Is construction sand subject to severance tax in Vietnam?

Is construction sand subject to severance tax in Vietnam?

Based on Article 2 of Circular 152/2015/TT-BTC which regulates the subject to severance tax as follows:

Taxable Subjects

The subjects to severance tax as stipulated in this Circular are natural resources within the land territory, islands, internal waters, territorial seas, contiguous zones, exclusive economic zones, and continental shelves under the sovereignty and jurisdiction of the Socialist Republic of Vietnam, including:

1. Metallic minerals.

2. Non-metallic minerals.

3. Products of natural forests, including various types of plants and other natural forest products, except animals and anise, cinnamon, cardamom, which are cultivated in natural forests assigned for cultivation and protection.

4. Natural marine products, including marine animals and plants.

5. Natural water, including: surface water and groundwater; except for natural water used for agriculture, forestry, fishery, salt production, and seawater for cooling machines.

Seawater for cooling machines, as stipulated in this clause, must meet the environmental requirements, ensure the efficiency of circulating water use and the specific economic-technical conditions confirmed by competent state agencies. In the case of seawater use that causes pollution and does not meet environmental standards, it will be handled according to the provisions of Decree No. 179/2013/ND-CP dated November 14, 2013, of the Government of Vietnam and the guiding documents for implementation or amendments, supplements, replacements (if any).

6. Natural bird nests, except nests obtained by organizations or individuals from investing in building houses to attract and exploit natural birds.

Bird nests obtained from organizations or individuals investing in building houses to attract and exploit natural birds must comply with the provisions of Circular No. 35/2013/TT-BNNPTNT dated July 22, 2013, of the Ministry of Agriculture and Rural Development and the amendment, supplement, replacement documents (if any).

7. Other natural resources as determined by the Ministry of Finance in coordination with relevant ministries and sectors for reporting to the Government of Vietnam and submitting to the Standing Committee of the National Assembly for consideration and decision.

In addition, sand used in construction is identified as a mineral according to the regulations in Article 64 of the 2010 Mineral Law as follows:

Exploitation of Minerals for Common Building Materials

1. Minerals used for common building materials include:

a) Various types of sand (except silica sand) with SiO2 content less than 85%, without or with minerals like cassiterite, wolframite, monazite, zircon, ilmenite, gold, but do not meet the reserve calculation criteria as stipulated by the Ministry of Natural Resources and Environment;

b) Clay used for bricks and tiles according to Vietnamese standards and technical regulations, various types of clay (except bentonite, kaolin clay) that do not meet the standards for producing ceramics, refractory materials, cement according to Vietnamese standards and technical regulations;

...

According to the above regulations, sand is classified as a common building material mineral (except silica sand).

Therefore, it can be seen that sand used in construction falls under the category of non-metallic minerals and is subject to severance tax.

Is construction sand subject to severance tax in Vietnam? (Image from the Internet)

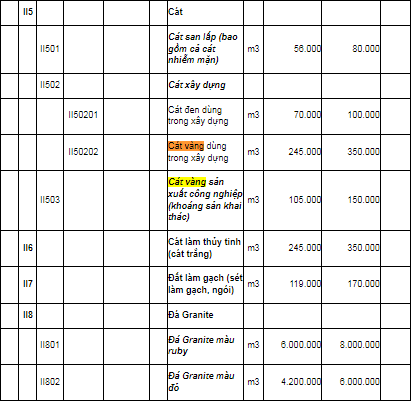

What is the severance tax rate for construction sand?

Based on the regulations in Appendix 2 issued with Official Dispatch 7487/BTC-VP in 2017 which stipulates the tax rate framework for construction sand from 245,000 VND/m3 to 350,000 VND/m3.

Download the latest 2024 non-metallic mineral severance tax rate framework.

06 cases exempt from severance tax in Vietnam

Based on Article 10 of Circular 152/2015/TT-BTC which stipulates tax exemptions in accordance with Article 9 of the 2009 severance tax Law and Article 6 of Decree 50/2010/ND-CP including:

- Exemption of severance tax for organizations and individuals exploiting natural marine products.

- Exemption of severance tax for organizations and individuals exploiting branches, tops, firewood, bamboo, rattan, straw, and other materials by individuals allowed to exploit for living purposes.

- Exemption of severance tax for organizations and individuals exploiting natural water for hydroelectricity production to serve household and individual needs.

- Exemption of severance tax for natural water exploited by households and individuals for living purposes.

- Exemption of severance tax for land exploited and used on site by organizations and individuals assigned or leased the land; land exploited for filling, constructing security, military, and dyke works.

Land exploited and used on site for exemption includes sand, stone, and gravel mixed in the soil but cannot be specified individually and is used in raw form for filling, constructing works; if transported to other places for use or sale, severance tax must be paid as per the regulations.

- Other cases exempt from severance tax, the Ministry of Finance in coordination with relevant ministries and sectors for reporting to the Government of Vietnam and submitting to the Standing Committee of the National Assembly for consideration and decision.

- What are 02 cases of handling in case a taxpayer finds that the requirements for quarterly declaration are not fulfilled in Vietnam?

- Is the allowance for working capacity loss subject to personal income tax in Vietnam?

- What are cases where taxpayers conduct e-tax transactions without using a digital certificate in Vietnam?

- Vietnam: What regulated entities does the enforcement by invalidating invoices apply to?

- What VAT rate applies to water for daily life in Vietnam from July 1, 2025?

- Can an employer give Tet bonuses in gold in Vietnam? Do employees who receive Tet bonuses in gold have to pay personal income tax in Vietnam?

- How does the Ministry of Finance of Vietnam respond to the proposal to expand the beneficiaries of student loan credit?

- What are cases where an imported air conditioner is subject to excise tax in Vietnam?

- What is the cylinder capacity of two-wheeled motor vehicless required to pay excise tax in Vietnam?

- How to prepare the authorized payment slip in Vietnam according to Official Dispatch 1483?