Shall the TIN of enterprises be deactivated due to dissolution in Vietnam? Can a deactivated TIN be reused in Vietnam?

Shall the TIN of enterprises be deactivated due to dissolution in Vietnam?

Cases of businesses having their TINs deactivated are stipulated in Clause 1 and Clause 2, Article 39 of the 2019 Law on Tax Administration as follows:

- Enterprises with taxpayer registration along with business registration, cooperative registration, or business registration shall deactivate the validity of the TIN in the following cases:

+ Cessation of business activities or dissolution, bankruptcy.

+ Being revoked of the business registration certificate, cooperative registration certificate, or business registration certificate.

+ Division, merger, or consolidation.

- Enterprises with taxpayer registration directly with the tax authority shall deactivate the validity of the TIN in the following cases:

+ Cessation of business activities, no longer incurring tax obligations for non-business organizations.

+ Being revoked of the business registration certificate or an equivalent license.

+ Division, merger, or consolidation.

+ Being notified by the tax authority that the taxpayer does not operate at the registered address.

+ Foreign contractors upon contract completion.

+ Contractors, investors participating in oil and gas contracts upon contract completion or transferring all rights to participate in the oil and gas contract.

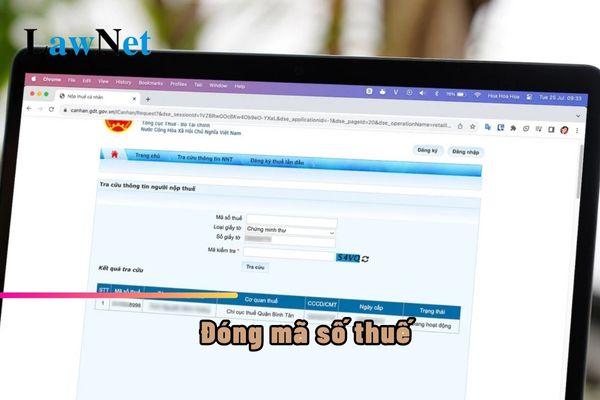

Thus, it can be seen that in the case of a enterprise dissolution, the TIN will be deactivated.

Shall the TIN of enterprises be deactivated due to dissolution in Vietnam? Can a deactivated TIN be reused in Vietnam? (Image from the Internet)

Can a deactivated TIN be reused in Vietnam?

Pursuant to the provisions in Clause 3, Article 39 of the 2019 Law on Tax Administration as follows:

deactivation of the Validity of the TIN

...

3. The principles of deactivating the validity of the TIN are prescribed as follows:

a) The TIN shall not be used in economic transactions from the date the tax authority notifies the deactivation of its validity;

b) The TIN of an organization, once its validity has been deactivated, shall not be reused, except as prescribed in Article 40 of this Law;

c) The TIN of a business household or business individual when its validity has been deactivated, the TIN of the business household's representative shall not be deactivated and shall be used to perform other tax obligations of that individual;

d) When an enterprise, economic organization, or other organization and individual deactivates the validity of their TIN, they must also deactivate the validity of TINs on behalf of others;

dd) When a taxpayer is a managing unit deactivating the validity of its TIN, the dependent units must also have their TINs deactivated.

The dissolution of a enterprise with a deactivated TIN will not be used in economic transactions from the date the tax authority announces the deactivation of its validity.

What are obligations to be fulfilled by the taxpayer prior to TIN deactivation in Vietnam?

According to the provisions in Clause 1, Article 15 of Circular 105/2020/TT-BTC:

Obligations to be fulfilled by the taxpayer prior to TIN deactivation

1. For taxpayers according to Points a, b, c, d, đ, e, g, h, m, n, Clause 2, Article 4 of this Circular:

- Taxpayers must submit the report on the use of invoices as prescribed by the law on invoices;

- Taxpayers must complete the obligation of filing tax returns, paying taxes, and handling overpaid taxes, and unclaimed value-added tax (if any) according to Articles 43, 44, 47, 60, 67, 68, 70, 71 of the Tax Administration Law with the tax management agency;

- In the case of managing units having dependent units, all dependent units must complete the procedures to deactivate the validity of the TIN before the managing unit deactivates the validity of its TIN.

2. For business households, business individuals according to Point i, Clause 2, Article 4 of this Circular:

- Taxpayers must submit reports on the use of invoices in accordance with the law on invoices if they use invoices;

- Taxpayers must fulfill the obligation of paying taxes and handling overpaid taxes according to Articles 60, 67, 69, 70, 71 of the Tax Administration Law with the tax management agency for business households, business individuals paying tax under presumptive tax method.

- Taxpayers must complete the obligations of filing tax returns, paying taxes, and handling overpaid taxes, unclaimed value-added tax (if any) according to Articles 43, 44, 47, 60, 67, 68, 70, 71 of the Tax Administration Law with the tax management agency for business households, business individuals paying tax under the deduction method.

3. For business households upgrading to small and medium enterprises according to the Law on Support for Small and Medium Enterprises, business households must fulfill tax obligations with the directly managing tax authority or send a document to the tax authority committing that the small and medium enterprise converting from a business household shall inherit all tax obligations of the business household as prescribed by the law on support for small and medium enterprises.

4. For individuals according to Points k, l, Clause 2, Article 4 of this Circular:

Taxpayers must fulfill the obligation of paying taxes and handling overpaid taxes according to Articles 60, 67, 69, 70, 71 of the Tax Administration Law with the tax management agency.

Thus, taxpayers must fulfill obligations before deactivating the validity of the TIN:

[1] Taxpayers must submit the report on the use of invoices in accordance with the law on invoices;

[2] Taxpayers must complete the obligation of filing tax returns, paying taxes, and handling overpaid taxes, unclaimed value-added tax if any;

[3] In the case of managing units having dependent units, all dependent units must complete the procedures to deactivate the validity of the TIN before the managing unit deactivates the validity of its TIN.

- Is the e-tax transaction code generated uniformly in Vietnam?

- What crime will be imposed for tax evasion with an amount of from VND 100,000,000 in Vietnam?

- What is the latest form for Country-by-Country reports of profits in Vietnam in 2024?

- Which is the current form for the annual application of APA in Vietnam? What are the principles of tax declaration with APA in Vietnam?

- When are the financial statements of public sector entities prepared in Vietnam?

- When is the deadline for paying the licensing fee after the 6-month fee exemption period ends in Vietnam?

- What are 4 compulsory accounting vouchers at public sector entities in Vietnam?

- What is the illegal use of invoices in Vietnam? How much is the penalty for illegal invoice use in Vietnam?

- What is the form for the authorization letter to purchase tax authority-ordered printed invoices in Vietnam?

- What are latest guiding documents on the Law on Personal Income Tax of Vietnam?