How to enter the e-transaction code when amending returns multiple times in Vietnam?

How to enter the e-transaction code in case of additional declaration submission multiple times in Vietnam?

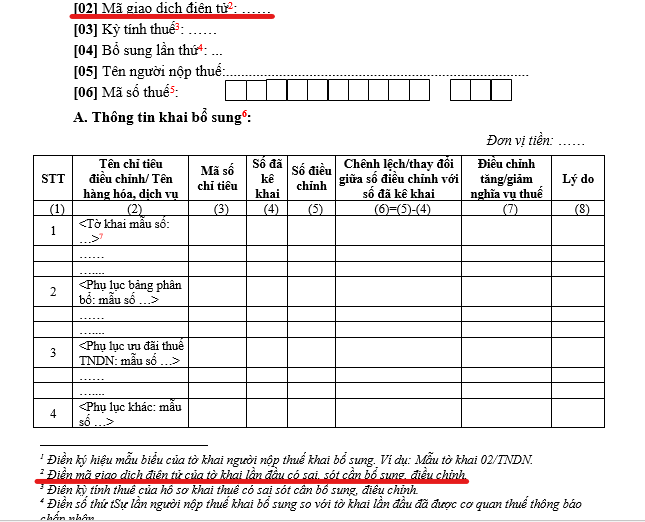

According to the guidance on preparing Form 01-1/KHBS - explanation form for amended tax returns attached to Circular 80/2021/TT-BTC:

Therefore, in cases where a business amends returns multiple times, the electronic transaction code of the initial return should be entered on the amended return.

How to enter the e-transaction code in case of additional declaration submission multiple times in Vietnam? (Image from Internet)

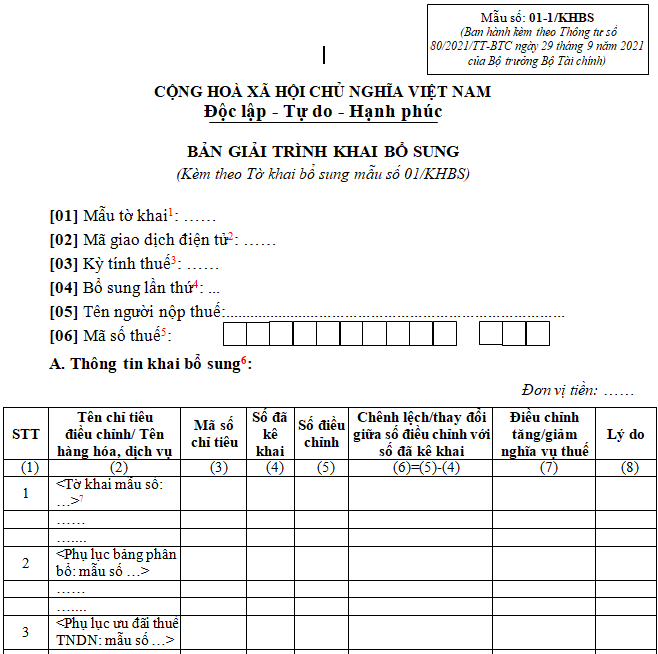

Download Form 01-1/KHBS on additional declaration in Vietnam

The additional declaration Form 01-1/KHBS, found in Appendix II attached to Circular 80/2021/TT-BTC, is as follows:

Download Form 01-1/KHBS additional declaration here.

What is the deadline for tax additional declaration submission due to errors or omissions in Vietnam?

Based on Article 47 of the Law on Tax Administration 2019, the provisions are as follows:

Amending Tax Returns

1. Taxpayers who discover errors or omissions in their tax returns submitted to the tax authority may amend the tax return within 10 years from the expiration of the deadline for submitting the tax return of the tax period having errors, but before the tax authority or competent authority announces the audit or inspection decision.

2. When the tax authority or competent authority has announced the audit or inspection decision at the taxpayer's office, the taxpayer is still allowed to amend their tax returns; the tax authority will impose administrative penalties for tax administration violations as stipulated in Articles 142 and 143 of this Law.

3. After the tax authority or competent authority has issued a conclusion or decision handling tax matters following an audit or inspection at the taxpayer's office, the amendment of tax returns is regulated as follows:

a) Taxpayers are allowed to amend tax returns in cases where it increases the taxable amount, or decreases the deductible or exempt, reduced, or refunded tax amount and will be subject to administrative penalties for tax administration violations as stipulated in Articles 142 and 143 of this Law;

b) In case taxpayers discover that the tax return has errors or omissions and an amendment would reduce the taxable amount or increase the deductible, exempted or refunded tax amount, the procedure follows the complaint resolution regulations about tax.

4. The amended tax return files include:

a) The amended return;

b) The explanation form for the amended return and related documents.

5. For exported and imported goods, the amendment of tax returns is governed by customs law.

Within 10 years from the expiration date for submitting the tax return of the period with errors, taxpayers can amend their tax returns, but should do so before the tax authority or competent body announces an audit or inspection decision.

Who needs to submit tax additional declaration in Vietnam?

According to Article 47 of the Law on Tax Administration 2019, those required to submit tax additional declaration are defined as follows:

- Taxpayers who discover that their submitted tax return has errors or omissions may submit tax additional declaration within 10 years from the expiration date for submitting the tax return of the period having errors, provided it is before the tax authority or competent body announces an audit or inspection decision.

When the tax authority or competent authority has announced an audit or inspection decision at the taxpayer's premises, taxpayers are still allowed to submit tax additional declaration; the tax authority will impose administrative penalties for tax management violations as specified in Articles 142 and 143 of the Law on Tax Administration 2019.

After the tax authority or competent authority has issued conclusions and handling decisions regarding tax post-inspection at the taxpayer's premises, taxpayers are allowed to submit tax additional declaration in cases where it increases the tax payable, reduces the deductible tax amount, or lowers the tax amount that is exempt, reduced, or refunded and will face administrative penalties for tax management violations as specified in Articles 142 and 143 of the Law on Tax Administration 2019.

In cases where taxpayers discover errors or omissions in the tax return, if the amendment would reduce the taxable amount or increase the deductible, exempted, or refunded tax, it shall be handled following the tax complaint resolution regulations.

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?

- What is the excise tax rate for beer in Vietnam in 2024?

- What is coefficient K for monitoring invoicing beyond a safety threshold in Vietnam? What is the formula for calculating coefficient K in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam?