Is personal income tax deducted during the probationary period in Vietnam?

What are regulations on probationary contract in Vietnam?

According to the provisions of Clause 1, Article 24 of the Labor Code 2019, the probationary period is stipulated as follows:

Probationary Period

1. The employer and the employee can agree on the probationary terms included in the labor contract or agree on a probationary period by entering into a probationary contract.

2. The main contents of the probationary contract include the probationary period and the provisions specified in points a, b, c, d, g, and h of Clause 1, Article 21 of this Code.

3. The probationary period does not apply to employees with a labor contract term of less than one month.

The employer and the employee can agree on the probationary terms included in the labor contract or agree on a probationary period by entering into a separate probationary contract. Depending on the agreement between the employee and the employer, one of the following types of contracts may be signed during the probationary period:

- A labor contract with agreed probationary terms.

- A probationary contract signed independently from the labor contract.

Is personal income tax deducted during the probationary period in Vietnam? (Image from Internet)

Is personal income tax deducted during the probationary period in Vietnam?

According to the provisions of Article 25 of Circular 111/2013/TT-BTC, the tax deduction is outlined as follows:

Tax Deduction and Tax Withholding Certificates

1. Tax Deduction

...

b) Income from salaries and wages

b.1) For residents who sign labor contracts for three (03) months or more, the organization or individual paying the income shall implement tax deduction according to the progressive tax rate schedule, including cases where individuals have signed contracts at multiple places for three (03) months or more.

b.2) For residents who sign labor contracts for three (03) months or more but leave before the end of the labor contract, the organization or individual paying the income shall still implement tax deduction according to the progressive tax rate schedule.

...

i) Tax deduction for certain other cases

Organizations, individuals who pay wages, remuneration, or other payments to residents without labor contracts (as guided in points c, d, Clause 2, Article 2 of this Circular) or with labor contracts under three (03) months, and whose total payment for each period is from two million (2,000,000) VND or more, must deduct tax at a rate of 10% on the income before paying the individual.

In cases where the individual has only one source of income subject to the above-mentioned tax deduction rate but estimates the total taxable income after family circumstance deductions to fall below the taxable threshold, the individual can make a commitment (according to the form issued with the tax management guidance document) to the income payer to temporarily suspend personal income tax deduction.

Based on the income recipient's commitment, the income payer will not deduct tax. At the end of the tax year, the income payer must still aggregate and list the incomes of individuals who fall below the tax deduction threshold and submit it to the tax authority. Individuals making commitments are responsible for their statements, and any detected fraud will be dealt with according to the Tax Management Law.

Individuals making commitments under this guidance must register for taxpayer registration and possess a tax identification number at the time of commitment.

2. Tax Withholding Certificates

a) Organizations, individuals paying income with tax deducted as outlined in Clause 1 of this Article must issue tax withholding certificates at the request of the individual subject to deduction. If the individual authorizes tax finalization, no withholding certificate will be issued.

b) Issuing withholding certificates in specific cases such as:

b.1) For individuals without labor contracts or with labor contracts under three (03) months: the individual can request the organization, individual paying the income to issue a withholding certificate for each tax deduction or one certificate for multiple deductions within a tax period.

Example 15: Mr. Q signed a service contract with company X to care for ornamental plants in the company's courtyard monthly from September 2013 to April 2014. Mr. Q's income is paid monthly at 3 million VND. In this case, Mr. Q can request the company to issue a withholding certificate monthly or one certificate reflecting tax deducted from September to December 2013 and another certificate for January to April 2014.

b.2) For individuals who sign labor contracts of three (03) months or more: organizations, individuals paying income will only issue one withholding certificate for each tax period.

Example 16: Mr. R signed a long-term labor contract (from September 2013 to the end of August 2014) with company Y. In this case, if Mr. R is subject to direct tax finalization with the tax authority and requests the company to issue a withholding certificate, the company will issue one certificate reflecting tax deducted from September to December 2013, and one from January to August 2014.

Therefore, the deduction of personal income tax during the probationary period depends on the type of contract and the individual's income level:

- For individuals who have signed labor contracts of 3 months or more (including the probationary period if the official labor contract is 3 months or more), the income-paying organization will implement tax deduction according to the progressive tax rate schedule. In this case, personal income tax will be calculated based on total income and deducted according to the progressive tax brackets.

- For employees on probation with contracts under 03 months, the enterprise will deduct 10% tax from the employee's income before paying the income to the employee.

However, for employees who have only one source of income subject to the above-mentioned deduction rate but estimate the total taxable income after family deductions to be below the taxable threshold, the individual can submit a commitment to the income-paying enterprise for temporarily not deducting personal income tax for such employees.

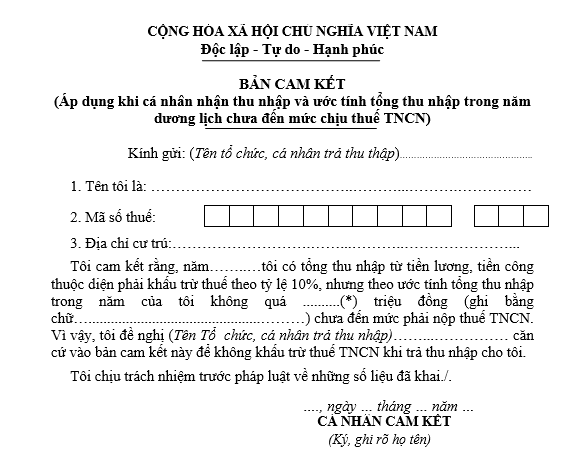

Which form is used for temporary non-deduction of personal income tax commitments in Vietnam?

The latest commitment form for temporary non-deduction of personal income tax follows Form 08/CK-TNCN issued with Circular 80/2021/TT-BTC.

>> Download Download Form 08/CK-TNCN, Declaration of No Personal Income Tax Liability

Taxpayers can refer to the latest guide on filling out the tax commitment form 08/CK-TNCN below:

(1) To: Specify the name of the organization or individual paying the income, not the tax authority's name (e.g., company, enterprise…).

(2) Enter your full name.

(3) Enter your tax identification number.

(4) Enter your place of residence (permanent, temporary).

(5) Enter the estimated total income in the calendar year that has not yet reached the taxable level (write in both numbers and words).

Individuals can refer to the table below to determine taxable income for personal income tax.

(6) Proposal: Enter the name of the organization or individual paying the income.

Note: In the tax identification number field: If an individual has a 10-digit tax code, fill in 10 digits, leaving the other 3 blanks.

- Note *: The amount entered in this section is determined by the deduction for family circumstances calculated within the year.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?