the year of receipt printing. For self-printed and e-receipts, the last two digits of the year are the year when the receipt begins to be used, as indicated on the release announcement or when the receipt is printed.

c) Receipt number is the serial number shown on the tax, fee, and charge collection receipt. The receipt number is recorded in Arabic numerals with a maximum of 7 digits. For self-printed and pre-printed receipts, the receipt number starts from 0000001. For e-receipts, the e-receipt number starts from 1 on January 1 or the start date of e-receipt usage and ends on December 31 each year.

d) Links of the receipt (applies to pre-printed and self-printed receipts) are the number of sheets in the same receipt number. Each receipt number must have at least 2 links or 2 parts or more, where:

- Link (part) 1: retained at the tax-collecting organization;

- Link (part) 2: delivered to the taxpayer, fee, charge payer;

Additional links from the third onward are named according to specific use for management purposes in accordance with the law.

e) Name, tax identification number of the tax, fee, charge collecting organization.

f) Name of tax items, fee, charge, and the amount recorded in numbers and words.

g) Date of issuance of the receipt.

h) Signature of the person collecting the payment. In the case of using e-receipts, the signature on the e-receipt is a digital signature.

i) Name, tax identification number of the receipt printing organization (for contracts printed on demand).

k) The receipt is shown in Vietnamese. If it requires a foreign language, the additional foreign language part is placed to the right in parentheses "( )" or immediately below the Vietnamese content line with a smaller font size than the Vietnamese text.

Numerals on the receipt are 0, 1, 2, 3, 4, 5, 6, 7, 8, 9.

The currency recorded on the receipt is in Vietnamese dong. In the case of other items to be collected are regulated by the law to be in foreign currency, it can be collected either in foreign currency or in Vietnamese dong based on the conversion rate from foreign currency to Vietnamese dong as prescribed in clause 4, Article 3 of Decree No. 120/2016/ND-CP dated August 23, 2016, by the Government of Vietnam detailing and guiding the implementation of some articles of the Law on Fees and Charges.

In case of fee and charge collection, if the list of fees and charges exceeds the line of one receipt, a statement may be attached to the receipt. The statement is designed by the fee, charge collecting organization suitable to the nature of each fee, charge. The statement must clearly state "attached to receipt number... on... month... year".

For fee, charge collecting organizations using e-receipts, in case of needing to adjust certain content criteria on e-receipts to fit reality, the organization should have written communication with the Ministry of Finance (General Department of Taxation) for consideration and guidance before implementation.

In addition to the mandatory information as prescribed in this clause, fee, charge collecting organizations may add other information, including creating logos, decorative images, or advertisements in accordance with the law and not obscuring or blurring the mandatory content on the receipt. The font size of the added information must not be larger than the font size of the mandatory content on the receipt.

...

Thus, according to the above regulation, one of the contents of the tax deduction document must include the nationality of the taxpayer. However, this is only recorded if the taxpayer is not a Vietnamese national.

Vietnam: Does the certificate of tax withholding include the taxpayer's nationality? (Image from Internet)

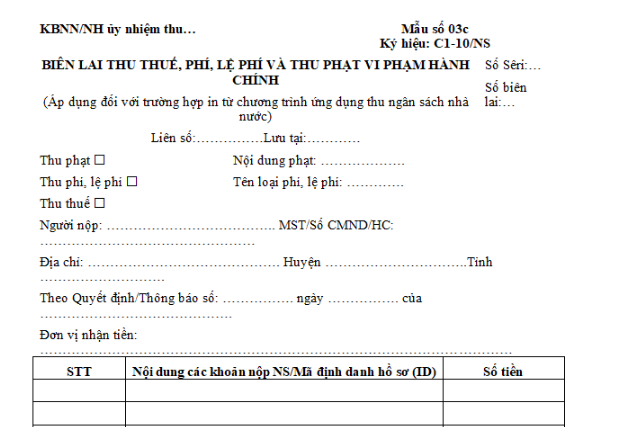

What is the format for e-documents for tax receipts when printed from a state budget collection application program in Vietnam?

Based on the provisions of clause 3, Article 32 of Decree 123/2020/ND-CP as follows:

Contents of documents

...

3. Display format of e-documents as guided in clause 10, Article 4 of Decree No. 11/2020/ND-CP dated January 20, 2020, of the Government of Vietnam stipulating on administrative procedures in the field of State Treasury and guiding documents for implementation.

Referring to clause 10, Article 4 of Decree 11/2020/ND-CP, the display format of e-documents is the tax receipt applied for in the case of printing from a state budget collection application program, as model 03c in Appendix I issued with Decree 11/2020/ND-CP.

Download the full version of the model displaying e-documents as a tax receipt applied for printing from a state budget collection application program.

What are the regulations on the format of e-documents for certificate of tax withholding in Vietnam?

e-certificate of tax withholding are also a type of e-document, hence the format will be based on Article 33 of Decree 123/2020/ND-CP as prescribed:

- Format of e-receipts:

Receipts specified at point b, clause 1, Article 30 of Decree 123/2020/ND-CP must comply with the following format:

+ e-receipt format using XML document markup language (XML stands for "eXtensible Markup Language" created for the purpose of sharing e-data between information technology systems);

+ e-receipt format includes two components: the component containing business data of the e-receipt and the component containing digital signature data;

+ The General Department of Taxation develops and announces the components containing business data of e-receipts, components containing digital signature data, and provides tools to display the contents of e-receipts as prescribed in this Decree.

- Format of e-documents for personal income tax deduction:

Personal income tax deduction organizations using e-documents as prescribed in point a, clause 1, Article 30 of Decree 123/2020/ND-CP must self-develop software systems for using e-documents ensuring mandatory contents as stipulated at clause 1, Article 32 of Decree 123/2020/ND-CP.

- e-documents, e-receipts must be fully and accurately displayed with the contents of the document, ensuring no misunderstanding so that users can read them through e-means.

- Download the file to look up which goods are not eligible for VAT reduction in Vietnam under Decree 72

- How to download the latest 2024 HTKK software (version 5.2.4) from the General Department of Taxation of Vietnam?

- Is there a Draft outline for the Law on Personal Income Tax replacing the Law on Personal Income Tax 2007 in Vietnam?

- What is the reference number of the tax receipt in Vietnam? What is the use of a reference number of the tax receipt when the tax receipt is burned?

- What is a form number of the receipt in Vietnam? Does the report on the use of receipts include the contents of the form number of the receipt?

- What is the environmental protection fee for natural gas obtained in the process of extraction of crude oil in Vietnam?

- What are cases of cancellation of outstanding tax in Vietnam?

- When are household businesses eligible for cancellation of outstanding tax in Vietnam?

- Is cell phone allowance subject to personal income tax in Vietnam?

- What is the VAT declaration form for computer-generated lottery business in Vietnam?