What is the fastest way to update the citizen ID card to change TIN information online in 2024?

Vietnam: What is the fastest way to update the Citizen Identification Card (citizen ID card) to change TIN information online in 2024?

*Below are the most popular methods currently available to update the citizen ID card with a TIN online:

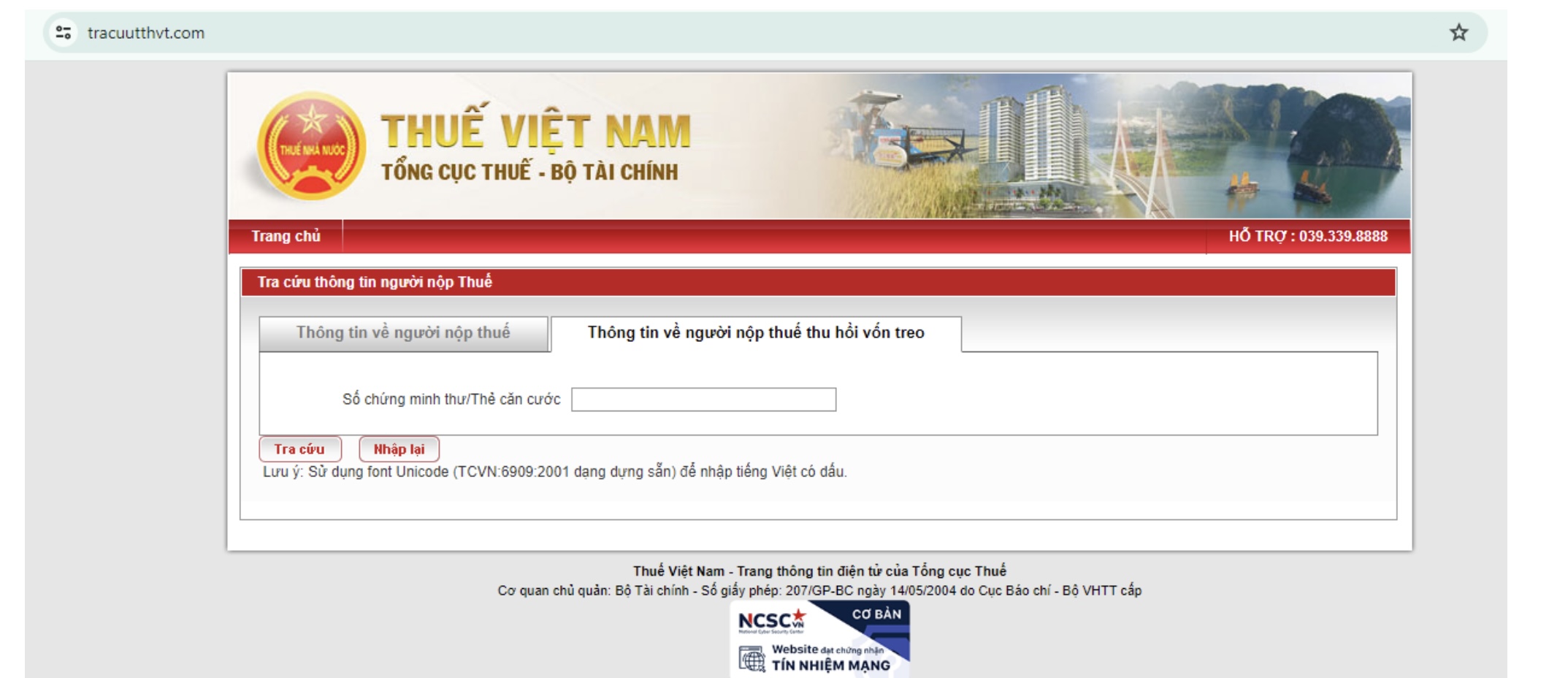

Method 1: Update online via the General Department of Taxation's electronic portal:

Guideline

Step 1: Access the General Department of Taxation's electronic portal at https://thuedientu.gdt.gov.vn/

Step 2: Log in to your personal account.

Find and select the "Update personal information" option.

Fill in all citizen ID card information in the corresponding fields.

Step 3: Review the information and click "Save".

Method 2: Update via the Etax Mobile application

Guideline:

Step 1: Download and install the Etax Mobile application on your phone.

Step 2: Log in to your personal account.

Step 3: Find and select the "Update personal information" section.

Follow the steps similar to the online update method.

Method 3: Submit documents directly at the tax office:

- Place for submission:

Tax Sub-department, Tax Sub-department in the area where the individual registers for permanent or temporary residence (in case the individual does not work at the income-paying organization).

