How to prepare the authorized payment slip in Vietnam according to Official Dispatch 1483?

How to prepare the authorized payment slip in Vietnam according to Official Dispatch 1483?

Based on Point 2b, Clause 2, Subsection I, Section B, Appendix 02 of the Guiding Document issued with Official Dispatch 1483/TCT-KK of 2023, the instructions for preparing the authorized payment slip are as follows:

Step 1: The taxpayer (NNT) accesses the "Pay Tax" function and selects "Prepare the authorized payment slip"

The system displays the screen to select the tax-paying bank and enter the recipient's tax code

- The taxpayer selects the tax-paying bank from the list of banks with which the account is linked.

- Enter the recipient's tax code: The recipient's tax code must differ from the tax code used to log in for substitute payment.

- File code: Enter the file code to execute substitute payment for the payable registration fee.

Step 2: The taxpayer clicks "Continue," and the system displays the screen to prepare the authorized payment slip

- Select the payment item arising from the "Declaration": It is mandatory to select a declaration from the declaration list

- Select the payment item arising from the "Decision Number/Notification Number": Entering values for the Decision Number/Notification Number column is mandatory.

- If the taxpayer enters the Declaration/Decision/Notification number/File identification code (ID), the system checks:

+ If the entered data exists in the list of tax liabilities of the recipient’s tax code, the system automatically displays the payment details, including: Payment order, Tax period/Decision date/Notification date, Sub-item, Program code, Amount.

+ If the entered data does not exist in the list of tax liabilities of the recipient’s tax code, the taxpayer is allowed to enter the data on the substitute payment slip.

+ For substituting payments of non-agricultural land use tax: enter the Declaration/Decision/Notification number/File identification code (ID) with the non-agricultural code.

Step 3: The taxpayer selects "Pay" for the system to display the payment slip, checks, confirms, and proceeds through the steps to sign and send the payment slip to the serving bank according to current procedures or selects "Edit" to return to Step 1.

How to prepare the authorized payment slip in Vietnam according to Official Dispatch 1483? (Image from Internet)

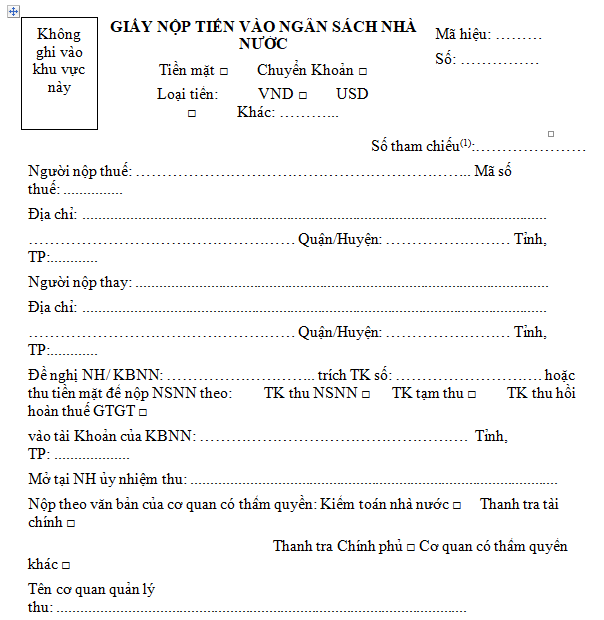

What is the Form of the payment slip into the state budget in Vietnam - Form C1-02/NS?

According to form number C1-02/NS issued together with Circular 84/2016/TT-BTC, the payment slip into the State Budget is regulated as follows:

Download the payment slip into the State Budget C1-02/NS here.

How to fill in the payment slip into the state budget in Vietnam?

Based on Article 6 of Circular 84/2016/TT-BTC which provides guidelines on how to fill in the payment slip into the state budget according to form C1-02/NS as follows:

(1) Information on the Type of Currency Paid:

- Select the "VND" box on the payment document if the taxpayer is obligated to pay in Vietnamese Dong into the state budget.

- Select the "USD" box or record other foreign currency information on the payment document if the taxpayer is obligated to pay in US dollars or other foreign currencies according to legal regulations.

(2) Information about the Taxpayer and the Substitute Payer:

- If selecting "Prepare payment slip," the system automatically displays information on the taxpayer, including: name, tax code, and address based on the login account.

- If selecting "Prepare Substitute payment slip," the system automatically displays information on the substitute payer, including: name and address based on the login account. The substitute payer must declare the information of the taxpayer, including: name, tax code, and address.

(3) Information on the Bank/State Treasury and the Account from which the Tax is Paid: Select the bank and account from the registered list to pay taxes electronically.

(4) Information on Payment into the State Budget:

The taxpayer selects the "State Budget Collection Account" or "VAT Refund Recollection Account" as follows:

- Select the "State Budget Collection Account" for paying taxes, late fees, fines, or other payments into the state budget.

- Select the "VAT Refund Recollection Account" for returning to the state budget the value-added tax amount that has been refunded according to the decision of a competent authority or if the taxpayer self-identifies an error in the refund according to regulations; excluding returning the refunded amount due to overpayment or mispayment.

(5) Information on State Treasury Account: Select the name of the state treasury agency that receives the payment from the list of state treasury agencies; simultaneously select the appointed collection bank corresponding to the selected state treasury agency from the system-provided list.

The state treasury agency receiving the budget payment is at the same administrative level as the tax management agency. If the state treasury agency receiving the payment is not at the same administrative level, the tax management agency must inform the taxpayer to select the appropriate state treasury agency name.

(6) Information on Payment as per Authorization Document (if any): Select one of the corresponding boxes to the issuing authority such as "State Audit," "Government Inspectorate," "Financial Inspectorate," or "Other Competent Authority."

In case of tax payment as per decision of tax authorities at various levels, select the "Other Competent Authority" box.

(7) Information on the Tax Management Authority: The system automatically displays the tax authority directly managing the taxpayer. If the payment is under the jurisdiction of another tax authority, the taxpayer selects the managing authority name from the tax authority list.

(8) Information on the Payment into the State Budget:

The taxpayer queries the amount due on the electronic tax system and selects one or several payments from the displayed payment list. The taxpayer may revise the amount of each payment.

If new payments arise that are not listed on the system’s payment list, the taxpayer enters the "State Budget Payment Items" menu to select the appropriate payment and declare the state budget payment amount.

For payments related to taxes, land levy, registration fees, or other items related to asset registration, the taxpayer provides additional details such as: house address, land plot; vehicle type, brand, model, color, chassis number, engine number of aircraft, boats, cars, or motorcycles.

For payments as per an authority document, the taxpayer provides additional information on the name of the issuing authority.

(9) Completion of Tax Payment Document: The taxpayer electronically signs at least one of the three positions: taxpayer/ chief accountant/ head of the unit and submits the payment slip into the state budget on the electronic tax system.