Shall the 2025 Tet holiday of Vietnam start on January 25, 2025? Shall VAT declaration be submitted on the 6th day of Tet?

Shall the 2025 Tet holiday of Vietnam start on January 25, 2025?

Based on Official Dispatch No. 8726/VPCP-KGVX dated November 26, 2024, from the Office of the Government of Vietnam, the 2025 Tet holiday schedule is as follows:

Official Lunar New Year Holiday Period:

Civil servants, public employees, and workers will have a 5-day holiday for the Lunar New Year, from Monday, January 27, 2025, to the end of Friday, January 31, 2025.

According to the lunar calendar, this period corresponds to the 28th day of the Twelfth Lunar Month, Year of the Wood Dragon, to the 3rd day of the First Lunar Month, Year of the Snake.

Additional Days Off and Weekends:

Since the 5 official holiday days for the Lunar New Year fall on weekdays, workers will have an additional 2 weekends before the official holiday period (January 25 and 26, 2025, which are Saturday and Sunday) and 2 weekends immediately after the official holiday period (February 1 and 2, 2025, which are Saturday and Sunday).

Total Lunar New Year Holiday Schedule:

By adding the weekends, the Lunar New Year holiday 2025 extends from Saturday, January 25, 2025, to the end of Sunday, February 2, 2025.

In total, workers will have 9 consecutive days off (from the 26th day of the Twelfth Lunar Month, Year of the Wood Dragon, to the 5th day of the First Lunar Month, Year of the Snake according to the lunar calendar).

The First Day of Lunar New Year:

In 2025, the first day of the Lunar New Year falls on Wednesday, January 29, 2025, according to the solar calendar.

Thus, when considering the detailed holiday schedule, officially starting the 2025 Tet holiday on January 25, 2025 (equivalent to the 26th day of the Twelfth Lunar Month) is completely accurate.

Official Dispatch No. 8726/VPCP-KGVX dated November 26, 2024... Download

Shall the 2025 Tet holiday of Vietnam start on January 25, 2025? Shall VAT declaration be submitted on the 6th day of Tet? (Image from the Internet)

Shall VAT declaration be submitted on the 6th day of Tet holiday of Vietnam?

Pursuant to Clause 1, Article 1 of Decree 91/2022/ND-CP amending Decree 126/2020/ND-CP, it is stipulated as follows:

Additional Article 6a as follows:

“Article 6a. Conclusion of Term

The deadline for submitting tax declaration dossiers, tax payment deadlines, deadlines for tax administration authorities to process dossiers, and the validity period of decisions to enforce administrative decisions on tax administration shall comply with the provisions of the Law on Tax Administration and this Decree. In cases where the last day of the deadline coincides with a public holiday, the last day of the deadline shall be the next working day immediately following the holiday.

...

The 6th day of Lunar New Year 2025 is Monday, February 3, 2025, and does not coincide with the regulated holiday schedule. Therefore, submitting the VAT declaration on the 6th day of Lunar New Year 2025 is still permissible.

What is the form for the VAT declaration in Vietnam?

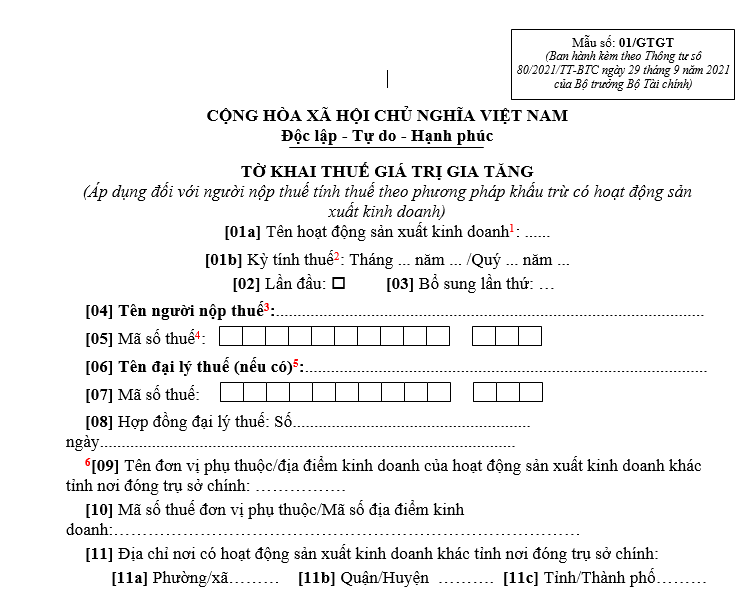

According to the regulations in Appendix 2 attached to Circular 80/2021/TT-BTC, the VAT declaration form is specified as follows:

Thus, the form for the value-added tax declaration is form 01/GTGT issued with Circular 80/2021/TT-BTC

VAT declaration form ....Download

Note: VAT declaration form number 01/GTGT according to Circular 80/2021/TT-BTC is the Value Added Tax Declaration Form (applicable to taxpayers calculating tax by credit method having production and business activities).

What is the deadline for the VAT declaration in Vietnam?

Pursuant to Clause 1, Article 44 of the Law on Tax Administration 2019, specific provisions on the time to submit tax declarations are as follows:

Deadline for submitting tax declaration dossiers

[1] The deadline for submitting tax declaration dossiers for taxes declared on a monthly or quarterly basis is as follows:

- No later than the 20th day of the following month for taxes declared and paid monthly;

- No later than the last day of the first month of the following quarter for taxes declared and paid quarterly.

[2] The deadline for submitting tax declaration dossiers for taxes calculated on an annual basis is as follows:

- No later than the last day of the third month from the end of the calendar year or fiscal year for annual tax finalization dossiers; no later than the last day of the first month of the calendar year or fiscal year for annual tax declaration dossiers;

- No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization dossiers for individuals directly finalizing taxes;

- No later than December 15 of the preceding year for lump-sum tax declaration dossiers of business households, individual businesses paying taxes by the presumptive method; in case of new business activities, tax declaration dossiers must be submitted no later than 10 days from the start of the business.

Where to submit the VAT declaration dossiers?

According to Article 45 of the Law on Tax Administration 2019, specific regulations on places to submit VAT declaration dossiers are as follows:

- Taxpayers submit tax declaration dossiers at the directly managing tax authority.

- In the case of submitting tax declaration dossiers according to the one-stop-shop mechanism, the place to submit tax declarations is as per the provisions of that mechanism.

- The place to submit tax declaration dossiers for export and import goods is according to the provisions of the Customs Law.

- The Government of Vietnam prescribes the place to submit tax declaration dossiers for the following cases:

+ Taxpayers having multiple production and business activities;

+ Taxpayers conducting production and business activities in multiple locations; taxpayers incurring tax liabilities for taxes declared and paid for each occurrence;

+ Taxpayers incurring tax liabilities related to land-use fees; rights to exploit water resources, mineral resources;

+ Taxpayers incurring tax liabilities related to personal income tax finalization;

+ Taxpayers declaring taxes via electronic transactions and other necessary cases.