- Document components:

+ Declaration of adjustments, supplementary information of taxpayer registration form no. 08-MST issued with Circular 105/2020/TT-BTC to declare changes in taxpayer registration information of the taxpayer.

+ Taxpayer registration declaration form no. 20-DK-TCT issued with Circular 105/2020/TT-BTC for changing taxpayer registration information of the dependent.

+ A copy of the Citizen Identification Card or a copy of a valid Identity Card for taxpayers/ dependents with Vietnamese nationality; a copy of a valid passport for taxpayers/ dependents who are foreign nationals or Vietnamese nationals residing abroad in case taxpayer registration information on these documents has changed.

What is the deadline for updating the citizen ID card to change TIN information online to change tax registration information in Vietnam?

According to clause 3, Article 36 of the Law on Tax Administration 2019 on notification of changes in taxpayer registration information as follows:

Notification of changes in taxpayer registration information

1. Taxpayers who register taxpayer registration along with enterprise registration, cooperative registration, business registration, when there is a change in taxpayer registration information, they shall notify the change of taxpayer registration information simultaneously with changes in enterprise registration, cooperative registration, or business registration content as prescribed by law.

If a taxpayer changes the address of the head office, resulting in a change in tax management authority, the taxpayer must carry out tax procedures with the directly managing tax authority as prescribed by this Law before registering any changes with the enterprise registration authority, cooperative registration authority, or business registration authority.

2. Taxpayers registering directly with the tax authority when there is a change in taxpayer registration information must notify the directly managing tax authority within 10 working days from the date the information change arises.

3. In case individuals have authorized organizations or individuals paying income to register changes in taxpayer registration information for the individual and their dependents, they must notify the income-paying organization or individuals no later than 10 working days from the date the information change arises; the organization or individual paying income is responsible for notifying the tax management authority no later than 10 working days from the day receiving the individual's authorization.

Thus, according to the above regulation, if taxpayers register directly with the tax authority when there is a change in taxpayer registration information, they must notify the directly managing tax authority within 10 working days from the date the information change arises.

In the case of delegation to organizations or individuals who pay income to register changes in information, they must notify the income-paying organization or individual no later than 10 working days from the date the information change arises, and the organization or individual paying income is responsible for notifying the tax management authority no later than 10 working days from the date of receiving the individual's authorization.

What is the fastest way to update the citizen ID card to change TIN information online in 2024? What is the deadline for updating citizen ID card to change TIN information online to change tax registration information in Vietnam? (Image from Internet)

What are the penalties for failing to update citizen ID card to change tax registration information in Vietnam?

According to Article 11 of Decree 125/2020/ND-CP on sanctioning administrative violations on the notification deadline for changes in taxpayer registration information as follows:

Sanctioning violations of the deadline for notification of changes in taxpayer registration information

...

5. A fine ranging from 5,000,000 VND to 7,000,000 VND for one of the following acts:

a) Notifying changes in taxpayer registration content beyond the prescribed time limit of 91 days or more, altering the taxpayer registration certificate or TIN notification;

b) Failing to notify changes in the information in the taxpayer registration records.

6. The provisions of this Article do not apply to the following cases:

a) Individuals not engaged in business activities who have been issued a personal income TIN and are late in changing information from the identity card to the citizen identification card;

b) Income-paying organizations delayed in notifying changes in identity card information when the personal income tax taxpayer is an individual authorizing personal income tax finalization and is issued a citizen identification card;

c) Notifying changes in the taxpayer registration records for the taxpayer's address beyond the prescribed time limit due to administrative boundary changes according to the Resolution of the Standing Committee of the National Assembly or the Resolution of the National Assembly.

7. Remedial measure: Forced submission of documents changing the content of taxpayer registration for the acts specified at point b, clause 5 of this Article.

Thus, failure to notify changes in the information in the taxpayer registration records will be subject to an administrative fine ranging from 5,000,000 VND to 7,000,000 VND. The remedial measure is to submit documents changing the content of taxpayer registration.

* The above fine does not apply to the following cases:

- Individuals not engaged in business activities who have been issued a personal income TIN and are late in changing information from the identity card to the citizen identification card;

- Income-paying organizations delayed in notifying changes in identity card information when the personal income tax taxpayer is an individual authorizing personal income tax finalization and issued a citizen identification card;

- Notifying changes in the taxpayer registration records for the taxpayer's address beyond the prescribed time limit due to administrative boundary changes according to the Resolution of the Standing Committee of the National Assembly or the Resolution of the National Assembly.

* Note:

The above fine applies to organizations; the fine for individuals is half that of organizations.