Viertnam: What is the authorization letter form for PIT finalization - Form 08/UQ-QTT-TNCN about?

What are the cases of authorization for PIT finalization in Vietnam?

Under the provisions at point d, clause 6, Article 8 of Decree 126/2020/ND-CP, resident individuals with income from salaries and remunerations can authorize the income payer to finalize the personal income tax if they fall into the following cases:

- An individual who has income from salaries and remunerations under an employment contract of 03 months or more at a single place and is practically working there at the time the income payer finalizes the tax, even if they have not worked for the full 12 months in the calendar year.

In the case where an individual is an employee transferred from an old organization to a new one due to the old organization undergoing a merger, consolidation, division, separation, conversion of the type of business, or both the old and new organizations being within the same system, the individual is authorized to finalize the tax with the new organization.

- An individual who has income from salaries and remunerations under employment contract of 03 months or more at a single place and is practically working there at the time the income payer finalizes the tax, even if they have not worked for the full 12 months in the calendar year; simultaneously, having incidental income at other places with an average monthly income in the year not exceeding 10 million VND and has been subject to a 10% PIT withholding if there is no request for tax finalization for this part of the income.

- An individual who is a foreigner concluding their work contract in Vietnam declares their tax finalization with the tax authority before departure.

In case the individual has not completed the tax finalization procedure with the tax authority, they shall authorize the income payer or another organization or individual to finalize the tax according to the personal tax finalization regulations.

If the income payer or another organization or individual receives the authorization for tax finalization, it will be responsible for any additional PIT payable or the refund of surplus tax paid by the individual.

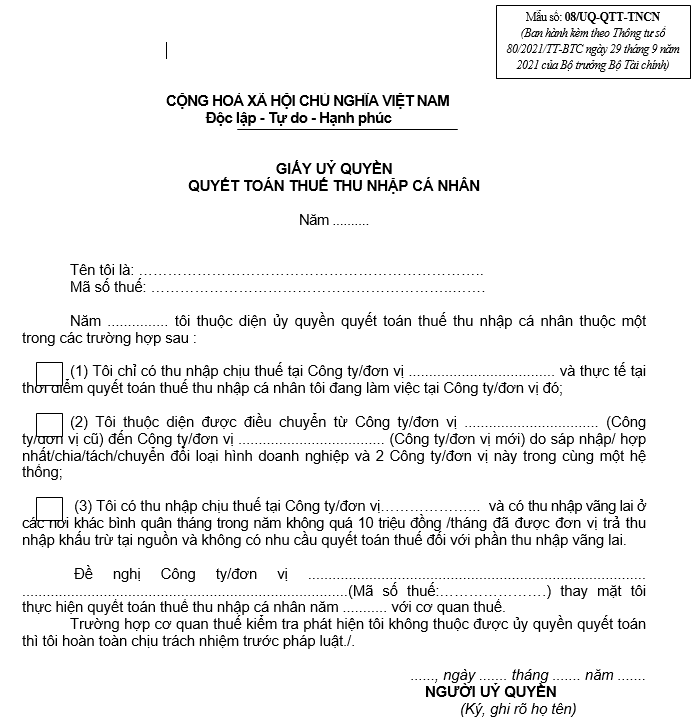

What is the authorization letter form of PIT finalization - Form 08/UQ-QTT-TNCN in Vietnam about? (Image from the Internet)

What is the authorization letter form for PIT finalization in Vietnam about?

The authorization letter form for PIT finalization in Vietnam follows the form 08/UQ-QTT-TNCN issued along with Circular 80/2021/TT-BTC as follows:

Download: authorization letter form for PIT finalization in Vietnam: Here

Instructions for filling out the authorization letter form for PIT finalization in Vietnam:

+ Year: Enter the year for authorizing PIT finalization;

+ My name is: Enter your full name;

+ Tax code: Enter your tax code;

+ Year… I am subject to..: Enter the year for authorizing PIT finalization.

+ Checkbox: Select one of the three corresponding cases as follows:

If you only have income from one company or unit, select the first box;

If you are in the case of being transferred from an old company/unit to a new one due to merger/consolidation/division/separation/conversion of the type of business, and both companies/units are within the same system, select the second box;

If you have income from the authorizing income payer and incidental income from other places with an average monthly income in the year not exceeding 10 million VND/month, which has been withheld at source by the paying unit, and you have no need to finalize the tax for the incidental income, then select the third box.

+ Request company/unit: Enter the name of the company/unit (where you are authorizing the tax finalization).

+ (Tax code:.....): Enter the tax code of the company/unit name (where you are authorizing the tax finalization).

+ I finalize personal income tax for the year ........... with the tax authority: Enter the year you need to authorize for PIT finalization.

+ Date/month/year: Enter the date/month/year of making the authorization letter form for PIT finalization in Vietnam.

What are the procedures for authorization for personal income tax finalization in Vietnam?

To authorize the finalization of personal income tax, taxpayers need to follow 02 steps as follows:

- Step 1: Prepare a tax finalization authorization letter form.

To authorize income payers to finalize on their behalf, taxpayers must download and fill in all information according to the PIT finalization authorization letter form (form No. 08/UQ-QTT-TNCN issued together with Circular 80/2021/TT-BTC).

- Step 2: Send the authorization letter with full information to the income payer.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?